Adani Enterprises Ltd. increased its bond sale size to Rs 800 crore from earlier Rs 600 crore. The issue includes oversubscription option. The company will issue up to 80 lakh secured, redeemable non-convertible debentures with a face value of Rs 1,000 each, amounting up to Rs 400 crore.

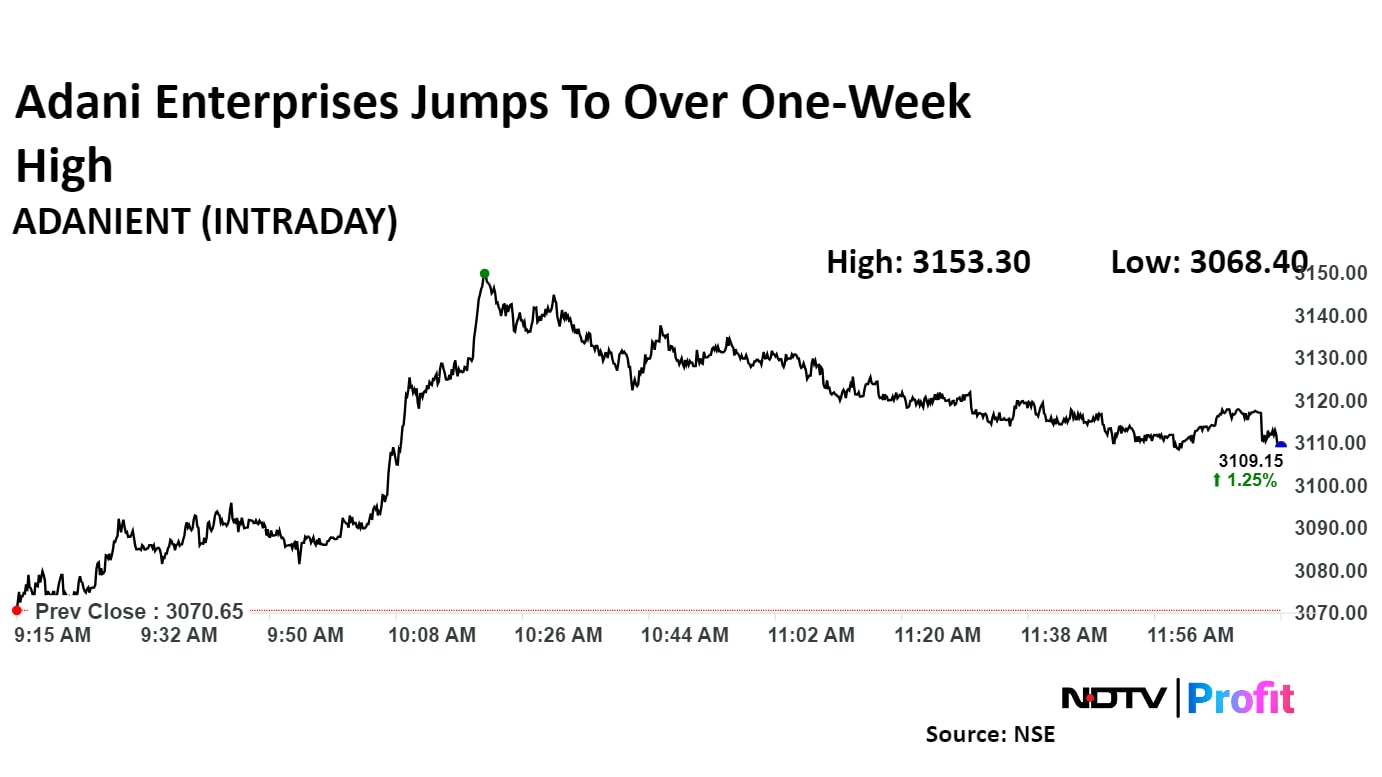

Shares of Adani Enterprises Ltd. rose 2.69%, the highest level since Aug. 13, before paring gains to trade 1.38% higher at Rs 3,113 per share as of 12:12 p.m. This compares to 0.12% advance in the NSE Nifty 50.

The issue will have greenshoe or oversubscription option of Rs 400 crore, aggregating to Rs 800 crore offer, it said in the draft prospectus on Friday.

The issue price is Rs 1,000 per NCD. Minimum application size is 10 NCDs, and in multiple of one bond thereafter, according to the draft prospectus.

Minimum subscription is 75% of the base size, which is Rs 300 crore.

Adani Enterprises will pay 2% interest per annum to NCD holders over and above agreed coupon in case of a default, the company said. The company will maintain 110% security cover on the outstanding principal amounts and interest thereon.

The coupon rate, yield, and redemption will be determined at the time of the issuance to the NCD holders.

The non-convertible debentures had CARE A+ rating with a positive outlook, Adani Enterprises said. The bonds will be listed in the National Stock Exchanges and BSE Ltd., once issued.

Trust Investment Advisors Pvt., and A. K. Capital Services Ltd., and Nuvama Wealth Management Ltd. are the lead manager of the issue, the draft prospectus said. Catalyst Trusteeship Ltd. is the debenture trustee.

Adani Enterprises will uses 75% of the raised amount through this issuance for paying and repayment of existing debts in part or full. Rest, it will use for business operation, the draft prospectus said.

In mid July, Adani Enterprises announced issuance of 60 lakh redeemable NCDs, with Rs 1,000 face value each, amounting to Rs 300 crore with additional greenshoe option of Rs 300 crore.

The Adani Enterprises stock has gained 17.81% in 12 months, and 9.15% year-to-date. Total traded volume so far in the day stood at 0.41 times its 30-day average. The relative strength index was at 49.85.

Three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 36.9%.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.