Shares of Bajaj Finance Ltd. fell over 3% on Friday as brokerages expect lower margins and moderate AUM growth in the second quarter of fiscal 2025. The stock had closed 3% lower in the previous trading session.

Morgan Stanley cautioned that the second quarter of financial year 2025 may show weaker results due to anticipated higher credit costs and lower margins. It predicts credit costs of 210 basis points for second half of financial year 2025, with an expectation that management will revise its credit cost guidance upward from the current 175-185 basis points.

The brokerage maintained an 'overweight' rating on Bajaj Finance with a target price of Rs 9,000 per share, indicating a potential upside of 21%. It noted that health loan growth has exceeded estimates and expects Bajaj Finance to achieve a growth rate of 27.3% in financial year 2025.

New customer acquisition has also reportedly outperformed the targets set by the company, it said. The brokerage remains optimistic about strong profit after tax growth in financial year 2026.

Citi maintained a 'buy' rating with a target price of Rs 8,257 per share, reflecting an upside of 11%. Asset under management growth has moderated as expected, with new loans booked experiencing a quarter-on-quarter decline from a high base, it said.

The brokerage expects margins to decrease by 14 basis points quarter-on-quarter and expects credit costs to remain elevated at approximately 2%.

Similar to Morgan Stanley, Citi also predicts that credit cost guidance is likely to be increased.

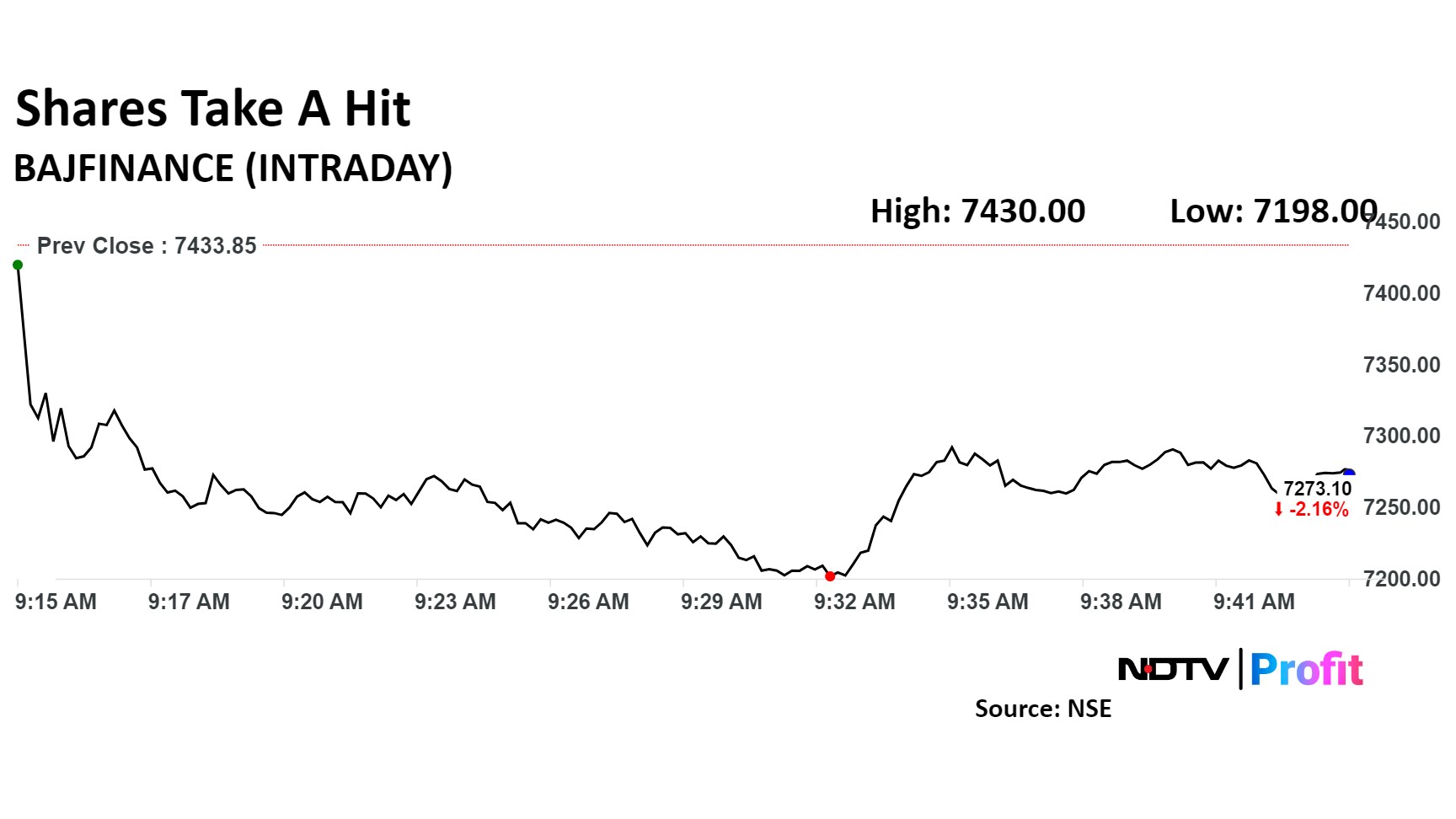

Bajaj Finance Share Price

The scrip fell as much as 3.17% to Rs 7,198 apiece. It pared losses to trade 2.07% lower at Rs 7,280 apiece as of 09:36 a.m., compared to a 0.28% decline in the NSE Nifty 50.

The stock has declined 7.3% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 44.

Out of 35 analysts tracking the company, 25 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 7.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.