Soros Contention on Global Crisis `Ridiculous,' Gorman Says

Soros’s contention that another major global crisis may be in store is unrealistic, said Morgan Stanley’s CEO.

(Bloomberg) -- Morgan Stanley Chief Executive Officer James Gorman said that investor George Soros’s contention another major global crisis may be in store is unrealistic, and that the Federal Reserve will probably hike interest rates three more times in 2018 despite recent volatility.

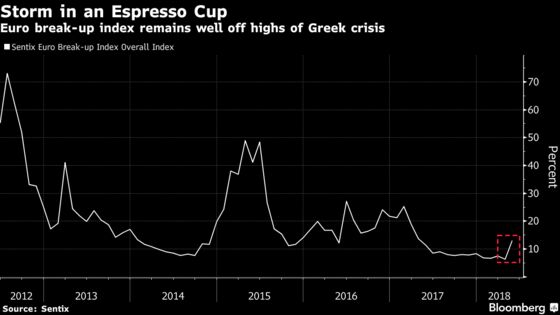

“Honestly I think that’s ridiculous,” Gorman said in an interview with Bloomberg Television in Beijing Thursday when asked about Soros’s comments this week, which included a warning that the European Union is at risk of breaking up amid Italy’s challenges. “I don’t think we’re facing an existential threat at all,” Gorman said of the EU.

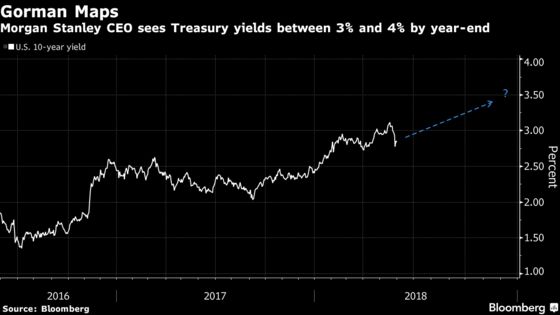

Investors should look through the bout of turmoil markets have been going through lately, with fears about Italian contagion seeing Treasury yields tumble from their recent highs of well over 3 percent, Gorman said. Benchmark 10-year U.S. yields are likely to keep climbing, taking the dollar up with them, in the Morgan Stanley chief’s view.

Asked about Jamie Dimon’s contention earlier this month that 10-year Treasury yields could hit 4 percent, Gorman said “I would be surprised if it’s under 3 percent; I would be as surprised if it was above 4.” The benchmark 10-year note yield was at 2.85 percent in Thursday morning trading in New York.

Yields are set to rise as the Fed keeps to its normalization path, in Gorman’s outlook. “The Fed has been incredibly consistent,” he said. While it’s true that wage pressures haven’t been sufficient to spark much inflation, “that’s why we’ve taken this long to get this far -- which is not very far at all. Rates are still at historic lows.”

Fed policy makers are still in the process of getting their key policy rate to a more normal level, to give it more “monetary power” in the case of the next crisis, Gorman said.

“My gut is the Fed will raise rates four times this year,” though it could be three, he said. “I certainly don’t think the past 24 hours will influence that.” Fed Chairman Jerome Powell and his colleagues have hiked once so far, with another move projected for June.

The latest turmoil in markets “could be the early warning sign” of trouble that causes the Fed to slow down, but “my gut is it’s not,” Gorman said.

“You don’t react to 24 hour news -- you can’t respond as an investor,” the bank CEO said. “My reaction is you don’t -- you watch it for a while.”

The dollar, caught between narratives of concern about American deficits and the attraction of rising rates, “is likely to strengthen over time,” as the yield lure proves the stronger dynamic, according to Gorman.

Gorman said Italy’s challenges are part of a broader political pattern that has been seen across much of the world, including in Britain, which voted to leave the EU in 2016. There’s a “sense the average performance of the economy is better than the individual performance of citizens” in each country, he said. Even so, “I don’t think the euro zone is in jeopardy,” he said.

Despite “good global synchronized growth” over the past couple of years, “we’ve had these

political eruptions,” including the Brexit vote, torturous coalition negotiations in Germany and recent strains in Italy and Spain, Gorman said. “It’s this almost competition between

inexorable corporate growth, earnings improvement, economic strength, against

political instability and the rise of populism.”

--With assistance from Cormac Mullen and Michael Heath.

To contact the reporters on this story: Tom Mackenzie in Beijing at tmackenzie5@bloomberg.net;Christopher Anstey in Tokyo at canstey@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, ;Malcolm Scott at mscott23@bloomberg.net, Cormac Mullen

©2018 Bloomberg L.P.