(Bloomberg) -- Shares in Asian markets gearing up for elections early this year are better placed than their American peers to tackle any surge in volatility due to the political events.

That's the view among some investors and strategists including those at Robeco Hong Kong Ltd. and Tellimer, who cite better prospects for policy continuity, robust economic growth and relatively low valuations in Asia.

An expected recovery in the global semiconductor cycle matters more for the chip-heavy markets of Taiwan and South Korea, they say. For India and Indonesia, the region's fastest-growing large economies, election results are unlikely to disrupt the pro-reform policies already in place.

What's more, the optimism about the Federal Reserve likely cutting interest rates this year has also raised the odds of Asian equities besting US stocks after they trailed the latter by 15 percentage points in 2023. Meanwhile, the US may face fresh uncertainty from a likely overhaul of its trade policy if former president Donald Trump wins a second term in November.

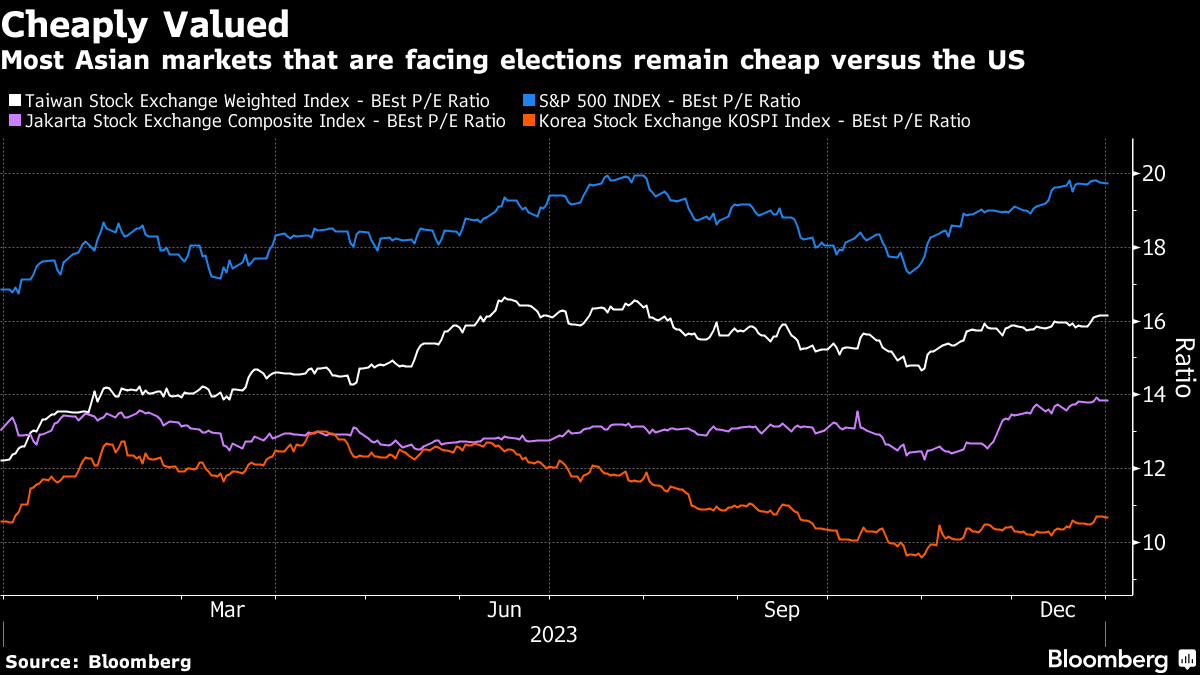

“Korea, Taiwan, Indonesia and India are all in a better position to deal with election volatility,” said Joshua Crabb, head of Asia Pacific equities at Robeco Hong Kong. “Valuations are lower than the US, which means lower expectations, while Indonesia and India also have better growth prospects.”

Korea's equity index's valuation discount to the S&P 500 has widened to more than 80%, while India's premium to the US has almost vanished from a high of 17% in January last year, data compiled by Bloomberg show.

“The strength of the incumbents, the repression of the political opposition, or the absence of competing policy agendas makes for more less market impact in some of the highest profile elections — e.g. India, Indonesia, and Taiwan,” Hasnain Malik, a strategist for Tellimer in Dubai, wrote in a note.

READ: Record Eight-Year Winning Streak Seen Extending for India Stocks

Here's a lowdown on the region's main elections in the first half of 2024:

Taiwan, Korea

While Taiwan's election this month are expected to shape US-China ties for years to come, its impact on the recovery in the country's vital chip sector is likely be minor. Ditto for South Korea, another mainstay of global semiconductor supply chains that votes in April.

Exports from Taiwan and Korea have begun to recover, adding to confidence about an upturn in the semiconductor cycle as businesses boost investments in artificial intelligence, pushing demand for advanced chips.

“The longevity of the global chip recovery cycle will hinge less upon the election results of Taiwan and Korea, and more on the disposable incomes of developed market consumers,” said Marcello Seongsoo Ahn, a portfolio manager at Quad Investment Management Co.

Indonesia

The influence of President Joko Widodo in Indonesian politics will likely extend beyond his tenure as the contenders for the presidential vote in February have signaled that they will preserve some of Jokowi's policies in some form.

Opinion polls in December put Prabowo Subianto, who picked the eldest son of Jokowi as a running mate, in the lead. About 41% of Indonesians who voted for Jokowi in the last election are now leaning toward Prabowo.

“The economic agendas of the candidates suggests that irrespective of the outcome, policy continuity is likely (i.e. a mix of populism and growth accretive measures) albeit the means to the end may differ,” Societe Generale SA analyst Kunal Kundu wrote in a note last month.

READ: A Guide to Indonesia's Elections as Candidates Lay Out Pledges

India

Prime Minister Narendra Modi's party is widely expected to win the election expected in April or May. His victories in the recently concluded state polls cemented his party's position before the nationwide contest, and lifted the nation's equities to fresh records in 2023.

A third term for Modi would likely mean a continuation of market-friendly reforms, infrastructure spending and a push for foreign direct investment. That could offer more upside to the nation's stocks, which have become a favorite on Wall Street, thanks to a relatively resilient consumption-driven economy.

“Opinion polls and recent state elections indicate that the incumbent BJP-led government may secure a decisive win, which could trigger a bull run in the first three to four months of the year on expectations of policy continuity,” HSBC Holding Plc strategists including Amit Sachdeva wrote in a note dated Dec. 7. “India remains an overweight market in our regional equity strategy portfolio.”

--With assistance from Youkyung Lee.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.