.jpg?downsize=773:435)

Stocks in Asia dropped after an afternoon sell-off on Wall Street as investors gauge the warning signals flashing in the bond market, where sovereign yields have slumped to multi-year lows.

Japan's Topix index opened 1 percent lower, with losses more modest in Australia and South Korea. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 0.14 percent to 11,912 as of 7 a.m.

Short on time? Well, then listen to this podcast for a quick summary of the article!

BQ Live

Here's a quick look at all that could influence equities today.

U.S Market Check

- U.S. stocks fell to the lowest since March as a rally in 10-year Treasuries rekindled concern that a key recession signal has started to flash warnings amid what could be a protracted trade dispute with China.

#BQMarketWrap | U.S. stocks fall to two-month low as Treasuries rally.

Read: https://t.co/zkmyGjBnHv pic.twitter.com/86pRf4JHONAsian Cues

- Japan's Topix index fell 1 percent.

- Australia's S&P/ASX 200 Index dropped 0.3 percent.

- South Korea's Kospi index lost 0.2 percent.

- Futures on the S&P 500 fell 0.3 percent.

Commodity Cues

- Brent crude fell 0.36 percent to $68.35 per barrel.

- West Texas Intermediate crude slid 0.6 percent to $58.79 a barrel.

- Gold was at $1,281.14 an ounce.

London Metal Exchange

- Copper ended higher for the second consecutive trading session, up 0.08 percent.

- Aluminium ended higher for the third consecutive trading session, up 0.39 percent.

- Nickel resumed declined after a one-day rally, closed 1.84 percent lower.

- Lead ended little changed.

- Tin ended lower for the second day, down 0.52 percent.

- Zinc ended higher for the second consecutive trading session, up 0.08 percent.

Key Events To Watch This Week

- China provides a first peek at its May economic performance on Friday, with economists anticipating the official manufacturing PMI will tick down to 49.9 — a contraction — amid the worsening trade war with the U.S.

- U.S. first-quarter revised GDP data are due Thursday.

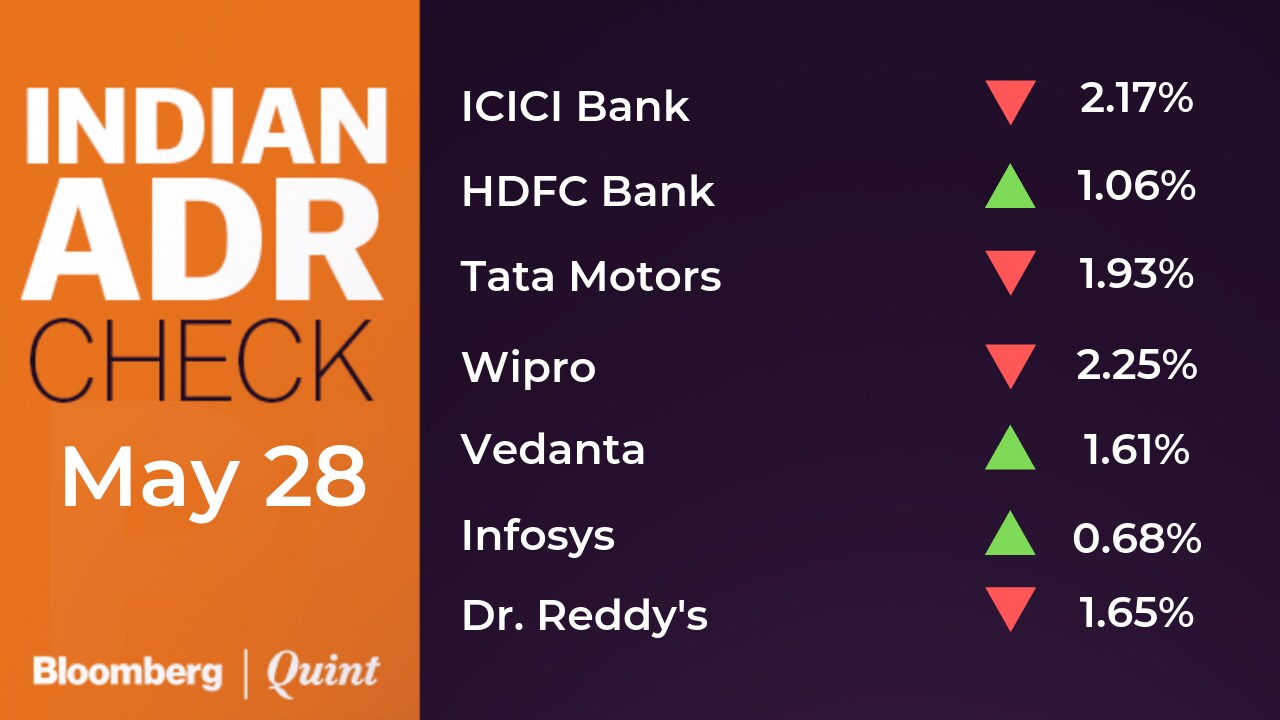

Indian ADRs

Stocks To Watch

- Indiabulls Housing Finance: Board said that the company has completed issuance and allotment of notes aggregating to $350 million under its Secured Euro Medium Term Note Program.

- IRB Infra Developers: Hapur Moradabad Project received an appointment date from competent authority. Toll collection and construction on the project to start from May 29. The company received work orders for operation and maintenance for project SPVs of its trust for a further period of 10 years.

- Meghmani Organics clarified that news of fire breaking out in its Dahej plant, which is being circulated in social media is fake and no incident has taken place. The company said that it has filed a police complaint in Ahmedabad. To expand it agrochemical production capacity by 10,800 MT at a cost Rs 127 crore. The project will contribute turnover of Rs 200 crore in full year of operation.

- DHFL clarified on the news of look-out notice issued against promoters stating that the promoters have not received any kind of such communication.

- Aksh Optfibre: Care Ratings changed its rating from ‘BBB' to ‘D'. The reason for decline in rating is on-going delays in debt servicing along with ongoing development of Letter of credit. The delays are on account of stressed liquidity position primarily due to delayed realization from government customers leading to cash flow mismatches.

- Karur Vyasa Bank: Received RBI nod for appointment of NS Srinath as Part-Time Non-Executive Chairman till May 2022. The company entered in to binding term sheet with Centrum Wealth Management to establish a JV to provide wealth management services.

- Great Eastern Shipping to consider share buy-back on June 1.

- Mindtree opened its off-shore delivery centre in the U.S.

Nifty Earnings To Watch

- Power Grid Corporation of India

- Mahindra & Mahindra

Other Earnings To Watch

- Power Finance Corporation

- Aban Offshore

- Adani Enterprises

- Adani Power

- Andhra Cements

- Havells India

- Finolex Cables

- Reliance Power

- Glenmark Pharmaceuticals

- Lemon Tree Hotels

- RITES

- Speciality Restaurants

- Maharashtra Seamless

- GMR Infrastructure

- V-Guard Industries

- NBCC (India)

- GPT Infraprojects

- Grindwell Norton

- IPCA Laboratories

- ISGEC Heavy Engineering

- Jagran Prakashan

- Karda Constructions

- Kiri Industries

- TTK Prestige

- Gufic Biosciences

- Gujarat Narmada Valley Fertilizers and Chemicals

- Harrisons Malayalam

- Apar Industries

- Balmer Lawrie & Company

- United Spirits

- Bharat Electronics

- SJVN

- Cadila Healthcare

- CIL Nova Petrochemicals

- Cimmco

- CL Educate

- Cupid

- DCM

- Dynamatic Technologies

- Excel Crop Care

- Excel Realty N Infra

- Fertilizers and Chemicals Travancore

- Garden Reach Shipbuilders & Engineers

- Hawkins Cookers

- Hindustan Tin Works

- IFB Industries

- India Tourism Development Corporation

- Indian Hume Pipe Company

- Indoco Remedies

- Ind-Swift Laboratories

- IOL Chemicals and Pharmaceuticals

- Kirloskar Electric Company

- Kohinoor Foods

- Max India

- Mercator

- MIRC Electronics

- Mishra Dhatu Nigam

- NACL Industries

- Nava Bharat Ventures

- PC Jeweller

- Rail Vikas Nigam

- Repco Home Finance

- Rico Auto Industries

- Ruchi Soya Industries

- SMS Lifesciences India

- Sreeleathers

- Titagarh Wagons

- Tourism Finance Corporation of India

- Ujaas Energy

- Vadilal Industries

- Wheels India

- Zenlabs Ethica

Earnings Reaction To Watch

Shalimar Paints (Q4, YoY)

- Revenue up 48.7 percent to Rs 89.5 crore.

- Net loss of Rs 43.3 crore versus net loss of Rs 16.1 crore.

- Ebitda loss of Rs 35.5 crore versus Ebitda loss of Rs 10.3 crore.

- Exceptional loss of Rs 11.6 crore.

- Other expenses up 2.8 times to Rs 40.9 crore.

S Chand (Q4, YoY)

- Revenue down 31.4 percent to Rs 449.1 crore.

- Net profit down 45.8 percent to Rs 12.2 crore.

- Ebitda down 45.4 percent to Rs 182.7 crore.

- Margin at 40.7 percent versus 51.1 percent.

Federal Mogul Goetze India (Q4, YoY)

- Revenue down 2.3 percent to Rs 320.3 crore.

- Net profit down 20.3 percent to Rs 17.7 crore.

- Ebitda down 8.6 percent to Rs 48.7 crore.

- Margin at 15.2 percent versus 16.3 percent

- Inventory gain of Rs 18.3 crore in base quarter.

- Depreciation expenses up 23 percent to Rs 21 crore.

Himatsingka Seide (Q4, YoY)

- Revenue up 22.6 percent to Rs 690.9 crore.

- Net profit down 3.8 percent to Rs 48.4 crore.

- Ebitda up 11.8 percent to Rs 138.6 crore.

- Margin at 20.1 percent versus 22 percent.

- Deferred tax reversal of Rs 18.7 crore.

- Finance cost up 41 percent and depreciation cost up 40 percent.

KDDL (Q4, YoY)

- Revenue up 8.8 percent to Rs 150.2 crore.

- Net profit down 59.7 percent to Rs 2.5 crore.

- Ebitda down 3.8 percent to Rs 12.6 crore.

- Margin at 8.4 percent versus 9.5 percent.

- Inventory gain of Rs 11.6 crore.

Sun Pharma (Q4, YoY)

- Revenue up 2.7 percent to Rs 7,163.9 crore.

- Net profit down 52.6 percent to Rs 635.9 crore.

- Ebitda down 39.6 percent to Rs 1,016.8 crore.

- Margin at 14.2 percent versus 24.1 percent.

- Inventory gain of Rs 425.4 crore.

- RM as percent of sales at 29 percent versus 16 percent.

- India sales down 44 percent to Rs 1,101 crore.

- One-time impact of Rs 1,085 crore related to change in distribution of India business impacted topline and operational performance of the company.

- Sudhir Valia steps down from post of whole-time director to non-executive with effect from May 29.

IRB Infra (Q4, YoY)

- Revenue up 40.9 percent to Rs 1,948.3 crore.

- Net profit down 13.2 percent to Rs 208.01 crore.

- Ebitda up 15.4 percent to Rs 760.1 crore.

- Margin at 39 percent versus 47.6 percent.

NMDC (Q4, YoY)

- Revenue down 6.2 percent to Rs 3,643.3 crore.

- Net profit up 31.5 percent to Rs 1,453.8 crore.

- Ebitda up 10.1 percent to Rs 2,092.3 crore.

- Margin at 57.4 percent versus 49 percent.

- Sales volume stood flat at 10.4 MT.

Teamlease Services(Q4, QoQ)

- Revenue down 1 percent to Rs 1,168.6 crore.

- Net Income up 3 percent to Rs 26 crore.

- Ebitda up 4 percent to Rs 25.5 crore.

- Margin at 2.2 percent versus 2.1 percent.

Aurobindo Pharma (Q4, YoY)

- Revenue up 30.7 percent to Rs 5,292.2 crore.

- Net profit up 10.8 percent to Rs 585.4 crore.

- Ebitda up 31.9 percent to Rs 1.060.3 crore.

- Margin flat at 20 percent versus 19.9 percent.

- Exceptional loss of Rs 36.2 crore.

- Finance Costs up 2 times to Rs 50.1 crore.

- Board approved the amalgamation of six arms with self.

- Formulations segment revenue up 34.6 percent to Rs 4,373.6 crore.

- API segment revenue up 14.6 percent to Rs 916.8 crore.

Lakshmi Vilas Bank (Q4, YoY)

- Net Interest Income up 16.4 percent to Rs 140.2 crore.

- Net loss of Rs 264.4 crore versus net loss of Rs 622.3 crore.

- Provisions of Rs 301.2 crore versus Rs 880.4 crore.

- GNPA at 15.3 percent versus 13.95 percent. (QoQ)

- NNPA at 7.49 percent versus 7.64 percent. (QoQ)

Pfizer (Q4, YoY)

- Revenue up 3 percent to Rs 535.6 crore.

- Net profit up 4.7 percent to Rs 109.47 crore.

- Ebitda up 9 percent to Rs 150.9 crore.

- Margin at 28.2 percent versus 26.6 percent.

- Lower employee cost and stable raw material cost aided operational performance.

Ircon International (Q4, YoY)

- Revenue up 2.4 percent to Rs 1,532.8 crore.

- Net profit down 55.8 percent to Rs 95.59 crore.

- Ebitda down 32.1 percent to Rs 157.43 crore.

- Margin at 10.3 percent versus 15.5 percent.

3M India (Q4, YoY)

- Revenue up 1.5 percent to Rs 689.2 crore.

- Net profit down 37.5 percent to Rs 58.14 crore.

- Ebitda down 4.5 percent to Rs 98.1 crore.

- Margin at 14.2 percent versus 22.1 percent.

- Higher depreciation, lower other income and revenue weighed on bottom-line numbers.

- Other income was down by 74 percent (YoY).

Asian Granito (Q4, YoY)

- Revenue down 5.7 percent to Rs 369.2 crore.

- Net profit down 65.8 percent to Rs 5.8 crore.

- Ebitda down 33.7 percent to Rs 24.1 crore.

- Margin at 6.5 percent versus 9.2 percent.

Man Industries (Q4, YoY)

- Revenue down 50 percent to Rs 244.7 crore.

- Net profit down 94 percent to Rs 1.6 crore.

- Ebitda loss of Rs 10.7 crore versus Ebitda profit of Rs 61.6 crore.

Navkar Corporation (Q4, YoY)

- Revenue up 13 percent to Rs 130.1 crore.

- Net profit down 63.2 percent to Rs 10.2 crore.

- Ebitda down 23 percent to Rs 38.1 crore.

- Margin at 29.3 percent versus 43 percent.

- Finance cost up three times to Rs 12.7 crore.

- Operating expenses as percent of sales at 54 percent versus 39 percent.

Gujarat A lakhalies & Chemicals (Q4, YoY)

- Revenue up 17.7 percent to Rs 820.6 crore.

- Net profit down 23.2 percent to Rs 169.8 crore.

- Ebitda down 6.6 percent to Rs 273.5 crore.

- Margin at 33.3 percent versus 42 percent

- Other income of Rs 60 crore in base quarter.

- Board approves appointment of Vinayak Kudtarkar as CFO with effect from June 1.

Himadri Speciality Chemicals (Q4, YoY)

- Revenue up 5.9 percent to Rs 583.4 crore.

- Net profit up 1.3 percent to Rs 72.2 crore.

- Ebitda down 0.8 percent to Rs 123.3 crore.

- Margin at 21.1 percent versus 22.6 percent.

- Board re-appoints Bankey Lal Choudhary as MD till April 2020.

Aegis Logistics (Q4, YoY)

- Revenue up 48 percent to Rs 1,852.6 crore.

- Net profit up 27.7 percent to Rs 61.7 crore.

- Ebitda up 48.3 percent to Rs 103.5 crore.

- Margin flat at 5.6 percent.

- Deferred tax reversal of Rs 40.9 crore in base quarter.

Balmer Lawrie (Q4, YoY)

- Revenue down 0.5 percent to Rs 474.5 crore.

- Net profit up 0.5 percent to Rs 88.3 crore.

- Ebitda up 3.6 percent to Rs 88.4 crore.

- Margin at 18.6 percent versus 17.9 percent.

- Deferred Tax Payment of Rs 12.1 crore in Base Quarter

Shipping Corporation of India (Q4, YoY)

- Revenue up 11.1 percent to Rs 1,019 crore.

- Net profit down 81.9 percent to Rs 46 crore.

- Ebitda up 32.9 percent to Rs 185.7 crore.

- Margin at 18.2 percent versus 15.2 percent.

- Deferred tax reversal of Rs 284.3 crore in base quarter.

SML Isuzu (Q4, YoY)

- Revenue up 16.7 percent to Rs 429.6 crore.

- Net profit up 47.7 percent to Rs 22 crore.

- Ebitda up 67.6 percent to Rs 40.9 crore.

- Margin at 9.5 percent versus 6.6 percent.

- Inventory gain of Rs 70.4 crore in base quarter.

Minda Corporation (Q4, YoY)

- Revenue up 7.1 percent to Rs 771.4 crore.

- Net profit flat to Rs 39.1 crore versus Rs 38.7 crore.

- Ebitda flat to Rs 82.1 crore versus Rs 81.8 crore.

- Margin at 10.6 percent versus 11.4 percent.

- Board re-appoints Ashok Minda as CMD from August 1.

GATI (Q4, YoY)

- Revenue up 0.9 percent to Rs 459.4 crore.

- Net profit of Rs 8.3 crore versus net loss of Rs 5.9 crore.

- Ebitda up 70.1 percent to Rs 26.2 crore versus Rs 15.4 crore.

- Margin at 5.7 percent versus 3.4 percent.

- Other Expenses down 11 percent to Rs 39.8 crore versus Rs 44.5 crore.

- Board appoints Peter H Jayakumar as CFO from May 28.

Reliance Naval & Engineering (Q4, YoY)

- Revenue up 6.9 percent to Rs 35.4 crore.

- Net loss of Rs 9,339.1 crore versus net loss of Rs 408.7 crore.

- Exceptional loss of Rs 8,746.6 crore.

Kolte Patil (Q4, YoY)

- Revenue down 59 percent to Rs 195 crore.

- Net profit down 1.2 percent to Rs 40.1 crore.

- Ebitda down 26 percent to Rs 76.8 crore.

- Margin at 39.3 percent versus 21.7 percent.

- Company to increase its stake in Kolte-Patil l-Ven Township to 95 percent from 45 percent. It bought stake from lClCl Venture Funds Management Company for Rs 140 crore

ITI (Q4, YoY)

- Revenue down 20 percent to Rs 632.9 crore.

- Net profit down 36 percent to Rs 68.7 crore.

- Ebitda up 23 percent to Rs 82.3 crore.

- Margin at 13 percent versus 8.5 percent.

- Net profit down due to lower other income.

Bulk Deals

- Cadila Healthcare: Integrated Core Strategies (Asia) acquired 54.6 lakh or 0.53 percent equity to Rs 258.21 each.

- ICICI Lombard GIC: Integrated Core Strategies (Asia) sold 54.6 lakh or 0.60 percent equity to Rs 1149.16 each.

Pledge Share Details

- LG Balakrishnan promoter and director V.Rajvirdhan created pledge of 18.36 lakh shares from Jan. 23 to May 7.

Trading Tweaks

- 5Paisa Capital record date for rights issue at 1:1 at a premium of Rs 70 per share.

- Magadh Sugar & Energy, Timken India to move into short term ASM Framework.

- Manpasand Beverages price band revised to 10 percent.

Who's Meeting Whom

- Fiem Industries to meet JM Financial Services on May 30.

- Indian Hotels to meet Copper Rock, Soros Capital Management and other investors from May 29-31.

- Sudarshan Chemical to meet Ambit Capital on May 29.

- Mahindra Logistics to meet Valuequest Investment Advisors and Stewart Investors from May 29-30.

- Cummins India to meet UTI MF, Invesco Hong Kong and other investors on May 30.

Insider Trading

- Mindtree: L&T acquired 3.56 lakh shares on May 28.

- Subex promoter Sudeesh Yezhuvath sold 1.7 lakh shares on May 24.

- Texmaco Infra Holdings promoter Adentz Finance acquired 5 lakh shares on May 27.

- Sterlite Technologies promoter Pravin Agarwal acquired 57,000 shares on May 27.

- Eris Lifesciences promoter and director Amit Bakshi acquired 1.85 lakh shares on May 24.

- Gateway Distriparks promoter Perfect Communications acquired 2 lakh shares on May 24.

- Man Infra promoter and director Parag Shah acquired 1 lakh shares on May 27.

Money Market Update

- The rupee on Tuesday closed at 69.68/$ versus Monday's 69.50/$.

F&O Cues

Futures

Nifty

- Nifty May futures closed trading at 11940.7, premium of 12 points Versus discount of 6 points

- Nifty futures open interest across series 8 percent, adds 18 lakh shares

Bank Nifty

- Bank Nifty May futures closed trading at 31629, premium of 31 points Versus discount of 52 points

- Bank Nifty open interest across all series down 1 percent, sheds 30k shares

Rollovers

- Nifty Rollover at 42 percent, Bank Nifty Rollover at 40 percent

Options

- Nifty PCR at 1.27 Versus 1.26 (across all series)

Nifty Monthly Expiry 30 May

- Max open interest on call side at 12,500 (40.8 lakh shares) followed by 12,000 (40.4 lakh shares)

- Max open interest on Put side at 11,000 (36.5 lakh shares) followed by 11,700 (26.4 lakh shares)

- Max open interest addition seen at 11,900P (+4.7 lakh shares), 11,900C (+3.7 lakh shares)

Stocks In F&O Ban:

In Ban:

- Adani Power

- PC Jewellers

Out Of Ban:

- IDBI Bank

Brokerage Radar

On Sun Pharma

UBS

- Maintained ‘Buy'; cut price target to Rs 500 from Rs 515.

- March quarter earnings were lower than estimates largely due to decline in India revenues.

- See slower than expected monetisation of the innovative pipeline.

- Continue to foresee a valuation discount for Sun to other large cap Indian pharma.

Morgan Stanley

- Maintained ‘Underweight' with a price target of Rs 470.

- March quarter results missed estimates.

- U.S. specialty looks to be taking a longer road to profitability.

- Expect 2019-20 to be a transition year for the specialty business.

CLSA

- Maintained ‘Buy'; cut price target to Rs 520 from Rs 560.

- Changes in India distribution hits Q4.

- Ilumya gaining traction but Cequa launch delayed to 2QFY20.

- FY20 growth guidance in-line with expectations.

Citi

- Maintained ‘Buy' with a price target of Rs 540

- Several One-Offs Impact Q4.

- FY20 guidance reasonable.

- Current price appears to factor in most concerns.

On IRB Infra

Deutsche Bank Research

- Maintained ‘Buy'; cut price target to Rs 185 from Rs 215.

- March quarter results missed estimate on lower EPC margin.

- IRB has ramped up execution of HAM projects which are expected to earn significantly lower margins.

- Maintain Buy on reasonable valuation and expected strong order book growth.

CLSA

- Maintained ‘Buy' with a price target of Rs 250.

- In-line FY19 despite economic slowdown led by construction.

- Toll collection mixed: Rajasthan and UP weak and Maharashtra and Gujarat OK.

- The stock offers deep value as it trades at lower valuation and 5 percent dividend yield.

On Prestige Estates

Morgan Stanley

- Maintained ‘Overweight'; hiked price target to Rs 347 from Rs 320.

- March quarter surpassed estimates; 2019-20 to be a growth year.

- Diversified portfolio of residential and annuity assets, with steady ramp-up potential.

- Company aims to lower net gearing in coming quarters.

CLSA

- Maintained ‘Buy'; hiked price target to Rs 345 from Rs 268.

- Results above estimates on a revenue beat.

- Pre-sales at 18-quarter high; strong guidance.

- Lease income scale-up continues; cashflows supportive.

- Planned deleveraging implies monetisation.

On Info Edge

Jefferies

- Maintained ‘Hold' with a price target of Rs 1,715.

- Margin drives slight beat in March quarter.

- Management guides for continued investments across businesses.

CLSA

- Maintained ‘Buy'; hiked price target to Rs 2,400 from Rs 2,070.

- Naukri revenue and billing growth remains strong.

- 99acres revenue growth stellar but billing growth moderates.

- Zomato's growth explosive in 2018-19 and city expansion on fire.

- Enters FY20 with all cylinders firing.

More Calls

Morgan Stanley on Punjab National Bank

- Maintained ‘Underweight' with a price target of Rs 75.

- Weak numbers; Asset quality was weak; Core PPOP was muted.

- Core pre-provisioning operating profit was weak owing to lower margins/fees.

- Balance sheet is weak given CET 1 ratio at just 6.2 percent.

SBICAP on SpiceJet

- Maintained ‘Buy' with a price target of Rs 172.

- Profit improves; fails to maximize on capacity crunch.

- Network structure and Max fleet grounding limit benefits from Jet withdrawal.

- Ability to profitably deploy the massive increase in capacity will be key to stock's performance.

Investec on Vedanta

- Initiated ‘Buy' with a price target of Rs 233

- Strong diversified play; mgmt. delivery should be monitored.

- Asset base offers significant scope of ramp-up posing upside risk to earnings.

- Stated dividend policy is positive and capital allocation priorities encouraging.

- Valuations attractive, restoring minority confidence is key.

Credit Suisse on Jindal Steel & Power

- Maintained ‘Outperform'; hiked price target to Rs 230 from Rs 196.

- Deleveraging through Angul ramp-up is key.

- Another catalyst is the award of PPAs in the power business.

- With capex behind it and favourable spreads going ahead, deleveraging should be faster.

Credit Suisse on Tata Steel

- Maintained ‘Outperform'; hiked price target to Rs 660 from Rs 570.

- Best positioned to play iron ore rally.

- Tata Steel is well positioned to benefit from higher global steel prices.

- Failure of the proposed European JV was a speed bump, not a road block.

CLSA on Century Ply

- Maintained ‘Sell'; cut price target to Rs 159 from Rs 174.

- March quarter results was an all-round miss.

- MDF market supply glut a key concern.

- Product mix shift in plywood likely to keep margins under pressure.

CLSA on Cement Sector

- Dalmia Bharat: Upgraded to ‘Buy' from ‘Outperform'; hiked price target to Rs 1,500 from Rs 1,300.

- India Cements: Maintained ‘Buy'; hiked price target to Rs 135 from Rs 115.

- With exit prices higher, Q1FY20 seems like a blockbuster.

- Checks suggest higher discounts in last two weeks due to weak construction activity.

- With elections behind, a clear picture should now emerge.

- Capacity expansion is not viewed as a big concern in the medium term.

Nomura on Max Financial

- Maintained ‘Buy' with a price target of Rs 550.

- Robust Q4: VNB margin continues to surprise.

- Steady APE growth trend; Strong margins driven by a more favourable product mix.

- Distribution risk factored into the share price.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.