Top two research firms remain divided on the impact on market leader Asian Paints Ltd. as Grasim Industries Ltd. takes on the oligopolistic paints market with the launch of its Birla Opus brand.

Analysts have raised concerns about the existing players in the market, given the quantum of investments, and the target set for the paint business by the company.

Can the Aditya Birla Group's biggest consumer bet weaken Asian Paints' position on the market?

Macquarie has a bullish outlook on Asian Paints and maintains an 'overperform' rating, with a target price of Rs 4,000 per share, as it expects the paintmaker to be less affected by a new entrant like Grasim.

"Asian Paints' history of effectively defending market share and its leadership position drives our belief that it would be relatively less affected than smaller players by a new entrant," Macquarie said in a Feb. 23 note.

However, CLSA said that the competitive intensity in the sector is likely to heat up significantly and has downgraded the company's rating from 'underperform' to 'sell'. It has also lowered the target price from Rs 3,215 apiece to Rs 2,425 per share.

With a new entrant in the market, the industry's cost and margin structures are likely to be challenged, CLSA said. "These new cost structures may have a larger impact on smaller players, which typically operate with higher dealer discounts."

This could impact Asian Paints as well, given Opus is promising a four-hour inventory replenishment cycle similar to the Mumbai-headquartered paint maker, CLSA said.

Asian Paints will likely emerge as the leader post-shakeup, but this is not a given, especially with industry-leading incremental capacity additions by Grasim, according to the brokerage.

The industry discounting pressures will not rise as sharply as they had earlier been envisaged, with Grasim's focus on brand creation along with its target for Rs 10 billion in net sales, Macquarie said.

However, a sharp moderation in demand remains a downside risk to near-term sales growth, according to Macquarie. If Grasim is able to create a strong brand among consumers in a short period of time, there could be downsides to the EPS estimates, it said.

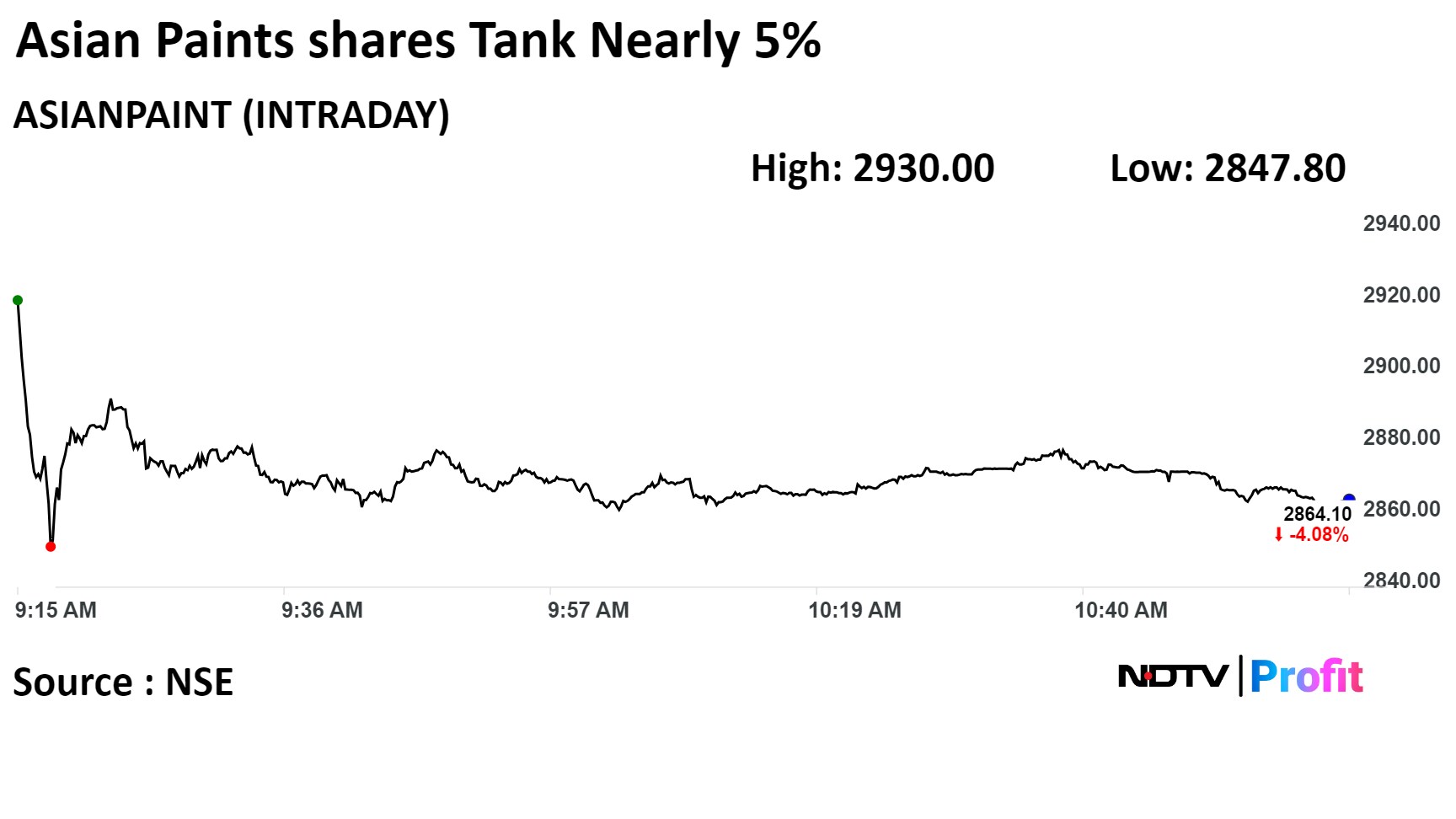

Asian Paints stock fell as much as 4.63% before paring some loss to trade 4.01% lower, compared to a 0.40% decline in the benchmark Nifty 50 as of 10:58 a.m.

The stock has risen 4.23% in the last 12 months. The total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 29.2.

Of the 37 analysts tracking the company, nine maintain a 'buy', 12 recommend a 'hold' and 16 suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 13.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.