(Bloomberg) -- This year's turmoil in China has sparked a stock meltdown, blown up structured financial products, led to public disgruntlement, and now President Xi Jinping has put a new market regulator in control.

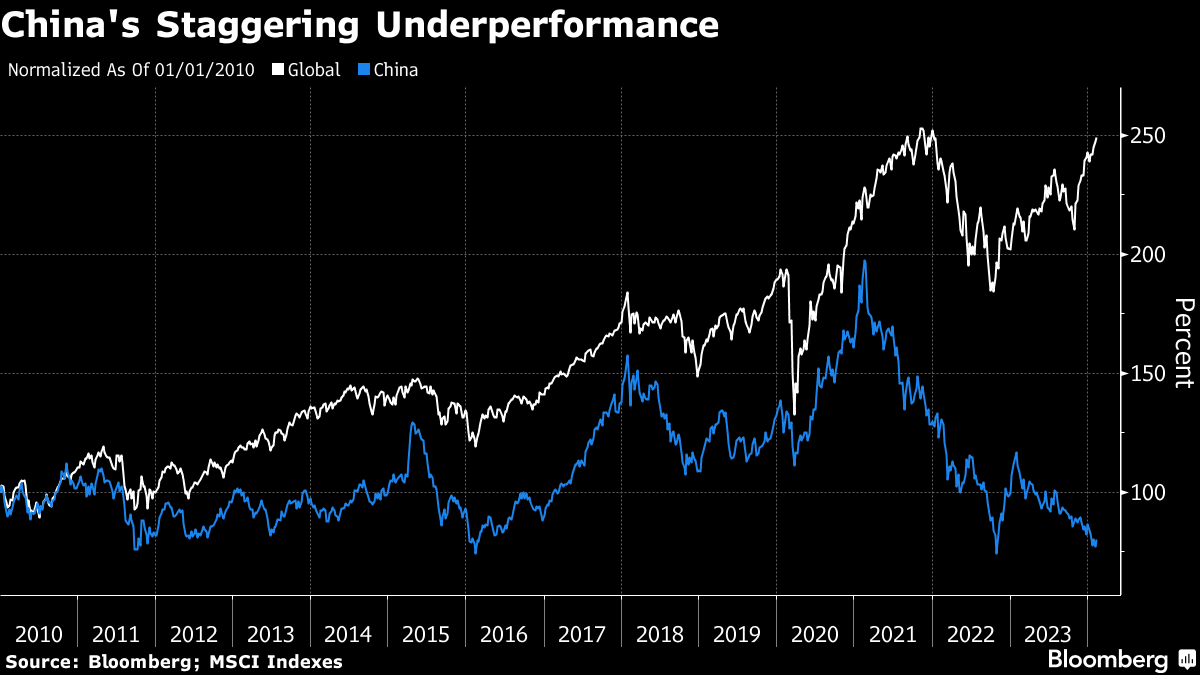

Yet powered by the US tech euphoria, global equities are approaching records, haven assets are out of favor and even neighboring Asian markets are relatively unscathed. Chinese assets are out of sync with the rest of the world, with a measure of global financial market volatility trending lower this year.

It's a stark contrast to what happened when China's bubble burst in 2015 and the world's two largest economies engaged in a trade war in 2018, which led to a synchronized drop in global shares. This time around Beijing's woes remain an isolated affair after an exodus of international capital.

With the selloff extending after three straight years of declines, even once-staunch China bulls including Goldman Sachs Group Inc. have been forced to rethink their views. If foreigners are not coming back, it will make Xi's mission to engineer a market recovery more difficult to achieve. It's also more fodder for investors looking to funnel capital to the pre-eminent US market and elsewhere in Asia instead.

“China seems to be divorced from the rest of the world,” said Steve Sosnick, chief strategist at Interactive Brokers. “Part of the lack of equity response is that the global economy is doing OK without China. The prior reactions occurred when China was a bastion of growth in a shakier world.”

The great divergence comes as onshore Chinese stocks have lost $4.8 trillion in value since their 2021 peaks, bogged down by a deepening property crisis, deflationary pressure and the state's sweeping control over the private sector. That's led to a record six months of outflows from mainland shares through January.

Read: Global Fund Exodus From China Stocks Hits Record Sixth Month

China's economic gloom and technical triggers associated with snowball derivatives and margin calls have added to the selling pressure. The CSI 300 Index remains down 2% for the year despite this week's more than 5% rebound. Beijing's attempts to rescue markets with short-selling restrictions and state fund interventions may prove insufficient to reverse prevalent pessimism.

Meanwhile, confidence in an economic soft landing over in the US has pushed the S&P 500 to new highs. Elsewhere, a global artificial intelligence boom has supported tech-reliant markets like Taiwan while India — seen a China alternative with its huge consumer base — is powering ahead.

Beijing's efforts to achieve self-sufficiency in key industries including tech has seen its economy somewhat disentangle from the rest of the world. The US has rolled out a series of sanctions aimed at containing its Asian rival's technological prowess but the move has ironically also empowered some Chinese firms to develop their own edge.

Read: Huawei's Chipmaker Turned US Sanctions Into China Success Story

With increased trade tensions prompting countries to diversify supply chains, a slowdown in the world's no. 2 economy is having less of an impact. Underscoring a shift in global trade patterns, US imports from China dropped 20% in 2023 to trail those from Mexico for the first time in 20 years.

China is “trying to reduce reliance on foreign technology and prevent foreign investment in many industries in order to counter Western influence,” said Ellen Hazen, chief market strategist and portfolio manager at F.L .Putnam Investment Management. “Right now — between the demographic issue, the debt issue, the property issue, and the lack of clarity on what minority shareholders really own — we don't think it's quite cheap enough to justify a position for US dollar-based clients.”

All told, the monthly co-movement between China and global stocks is near historic lows, according to MSCI indexes. Back in August 2015, China's devaluation of the yuan sparked a chain reaction across global markets, weighing on equities and commodities while giving bonds a boost. More than $5 trillion was wiped from the value of global stocks in two weeks.

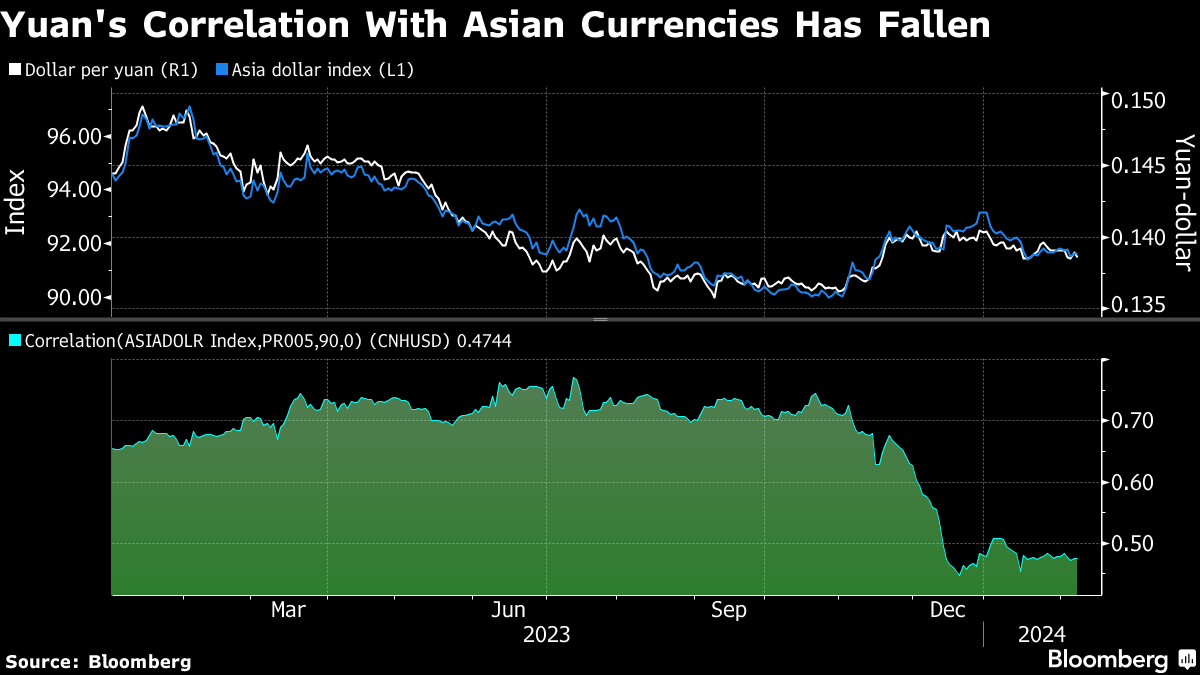

Now, the falling correlation isn't limited to stocks. The offshore yuan's correlation with the Bloomberg Asia dollar spot index has fallen to 0.47 — with 1 indicating movements in tandem — from above 0.70 just four months ago. Using the same criteria, the link between China's 10-year government bond yield and its Treasury equivalent is close to zero.

“The market is basically saying or acknowledging that some of the problems that China have are more idiosyncratic in nature,” said Arjun Jayaraman, portfolio manager at Causeway Capital Management. “We do find China to be very inexpensive on a variety of metrics but you have to have higher risk tolerance to buy China.”

All of this circles back to the question of whether Beijing's efforts to prop up stocks will allow them to catch up with the global rally. The CSI 300 benchmark remains more than 40% lower than a 2021 high.

As Jason Hsu notes, the downfall has been driven by sentiment, which “can just change on a dime.”

“If it's just sentiment, people are just pessimistic, they are unwilling to invest, they are just risk off, they are just selling, that part is more contained,” said Hsu, chief investment officer at Rayliant Global Advisors. “I am more optimistic than the broader market with regard to long term China growth.”

Yet a sustained rebound will require a shift in investor perception of the country as an unfavorable investment landscape. A January research by Citigroup Inc. showed some of the largest asset managers, which collectively manage some $18.6 trillion of assets, have shifted their positioning to “fully neutral,” and winning back their money will be a tall order.

The types of direct market intervention seen through the so-called national team may ultimately prove insufficient to prop up markets, according to Nick Ferres, chief investment officer for Vantage Point Asset Management.

“All the support measures from the national team, the ban on short-selling and changing the securities regulator leadership are not addressing the key fundamental issues of debt and growth,” he said.

--With assistance from Marcus Wong.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.