Italian Markets Rattled After Tria's Future Is Thrown Into Doubt

Italian Bonds Decline After Tria's Future Is Thrown Into Doubt

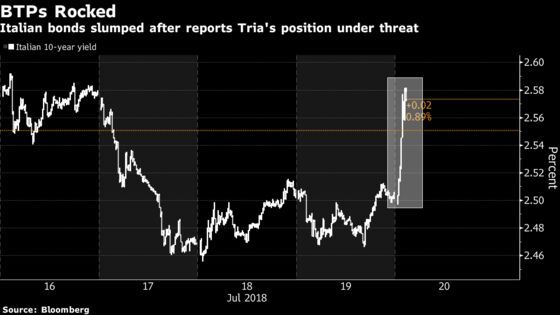

(Bloomberg) -- Italian bonds and stocks fell on concern that Finance Minister Giovanni Tria, whose appointment brought a relative calm to the nation’s markets, may be forced to step down.

Short-end Italian bonds led the declines after La Repubblica reported that the country’s populist leaders were united in battle against Tria over nominations for the leadership of state lender CDP. Five Star Movement leader Luigi Di Maio and League chief Matteo Salvini were said to have gone so far as to “threaten unofficially to use the weapon of seeking Giovanni Tria’s resignation.” The securities briefly pared losses after Di Maio and a Treasury spokeswoman denied the reports.

Italy’s bond market had taken a breather in recent weeks after being roiled in May as Five Star and the League formed a coalition, but the latest slip shows that investors are still jittery. Tria’s appointment at the end of May heralded a period of relative calm to the nation’s assets, with yields sliding from a peak not seen since the euro-zone crisis.

Tria, who was a professor of political economy before he took on his current role, has assured investors that the country remains committed to the euro and vowed to block any moves that would push it toward an exit. He is also seen as a counterweight to the coalition’s radical spending plans ahead of the country’s budget, due before October.

“The conflict is not new news, but the prospect of Tria leaving the government is not a positive for BTPs and confidence in the new government,” said Antoine Bouvet, a strategist at Mizuho International Plc. “He was very much the appointment aimed at calming markets earlier this year.”

Summer Carry

The yield on the nation’s two-year bonds climbed seven basis points to 0.61 percent as of 10:52 a.m. in London. The securities briefly pared losses after the finance ministry dismissed reports of a rift as “pure invention.”

The premium that benchmark 10-year notes offer over similar-dated German bunds widened three basis points to 220 basis points, having earlier touched the highest level in a week. The FTSE MIB Index of stocks slumped as much as 1.3 percent on Friday, with banking shares, including UniCredit SpA and Intesa Sanpaolo SpA, leading the declines.

Some of the moves in the bond market may have been exacerbated by quiet summer trading, according to two London-based traders who asked not to be identified because they aren’t authorized to speak publicly. Italian bonds benefited earlier in the week from the placing of “carry” trades, where investors sell lower-yielding assets in favor of those with higher coupons. Italian bonds offer some of the highest yields in the euro area.

Meanwhile, Claudio Borghi, the head of the budget committee in the Italian lower house, told Corriere della Sera’s newspaper Thursday that he is sure Italy will exit the euro sooner or later, though he reiterated it’s not the government’s intention.

Under Italian law, even the prime minister can’t fire government ministers, but a rift between the key political figures in the government and the finance chief could lead to a gridlock. Spokespersons for Salvini and Di Maio didn’t immediately respond to calls seeking comment.

--With assistance from Ksenia Galouchko, Marco Bertacche and Ben Sills.

To contact the reporter on this story: John Ainger in London at jainger@bloomberg.net

To contact the editor responsible for this story: Ven Ram at vram1@bloomberg.net

©2018 Bloomberg L.P.