Shares of the Angel One Ltd. surged as much as 7.5% on Tuesday after it levied transaction charges on delivery based equity trades, which had earlier been free.

Brokerage charges of Rs 20 or 0.1%+GST, whichever is lower, will be levied per executed order. Minimum brokerage of Rs 2 shall be levied.

Set to be in effect from Oct. 1, the brokerage raised the securities transaction tax in accordance with the updated guidelines provided by the Union Budget 2025.

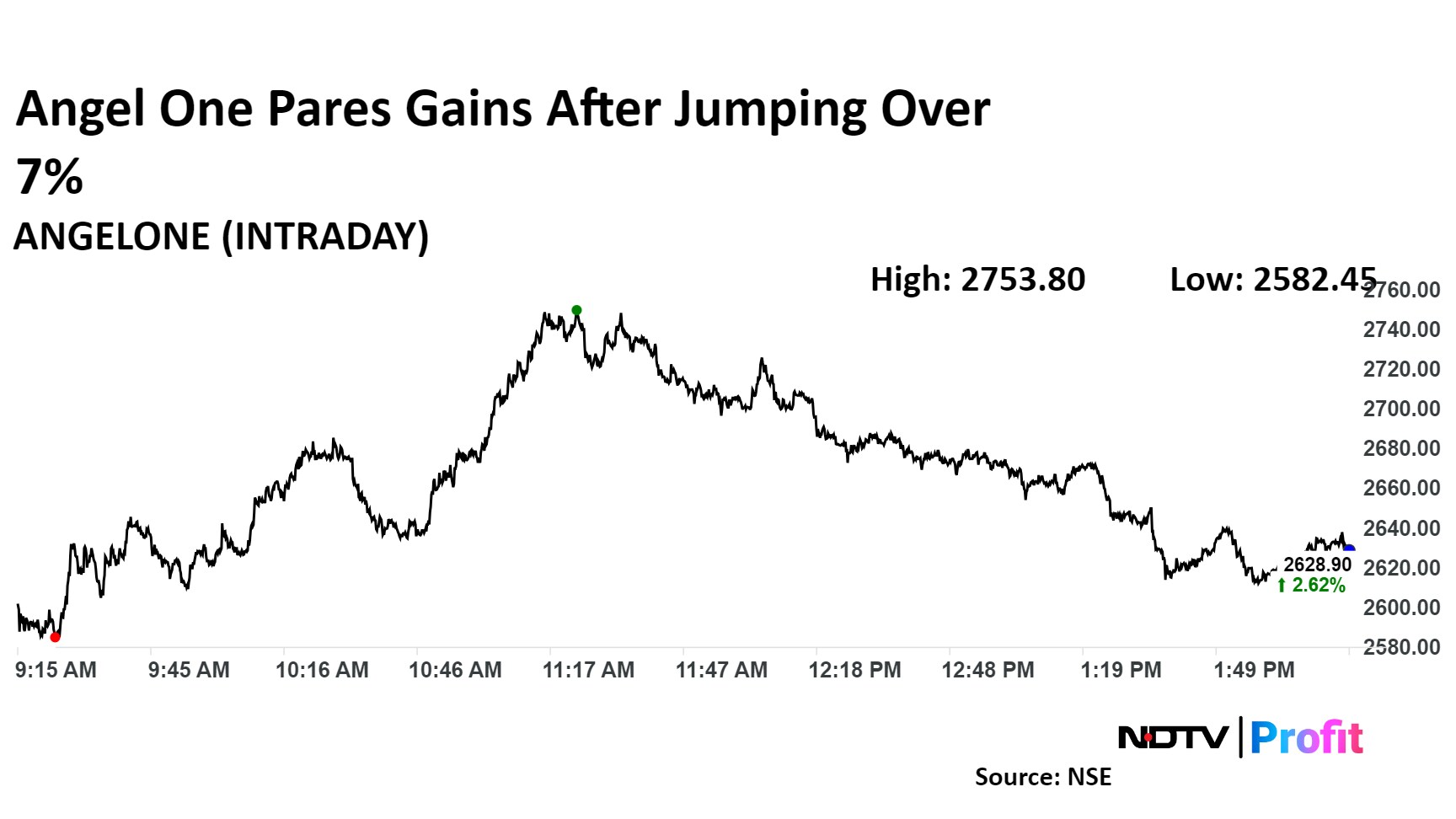

Angel One Share Price

Angle One shares rose as much as 7.5% before paring gains to trade 1.92% higher at Rs 2,611.00 per share as of 2:47 p.m., compared to a 0.17% decline in the NSE Nifty 50.

The scrip gained 41.88% in 12 months, but declined 25.17% year-to-date. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 57.41.

Out of nine analysts tracking the company, six maintain a 'buy' rating, two recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.0%.

The sale of futures in securities will now attract an STT of 0.02% against 0.0125% earlier, while STT on sale of options contracts will be 0.1% of the premium value, from 0.0625% earlier.

Investor Protection Fund Trust Charges

A charge of Rs 10 per crore of NSE equity and futures traded, along with an additional 18% goods and services tax, will be levied.

For equity options, the charge will be Rs 50 per crore of premium value of equity option traded on the NSE, with an addition of 18% GST.

Currency derivatives will also attract a charge of Rs 2 per lakh of premium value of options, and Rs 0.05 per lakh of traded value of futures, with an additional 18% GST.

NCDEX Risk Management Fee

A fee of Rs 100 per lakh will be levied, calculated on the premium value of every new overnight open interest position created.

Exchange Transaction Charges

MCX derivates will face charges of 0.0021% on futures and 0.0418% for options, revised from 0.05% earlier.

On NSE, cash transactions will face charges of 0.00297%, while equity futures and options will face 0.00173% and 0.03505%, respectively. Currency futures will face charges of 0.00035%. Currency and interest rate options will face a charge of 0.0311% for each.

On BSE, index/stocks futures will not attract any additional charge in this category. Sensex 50 options and stock options, however, will face 0.005% in charges, while Sensex and Bankex options will carry a charge of 0.0325%.

Depository Charges

The brokerage will also levy depository charges of Rs 20 per transaction, along with a GST of 18%.

Annual Maintenance Charges

A charge of Rs 60 per quarter will also be made for Non-Basic Service Demat Accounts, from the second year onwards.

Cash Collateral Margin

In case of a shortfall in excess of Rs 50,000, an interest charge of Rs 0.0342% will be made each day, which comes out to be an annualised charge of 12.5%, according to the company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.