Short-selling, a trading strategy where investors speculate on a stock's decline thereby creating volatility, is gaining further scrutiny from regulators in India and the United States.

On Friday, US authorities charged renowned short-seller Andrew Left with committing fraud through his stock trades, social media activity, and research reports, Bloomberg reported. This marks a significant escalation in the ongoing crackdown on traders who promote negative stock positions in America.

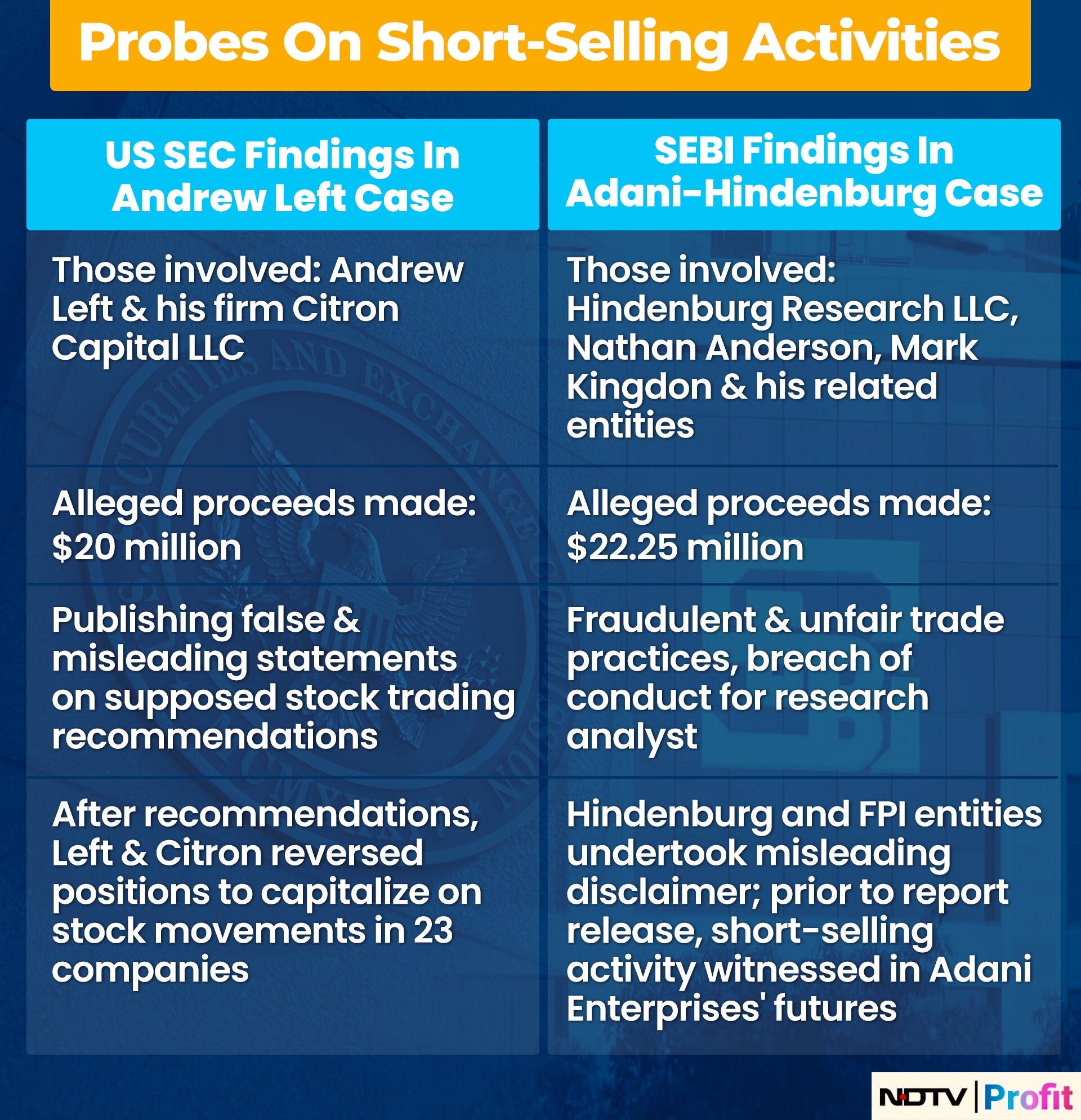

The Securities and Exchange Commission alleged that Left, operating through his firm Citron, illegally generated approximately $20 million in profits from trading activities involving nearly two dozen companies. Additionally, the Justice Department has brought criminal charges against Left, accusing him of securities fraud and of allegedly misleading investigators about his compensation from hedge funds.

Prosecutors claim that Left would rapidly close his positions after publishing a research report or making public comments. This strategy allowed him to capitalize on short-term price fluctuations.

"The SEC reminds investors to be skeptical and never make investment decisions based solely on information from social media or other unverified platforms," the regulator said.

Source: NDTV Profit

SEBI's Eye On Hindenburg Saga

Earlier this month, the Securities and Exchange Board of India issued a show cause notice to Hindenburg Research, Nathan Anderson and the entities of Mauritius-based foreign portfolio investor Mark Kingdon for trading violations in the scrip of Adani Enterprises Ltd. leading up to Hindenburg Report and thereafter.

The regulator has alleged that Hindenburg and Anderson have violated regulations related to fraudulent and unfair trade practices, and the code of conduct for research analyst.

SEBI pointed out the Hindenburg and the FPI entities undertook misleading disclaimer that the report was solely for the valuation of securities traded outside India when it clearly pertained to listed entities in India. The regulator said Kingdon aided Hindenburg to indirectly participate in Adani Enterprises by collaborating with the short seller to trade in the company's futures in the Indian derivatives market and shared profits with the research firm.

According to the show cause notice, SEBI has alleged that prior to report release, short-selling activity was witnessed in the futures of Adani Enterprises and after the report the share lost 59% between Jan. 24, 2023 and Feb. 22, 2023.

The SEBI investigation revealed that K-India Opportunities Fund – Class F opened a trading account and started trading in the scrip of Adani Enterprises before the release of report. The FPI then squared off the positions in February making a profit of $22.25 million or Rs 183.24 crore.

Hindenburg continues to defend its January 2023 report. The Adani Group has denied allegations leveled by the short seller.

The Supreme Court this month dismissed a review petition that was filed against its Jan. 3 judgement in the Adani Group-Hindenburg Research case, wherein the court reposed confidence in SEBI's regulatory powers and ruled that petitioners could not provide enough material to transfer the probe to a special investigation team.

Short-selling profits can be minimal, even if a well-researched report significantly impacts the market. Moreover, these modest gains can quickly be offset by the expenses associated with lawsuits and, more recently, government investigations.

Hindenburg Researh for example, claimed that it earned only $4.1 million through the Adani short.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.