Goldman Sachs initiated coverage on AU Small Finance Bank Ltd. with a 'buy' rating, and the highest target price among analysts tracking the lender. The brokerage cited growing market share in deposits and the bank's focus on commercial retail profit pool behind the positive outlook.

The bank is ready to graduate to the next level and has applied to transition to a universal banking licence on the back of the holistic banking franchise, the brokerage said in a Sept. 4 note. The investment firm has the target price of Rs 831 per share, implying a potential upside of 18.5% from the previous close.

The small finance bank is growing market share in deposits and is focussed on the commercial retail profit pool in a sector facing challenging dynamics of modest deposit growth and stress in unsecured lending, it said in the note.

Goldman Sachs has forecasted an earnings per share growth of 27% CAGR over fiscal 2024-27, on improving return on asset and robust loan growth. Its improving deposit market share should sustain on its multi-pronged strategy, the brokerage said.

Stock de-rating is largely done and drivers are in place for re-rating, Goldman Sachs said. "With most concerns reflected in below historical mean valuations, management is taking various initiatives to improve profitability and expand the franchise."

Key risks for the lender include merger-related risks, asset quality deterioration and delayed operating leverage among others.

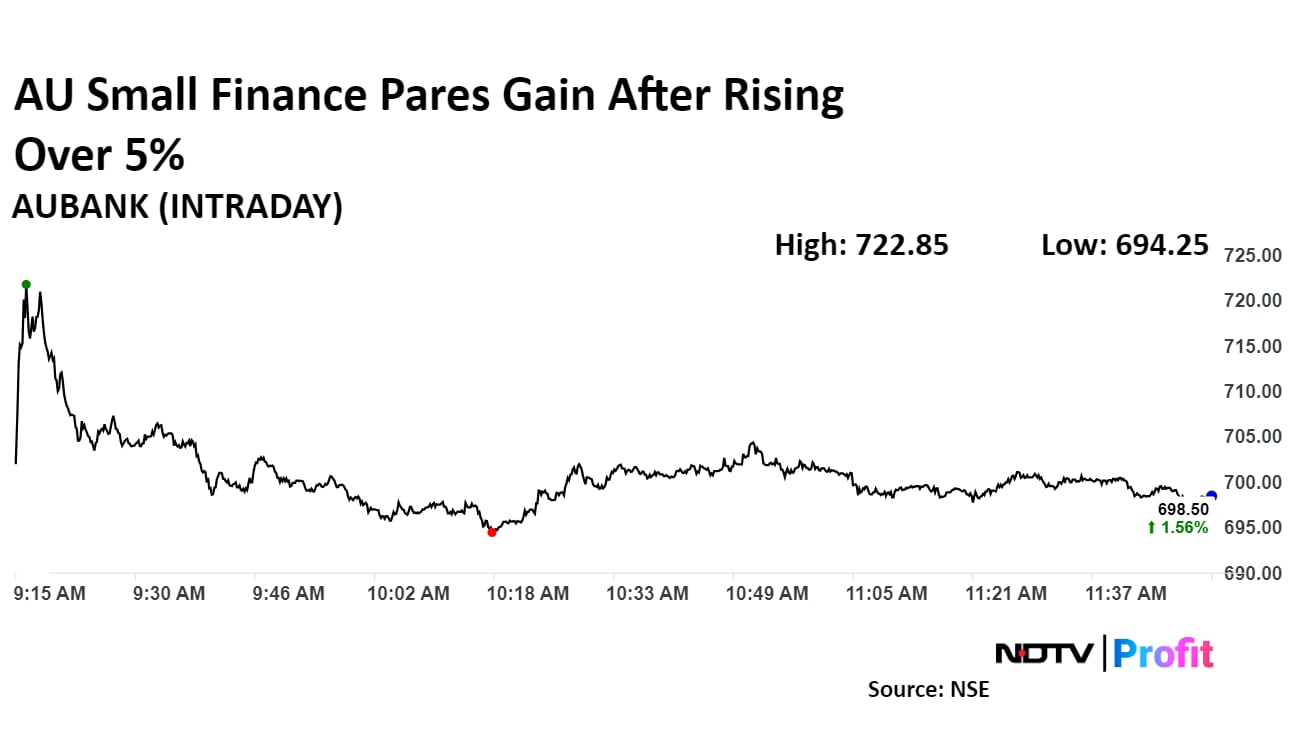

AU Small Finance Bank shares rose as much as 5.1% during the day, before paring gains to trade 1.6% higher at Rs 689.7 apiece, compared to a 0.10% decline in the benchmark Nifty 50 as of 11:50 a.m.

The stock has declined 2.2% during the last 12 months and 11.2% year-to-date. Total traded volume so far in the day stood at 4.1 times its 30-day average. The relative strength index was at 70.

Fifteen out of 26 analysts tracking the company have a 'buy' rating on the stock, six suggest a 'hold' and five recommend a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.