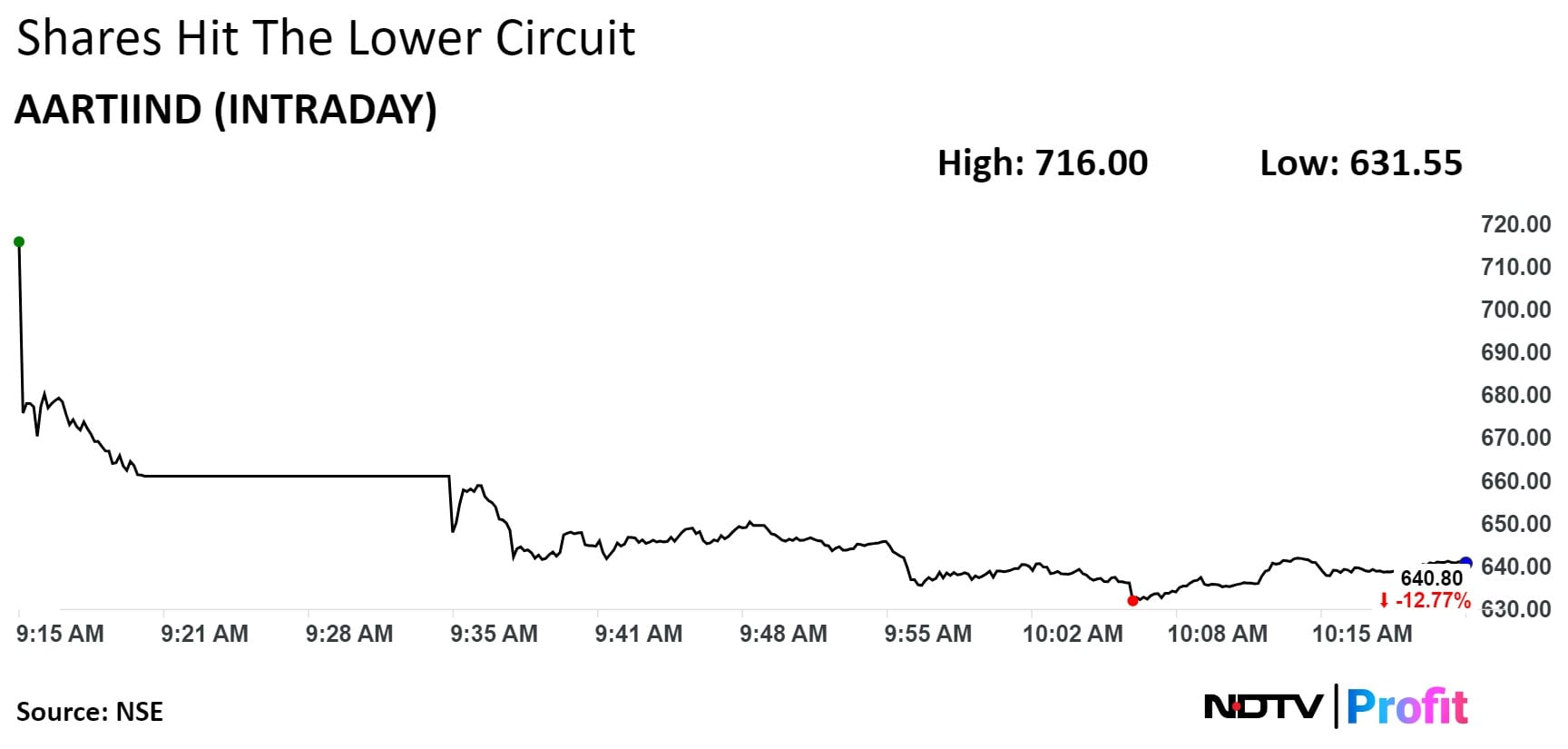

Shares of Aarti Industries Ltd. hit lower circuit and plummeted 14.03% following a recent earnings call. The sharp decline comes after the company revealed that it will revisit its Ebitda guidance due to significant margin volatility and increasing pressure from China.

During the call, Aarti Industries highlighted concerns over its financial outlook, specifically revisiting its Ebitda guidance. The company's debt is projected to rise to Rs 3,500-3,600 crore due to ongoing capital expenditure. Despite these challenges, Aarti Industries remains optimistic about achieving a volume growth of 20-30% for FY25. It is also confident of reaching 40-50% capacity utilisation within the current financial year.

However, the company is facing persistent issues with its global supply chain, which are impacting its volume in certain segments. Additionally, heightened competition from Chinese firms is contributing to difficulties. The inability to meet its financial guidance has been identified as a primary factor behind the pressure on the stock.

The company's material costs are expected to impact its revenue guidance for the year, with expected revenue ranging from Rs 3,500 crore to Rs 3,800 crore, depending on raw material prices and working capital.

Aarti Industries reported a net profit of Rs 137 crore in the first quarter of fiscal 2025, a 96% increase from Rs 70 crore in the same period last year. But it missed the Bloomberg estimate of Rs 148-crore net profit.

The company's profit after tax was Rs 132 crore in Q4 FY24.

Shares of the company fell as much as 14.03%, the highest level since July 23, before paring loss to trade 13.45% lower at Rs 635 apiece, as of 10:13 a.m. This compares to a 0.05% advance in the NSE Nifty 50.

The stock has risen 38.34% in the last 12 months, but declined 1.34% year-to-date. Total traded volume on the NSE so far in the day stood at 5.50 times its 30-day average. The relative strength index was at 34.2.

Out of 25 analysts tracking the company, eight maintain a 'buy' rating, five recommend a 'hold' and 12 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 4.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.