Bajaj Finance Ltd. received a first-time Baa3/P-3 long-term and short-term foreign and local currency issuer ratings from Moody's rating agency with a stable outlook.

The rationale for the rating comes after the non-banking financial company's strong and entrenched franchise, Moody's said in a note on Friday. The strengths for the lender include its diversified loan book, capitalisation and its competitive funding costs, it said.

These strengths are counterbalanced by its focus on riskier unsecured consumer and small business loans, which are susceptible to higher credit costs during economic duress, it said.

Bajaj Finance will likely continue gaining market share and further augment its already sizable franchise with consolidated assets under management of Rs 3.5 lakh crore as of June 2024, Moody's said.

"We expect the company to maintain its two-pronged strategy of having a mix of secured lending," it said. BFL's strong loan diversification gives it the flexibility to calibrate loan growth, depending on the prevailing asset quality trends in the respective segments, it said.

The diversification also helps in asset-liability management via a judicious mix of short- and long-term loan assets, it added.

Although the lender's sizable unsecured lending exposes it to economic shocks, it said, the company has employed various risk management processes to ensure adequate risk-adjusted returns.

Its return on average assets averaged 3.7% over the last eight years, with its ROAA at 4.4% in fiscal 2024.

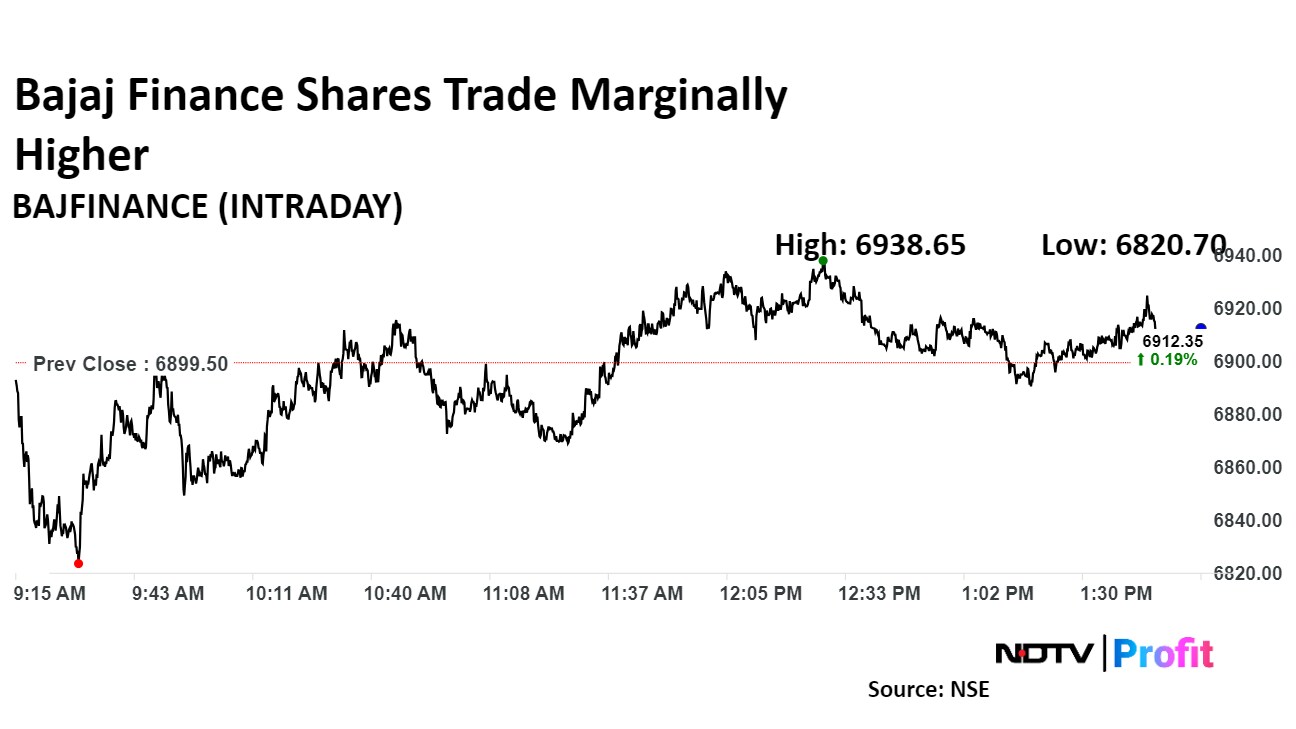

Bajaj Finance Share Price Today

Bajaj Finance's share price rose as much as 0.57% before paring gains to trade 0.1% higher at Rs 6,906 apiece as of 1:57 a.m., compared to a 0.45% advance in the benchmark Nifty 50.

The stock has declined 12% during the last 12 months and has slipped by 5% on a year-to-date basis. The relative strength index was at 34.

Of the 34 analysts tracking the company, 23 have a 'buy' rating on the stock, six suggest a 'hold' and five have a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 18%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.