Oil prices crashed, equities plunged and sovereign bond yields slumped after crude producers launched a price war, an additional disruption to a global economy already struggling thanks to the coronavirus.

Japan's Topix index declined 4.2 percent, while Australia's S&P/ASX 200 Index plunged 5.5 percent. South Korea's Kospi index sank 2.8 percent. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, fell 2.5 percent to 10,625 as of 7 a.m.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Here's a quick look at all that could influence equities today

- Oil markets tumbled more than 30 percent after the disintegration of the OPEC+ alliance triggered an all-out price-war between Saudi Arabia and Russia that is likely to have sweeping political and economic consequences.

- U.S. stocks staged a furious rally in the final hour of trading on Friday that cut in half a rout that reached 4 percent and left the S&P 500 higher after a tumultuous week dominated by fear the spreading coronavirus will upend global growth.

- The yield on 10-year Treasuries dropped 26 basis points to 0.49 percent.

- Futures on the S&P 500 Index cratered as much as 5 percent, triggering trading curbs.

Get your daily fix of global markets here.

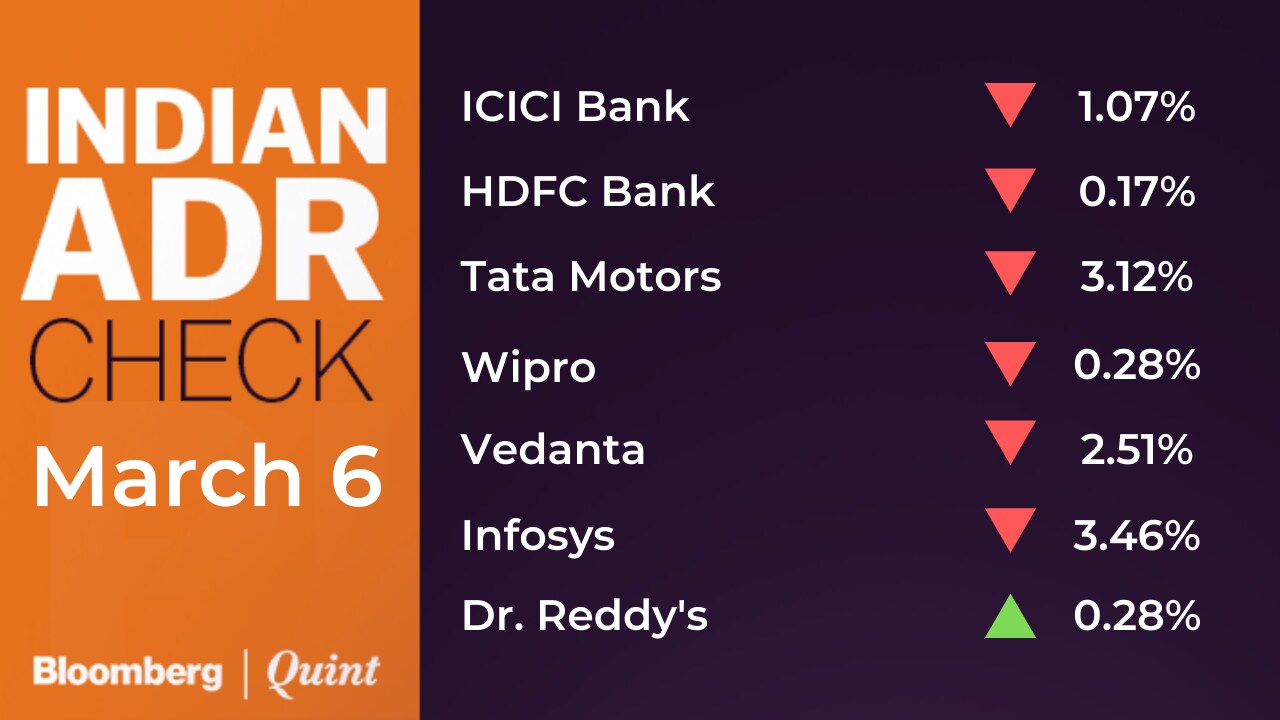

Indian ADRs

Stocks To Watch

- SBI, Yes Bank: SBI will acquire a 49 percent stake in Yes Bank and make an initial investment of Rs 2,450 crore. That came after the RBI on Thursday advised the central government to put Yes Bank under a moratorium and superseded its board, capping withdrawals at Rs 50,000 for a month. The day after, the central bank released a draft plan aimed at altering Yes Bank's authorised share capital to Rs 5,000 crore and issuing 2,400 crore shares with a face value of Rs 2 apiece. To be sure, as an investor under the reconstruction scheme, SBI is expected to maintain at least 26 percent stake for three years. This means as new investors buy into Yes Bank, SBI will have to infuse further equity to maintain its stake.

- IndusInd Bank: Board meeting to raise funds has been deferred in view of the current market conditions and as the bank is adequately capitalized at present.

- PNB Housing Finance: India Ratings downgraded ratings on NCD to AA from AA+ due to challenging operating environment for majority of NBFCs in the mid-to-higher ticket size housing loan segment, increasing pressure on asset quality and higher leverage in view of the portfolio composition.

- Indiabulls Housing Finance: Exposure to Yes Bank's AT-1 bonds is close to Rs 662 crore.

- BPCL: DIPAM uploaded EoI for selling government's entire stake in BPCL. Government will carve out BPCL's 61.65 percent stake in Numaligarh Refinery Ltd. to a CPSE and that won't be a part of the divestment. Relief for PSUs as the document mentions Indian state-run entities, in which the government owns a stake of at least 51 percent, won't be eligible to participate in the bidding.

- Hindalco: Department of Justice says arbitration concludes in Novelis-Aleris merger dispute. Justice Department says arbitration decision in an antitrust lawsuit to block Novelis's deal for Aleris will be issued by March 13. If DOJ wins, Novelis will have to divest assets to proceed with merger and if Novelis wins DOJ will dismiss its complaint.

- Cox & Kings: Releases list of financial and operational creditors. It has a financial debt of Rs 5,912 crore. Major loans have been taken by Yes Bank (Rs 2,285 crore), Axis Bank (Rs 1,065 crore), SBI (Rs 635 crore) and IndusInd Bank (Rs 270 crore).

- Cochin Shipyards: NCLT Chennai has approved a resolution plan submitted by the company with respect acquisition of Tebma Shipyards.

- Hikal: said that it has received a notice from the Maharashtra Pollution Control Board (MPCB) for the closure of its Mahad Unit based on a complaint received from the local community in Taloja. The company has filed a writ petition in the Bombay High Court for stay and said that there is a possibility of some impact on operations at Mahad site until this matter is resolved. The complaint mentions that a tanker of an authorised transporter, carrying by-product of Hikal was found near the river Kasadi in Taloja. This material was en-route for further processing to an MPCB approved manufacturer located in MIDC Dhule.

- Natco Pharma: received one observation for its formulation facility at Kothur by the U.S. FDA, who had completed pre-approval inspection from March 2-6. The observation is related to equipment qualification of a co-mill used in the process that had operating speed slightly outside the qualification range. The company believes that this is a minor observation and can be addressed within a short period of time.

- Novartis: received demand notice for Rs 169.52 crore from the income tax department. The main contention is that the company has not deducted TDS on discount given to the stockists and that there was a delay in deduction of TDS on performance-based shares and that no TDS was deducted on the accrual of interest on outstanding payments to MSMEs. The company has filed an appeal before the Commissioner of Income Tax (Appeals), Mumbai along with detailed submissions.

- Canara Bank: Board has permitted to offload equity shares of Commonwealth Trust through the bidding process.

- Allahabad Bank: Has fixed March 23 as the record date for its amalgamation into Indian Bank.

- Supreme Petrochem: To consider share buyback on March 12.

- PTC India: Received projects worth Rs 75 crore for its consulting business from EESL.

- HPCL: Allotted debentures worth Rs 1,400 crore on March 6.

- Simplex Infrastructures: lnfomerics Valuation and Rating has downgraded the company's long-term bank facilities, commercial paper and short-term fund-based facilities worth Rs 3,325 crore to Default Rating. The revision in ratings is due to recent delays in servicing its obligation in bank facilities and non -convertible debentures.

- Gayatri Projects: Received Rs 44 crore from a settlement of its claim related to a NHAI project.

- Bank of Maharashtra: Allotted bonds worth Rs 600 crore on March 6.

Brokerage Radar

Morgan Stanley on Grasim

- Maintained ‘Overweight' with a price target of Rs 910.

- Standalone businesses are facing cyclical challenges; believe the same is reflected in stock price.

- Lack of clarity on the fate of the group's telecom company remains an overhang.

- Grasim's board has not yet received any proposal to evaluate such an investment.

Citi on Dr Reddy's

- Maintained ‘Buy' with a price target of Rs 3,700.

- Mgmt. sees more headroom on profitability.

- US generics focus on diversifying base and improving profitability.

- Sanguine on China sourcing; manufacturing in China is gradually picking up.

On SBI

Ambit Capital

- Maintained ‘Buy' with a price target of Rs 457.

- SBI's capital infusion in Yes Bank is meagre 1 percent of its current networth.

- Total investment in Yes Bank could be Rs 6200-11800 crore.

- Maximum impact on SBI if entire investment goes bad will be 5 percent.

- Contours of the scheme show that the government does not want to put entire burden of rescuing Yes Bank on SBI.

Investec

- Maintained ‘Buy' with a price target of Rs 380.

- Draft reconstitution scheme - better than a full merger.

- Total capital infusion from all investors could be around Rs 20,000 crore.

- Impact of Rs 10,000 crore on book value in FY20 & FY21 shall be around 4 percent and impact on CET1 at 40 basis points.

Axis Capital

- Good part is that the Yes Bank saga has moved on quickly.

- Since AT-1 bonds are written down and new capital is coming at Rs 10 per share, the loss on investment by SBI if any will be limited.

- Write-down of AT-1 reduces the attractiveness and will force banks to look to other avenues.

- According to calculations, Yes Bank total stress book of Rs 45,000 crore.

On Reliance Industries

Macquarie

- Maintained ‘Underperform' with a price target of Rs 1,300.

- See material risk to consensus 40%+ earnings growth forecast.

- To meet consensus growth, GRMs need to rise to $13 a barrel.

- Every $1 per barrel change in GRM impacts FY21 group EPS by 4 percent.

HSBC

- Maintained ‘Buy'; cut price target to Rs 1,740 from Rs 1,780.

- See underperformance as a buying opportunity.

- Concerns related to deleveraging and downstream margins appear to overlook upside potential from telecom and retail.

- Cut EPS estimates for the next two financial years by 8 percent and 5 percent respectively to factor in lower downstream margins.

Offerings

- Antony Waste Handling Cell IPO subscribed 0.5 times. Retail investors subscribed 0.38 times. Institutional investors subscribed 0.89 times. IPO extended till March 16, citing market volatility. Earlier closing date was March 6.

- SBI Cards to raise Rs 10,340.8 crore at offer price of Rs. 755 per share. Offer includes a reservation of 18.64 lakh shares for employees at a discount of Rs 75 on the offer price and reservation of 1.3 crore shares for SBI shareholders.

Bulk Deals

- RBL Bank: Credit Suisse Singapore acquired 43.55 lakh shares (0.68 percent) at Rs 256.48 each

- Eveready Industries: HDFC sold 8.5 lakh shares (1.17 percent) at Rs 64 each

- Yes Bank: Government Pension Fund Global sold 1.56 crore shares (0.61 percent) at Rs 7.22 each

Pledged Share Details

- Granules India: Released pledge of 1.28 crore shares on March 5

- Future Retail: Promoter Future Corporate Resources created pledge of 1.6 crore shares from March 4-5

- Sadbhav Engineering: Promoter created pledge on additional 0.42 percent stake

- GMR Infra: Promoter created pledge on additional 0.43 percent stake

- Adani Transmission: Promoter created pledge on additional 0.11 percent stake

- Adani Green Energy: Promoter created pledge on additional 0.16 percent stake.

- Max India: Promoter created additional pledge on 2.76 percent stake.

Trading Tweaks

- Borosil Renewables record date for demerger.

- AGC Networks, Ruchi Soya Industries, Pioneer Distilleries, Industrial Investment Trust, Apollo Tricoat Tubes to move out of ASM Framework.

- Alok Industries, Intrasoft Technologies to move into short term ASM Framework.

- India Cements, Honeywell Automation, Tata Teleservices (Maharashtra) to move out of short term ASM Framework.

- Bajaj Hindusthan Sugar price band revised to 10 percent.

- Orissa Minerals Development, Indiabulls Ventures, MTNL, Rushil Décor price band revised to 5 percent.

Who's Meeting Whom

- Tata Motors to meet Bernstein and SMBC Nikko Securities from March 11-13.

- Thyrocare Technologies will meet JPMorgan India on March 11, Aditya Birla Capital on March 12 and Hill Fort Capital on March 18.

Insider Trading

- Maruti Suzuki promoter Suzuki Motor Corporation acquired 2.11 lakh shares on March 6.

- Greenply Industries promoters acquired 85,000 shares on March 5.

- V2 Retail promoter V2 Conglomerate acquired 1.15 lakh shares from March 4-5.

(As Reported On March 6)

Money Market Update

- The rupee ended weaker at Rs 73.79 against the dollar on Friday versus Rs 73.31 against the dollar on Thursday.

F&O Cues

Futures

- Nifty March futures closed at 10,939.90, discount of 50 points versus 13.6 points.

- Nifty March futures OI up 15 percent, adds 22 lakh shares in OI

- Nifty Bank March futures closed at 27,782.95, discount 18 points versus premium of 14 points.

- Nifty Bank March futures OI down 2 percent, sheds 24,600 shares in OI.

Options

- Nifty PCR at 1.25 versus 1.41 (across all series)

Nifty Weekly Expiry: March 12

- Max OI on call side at 11,500 (18.3 lakh shares)

- Max OI on put side at 10,500 (9.8 lakh shares)

- OI addition seen in 11,200C (+2.7 lakh shares), 10,500C (+4.6 lakh shares)

Nifty Monthly Expiry: March 26

- Max OI on call side at 12,000 (29 lakh shares)

- Max OI on put side at 11,000 (31.3 lakh shares)

Securities Out Of F&O Ban

- Yes Bank

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.