Bharat Heavy Electricals Ltd. has secured a major order in India's thermal power sector by winning a 16% inflow of NTPC's tender for the current fiscal. Even as CLSA has raised its target price on the stock, its is cautious and maintains an 'underperform' rating due to valuation concerns.

This order represents a strong foothold in India's renewed focus on fossil fuel-based power generation, as the government pushes for energy security amid rising demand. The brokerage has hiked its target price on the stock to Rs 205 per share from Rs 189.

However, this recent uptick in orders does not justify BHEL's pricey valuation, CLSA said.

With the country aiming to add 52 GW to 80 GW of thermal capacity by fiscal 2032, the sector appears poised for growth, creating a window of opportunity for equipment makers like BHEL, the brokerage said. The firm's order book, boosted by India's power expansion goals, is projected to contribute meaningfully to revenues through financial year 2027.

However, CLSA sees BHEL's stock as overvalued, currently trading at a steep 40 times its estimated earnings per share for fiscal 2026. The brokerage highlights that even after incorporating these new orders and anticipated earnings growth, BHEL is priced significantly higher than peers.

Moreover, the company has underperformed the Nifty 50 by 28% over the past three months and 21% over the last six months. While some fund inflows and passive index inclusions have supported the stock this year, CLSA warns that these may not be enough to sustain its current valuation levels.

BHEL is diversifying into areas such as defence, railways, and coal gasification, but CLSA points out that these sectors are highly competitive. The recent gains by rival Larsen & Toubro Ltd. in thermal power equipment also present a potential challenge to BHEL's market dominance, it said.

In CLSA's view, while BHEL's strong order inflow outlook indicates a positive growth narrative, the stock remains expensive. Unless valuations correct or order wins accelerate further, BHEL may face pressure in the long term, with a potential de-rating risk if it cannot justify its premium price, the brokerage said.

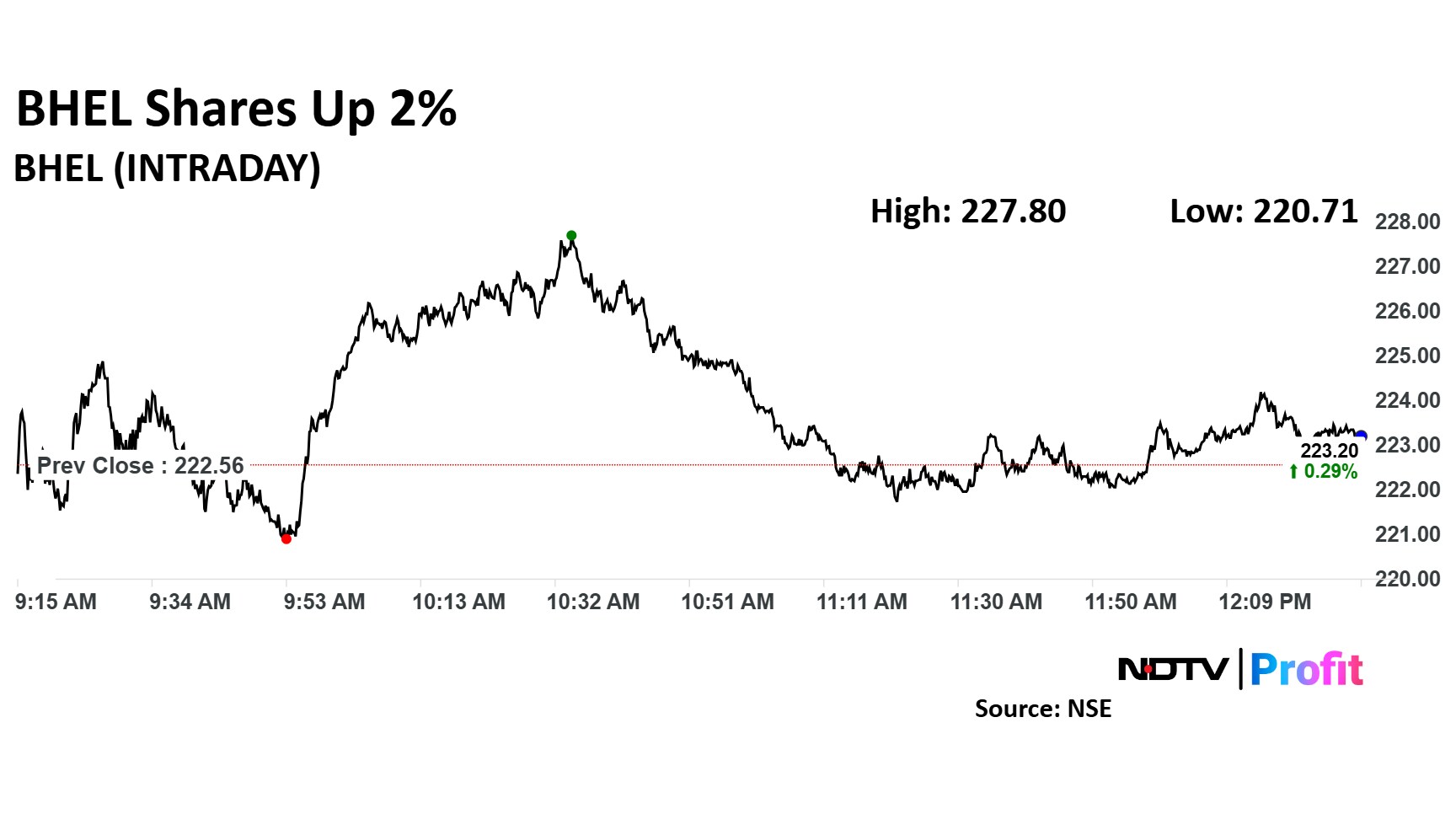

BHEL Share Price Today

BHEL's share price rose as much as 2.35% to Rs 227.80 apiece. It pared gains to trade 0.30% higher at Rs 223.23 apiece, as of 12:24 p.m., compared to a 0.09% decline in the NSE Nifty 50.

The stock has risen 10.55% on a year-to-date basis. Total traded volume so far in the day stood at 0.36 times its 30-day average. The relative strength index was at 36.43.

Out of 17 analysts tracking the company, six maintain a 'buy' rating, two recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.