Adani Enterprises Ltd.'s airports, roads and new energy verticals are driving its valuations and investors are getting six other revenue-earning businesses from the company for "free", according to research firm Cantor Fitzgerald.

These verticals accounted for over 85% of revenue in fiscal 2023 and include ones that are in the incubation phase but will materially contribute to financials over the coming years, Cantor Fitzgerald said in a Jan. 28 note.

The firm initiated coverage on Adani Enterprises with an 'overweight' rating and a 12-month price target of Rs 4,368 per share. That implies a 51% upside to the Jan. 25 close of Rs 2,894.55 apiece.

India needs to invest in both physical and digital infrastructure, while increasing energy production as well as consumption, to become the third-largest economy by 2030, the brokerage said. "To that extent, we believe AEL is at the core of everything India wants to accomplish."

As Adani Enterprises is a publicly traded incubator, the brokerage expects many of the current business segments to be demerged.

"We also believe our target multiples for these three segments—airports, roads and new energy—are justified, as we use close peers to determine our target multiple and have assigned a premium to those multiples based on our expectations for the respective segment to outgrow that of its closest peers. This means that shareholders, in our view, are effectively getting the other six businesses for free," the note read.

The brokerage pointed out Adani Enterprises' actions to reduce liquidity risk, improve governance, and increase transparency. "Thus, at this juncture, we believe Adani is too big to ignore."

The note also emphasised Adani Enterprises' efforts to clean up its balance sheet. "Net debt as a percentage of fixed assets has fallen from 51.6% in FY21 to 35.5% in the first half of fiscal 2024; finance costs as a percentage of Ebitda have fallen from 53.5% in FY22 to 38.7% on a TTM basis; and net debt/Ebitda has gone from 5.2 times in FY21 to 2.2 times in the first half of the current fiscal.

"We believe both Ebitda margin and FFO margin will continue to improve over the coming years as utilisation rates increase and incubating businesses become more mature, enabling AEL to rely less on outside capital," the note said.

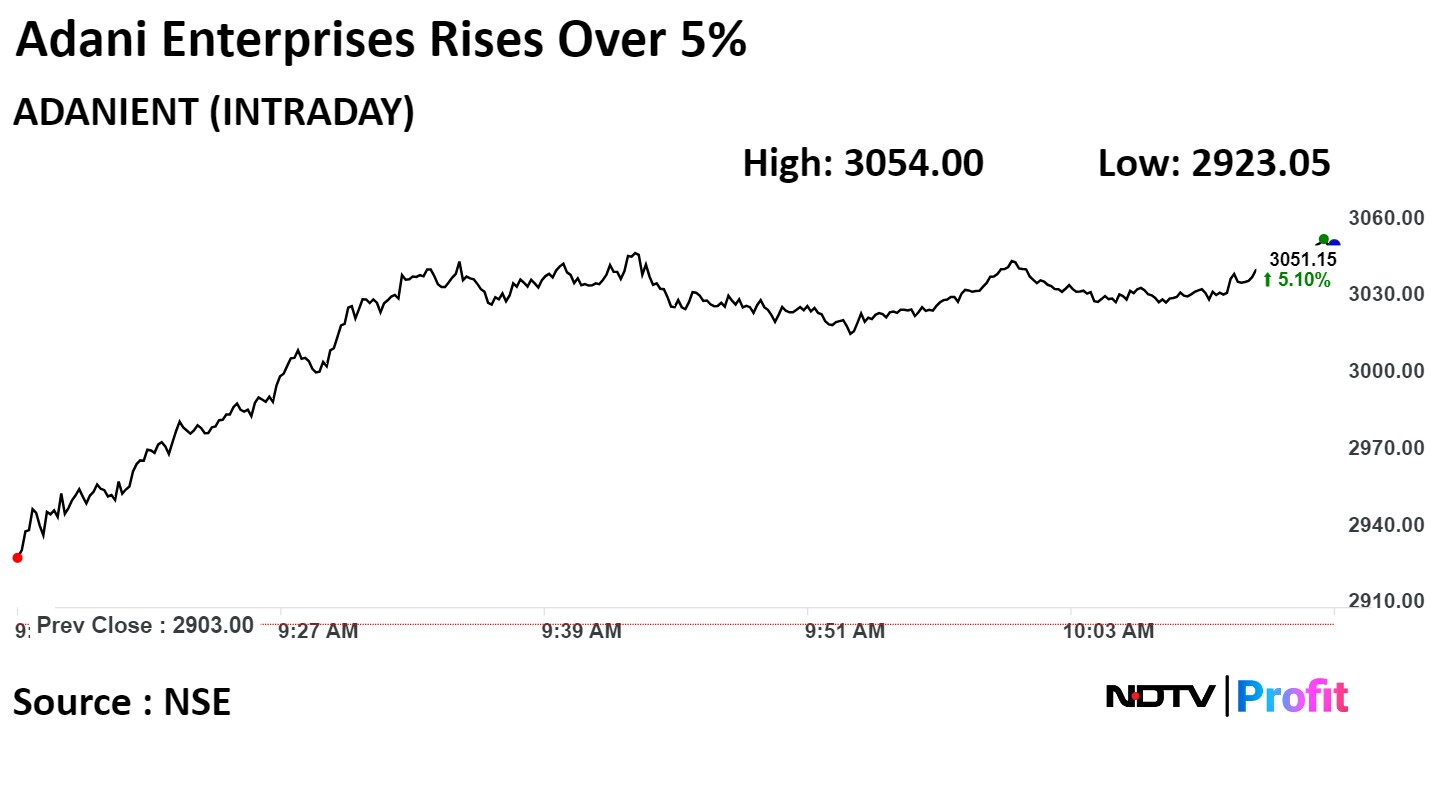

Adani Enterprises shares rose as much as 5.32% during the day after the rating. As of 10:13 a.m., the stock was trading 5.06% higher, compared to a 0.95% rise in S&P BSE Sensex.

All Adani Group stocks moved higher, adding as much as Rs 69,719.21 crore in investor wealth, taking their total market capitalisation to Rs 15.51 lakh crore, intraday.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.