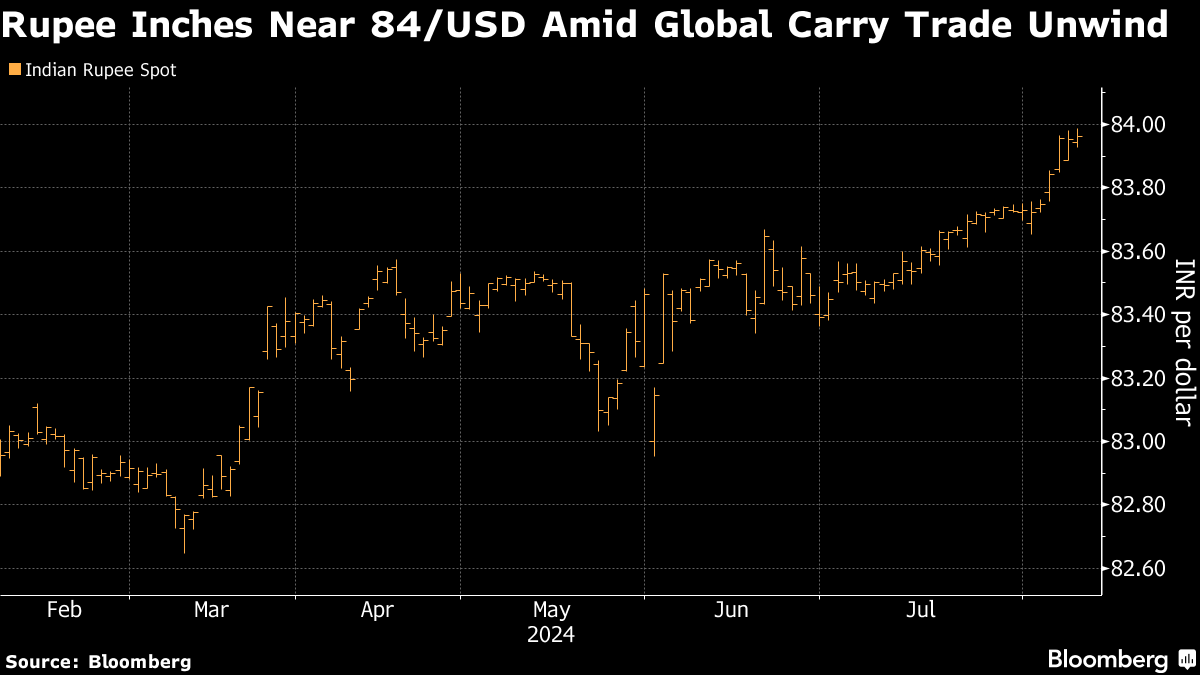

(Bloomberg) -- India's central bank looks to have drawn a new line in the sand for the rupee at the 84-per-dollar level, according to analysts.

The Indian currency tested a series of record lows in recent days but stopped short of crossing that key level on likely intervention by the Reserve Bank of India, according to ANZ Banking Group Ltd. and Nuvama Institutional.

Even while emerging-market currencies came under pressure in recent days as the global carry trade unwound, the rupee remained one of the least volatile emerging-market currencies this year due to the central bank's repeated interventions.

The rupee's lower volatility highlights India's economic and financial stability, RBI Governor Shaktikanta Das said Thursday, adding that the nation's foreign-exchange reserves climbed to a new record high of $675 billion.

“The fact that there is a continuous supply of dollars at around 84 levels indicates the presence of RBI,” said Sajal Gupta, executive director and head of forex and commodities at Nuvama Institutional. The RBI wants to keep the rupee in a tight range, with 84 being more of a psychological level, he added.

The RBI has been doing “both onshore and offshore interventions to ensure that the weakening pressure on the rupee is realized only in a gradual sense and not in a very sudden sense,” said Dhiraj Nim, an economist and FX strategist at ANZ. 84 is a key near-term test for the USD/INR pair, he added.

The rupee fell to a new all-time low of 83.9875 per dollar on Thursday, and is down 0.7% this quarter. It came under pressure as foreigners pulled out more than $1 billion from local stocks this month amid worsening global sentiment.

The central bank is expected to step up intervention if the Indian currency were to touch the 84 level, according to Allan von Mehren, chief analyst at Danske Bank AS.

“The risk, of course, would be if we see more market turmoil in global markets that leads to more unwinding flows,” Mehren said. ‘That could take us above 84.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.