(Bloomberg) -- US stocks kicked off the week on positive note buoyed by a burst of deals, even as central bankers sought to sow doubts that aggressive interest-rate cuts will materialize early next year.

Coming off a seven-week bull run, the S&P 500 rose while the Nasdaq 100 climbed after the tech-heavy benchmark closed at a record on Friday. More than $40 billion of mergers and acquisitions hit the wire on Monday after months of disappointing volumes. The dollar steadied while the rally in Treasuries took a breather as yields climbed across tenors.

Read more: Dealmakers Unveil $40 Billion M&A Flurry in Year's Last Hurrah

Federal Reserve Bank of Chicago President Austan Goolsbee was the latest to join a chorus of officials tempering market optimism after he said markets were front-running rate cuts. European Central Bank Governing Council member Bostjan Vasle also took a cautious tone after New York Fed President John Williams last week said bets on a March reduction were premature, and ECB President Christine Lagarde said the bank had not discussed cuts at all.

“This week we'll see whether the stock market's seasonal tendency to rally in the second half of December bumps up against potential exhaustion amid one of the strongest short-term rallies of the past several years,” according to Chris Larkin, managing director of trading and investing at E*Trade from Morgan Stanley.

Whether or not the S&P 500 can extend its seven-week bull run may be determined by data this week on durable goods orders, personal consumption expenditures — the Fed's preferred measure of inflation — and the final third quarter gross domestic product estimate.

“The S&P 500 has closed higher seven weeks in a row only 20 other times since 1964, and it's stretched the run to eight weeks 12 of those times,” Larkin wrote in emailed commentary.

BOJ in Focus

Traders will also be watching Japan with the nation's central bank beginning a two-day policy meeting Monday. While speculation has grown the Bank of Japan will soon end the world's last negative-rate regime, economists see April as the most likely timing for a change, with around 15% expecting Ueda to pull the plug on negative rates in January, according to a Bloomberg survey of more than 50 economists.

“The BOJ has little need to rush into making policy changes,” Societe General economists led by Wei Yao wrote in a note. “But markets will be watching for any sign the board is willing to end negative rates or yield curve control.”

In commodities, gold moved higher, while oil extended last week's rise as major shipping lines suspended transit through the Red Sea, following escalating attacks on merchant ships. Bitcoin slumped.

Read More: Fed Officials Add to Chorus Pushing Back Against Rate-Cut Bets

Corporate Highlights:

- A consortium backed by Clearlake Capital and Insight Partners has agreed to buy Alteryx Inc. in a deal valuing the software developer at $4.4 billion including debt.

- Nippon Steel Corp. agreed to buy United States Steel for $14.1 billion in cash, in a deal to end months of uncertainty about the future of the historic American metal producer.

- Illumina said it will sell Grail Inc. following an appeals court finding that the acquisition of the cancer detection startup violated antitrust laws.

- Farfetch Ltd. found a backer in e-commerce company Coupang Inc., which agreed to lend $500 million, buy the assets and delist the troubled fashion platform's shares.

- HSBC initiates coverage of Thermo Fisher and Teva with buy ratings. Danaher is initiated at hold as HSBC analysts update their ratings in the life sciences and health care sectors ahead of a year which could see a US election spark “angst” for biopharma investors amid a focus on drug pricing.

- Unity Software was initiated at hold by HSBC. The company has little prospect of near-term profitability and a “sizable convertible debt overhang,” according to the broker.

- Shares of Vodafone Group Plc rallied after Billionaire Xavier Niel's Iliad proposed combining its Italian business with Vodafone's local operations.

Key events this week:

- ECB holds biennial conference on fiscal policy and EMU governance, Monday

- Pro-democracy media tycoon Jimmy Lai heads to court in Hong Kong, Monday

- Nasdaq 100 index annual reconstitution, Monday

- RBA Dec. policy meeting minutes, Tuesday

- Bank of Japan decision, Tuesday

- Canada inflation, Tuesday

- Eurozone inflation, Tuesday

- Atlanta Fed President Raphael Bostic speaks, Tuesday

- New Zealand issues half-year economic and fiscal update, Wednesday

- China loan prime rates, Wednesday

- UK inflation, Wednesday

- Bank Indonesia rate decision, Thursday

- US GDP, Thursday

- Nike earnings, Thursday

- Japan inflation, Friday

- UK GDP, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.4% as of 10:35 a.m. New York time

- The Nasdaq 100 rose 0.4%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 fell 0.3%

- The MSCI World index was little changed

Currencies

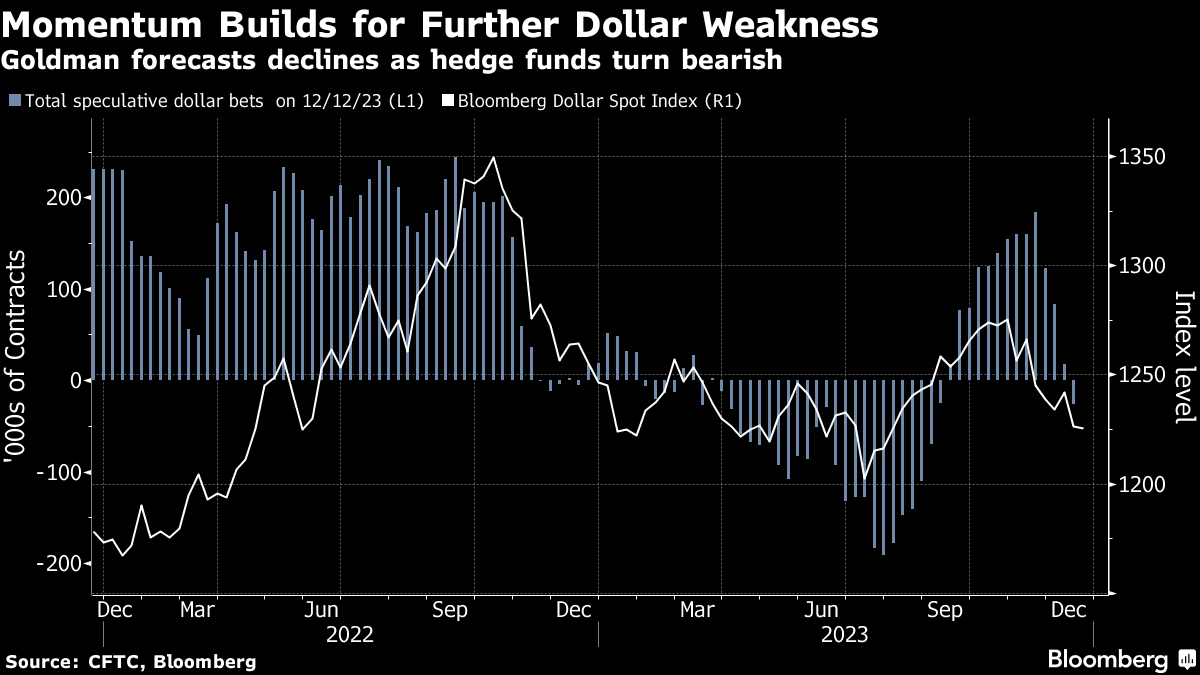

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.0922

- The British pound fell 0.2% to $1.2651

- The Japanese yen fell 0.6% to 143.00 per dollar

Cryptocurrencies

- Bitcoin fell 1.3% to $41,320

- Ether fell 3.6% to $2,157.58

Bonds

- The yield on 10-year Treasuries advanced five basis points to 3.96%

- Germany's 10-year yield advanced six basis points to 2.08%

- Britain's 10-year yield advanced two basis points to 3.71%

Commodities

- West Texas Intermediate crude rose 2.8% to $73.44 a barrel

- Spot gold rose 0.2% to $2,022.85 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Michael G. Wilson, Pearl Liu and Robert Brand.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.