"The merger will go through whether I'm CEO or not," Zee Entertainment Enterprises Ltd.'s Punit Goenka said this in an interview to two business dailies on Thursday.

The "not" is the most realistic possibility at this stage if the merger has to go through, according to legal experts that BQ Prime spoke with.

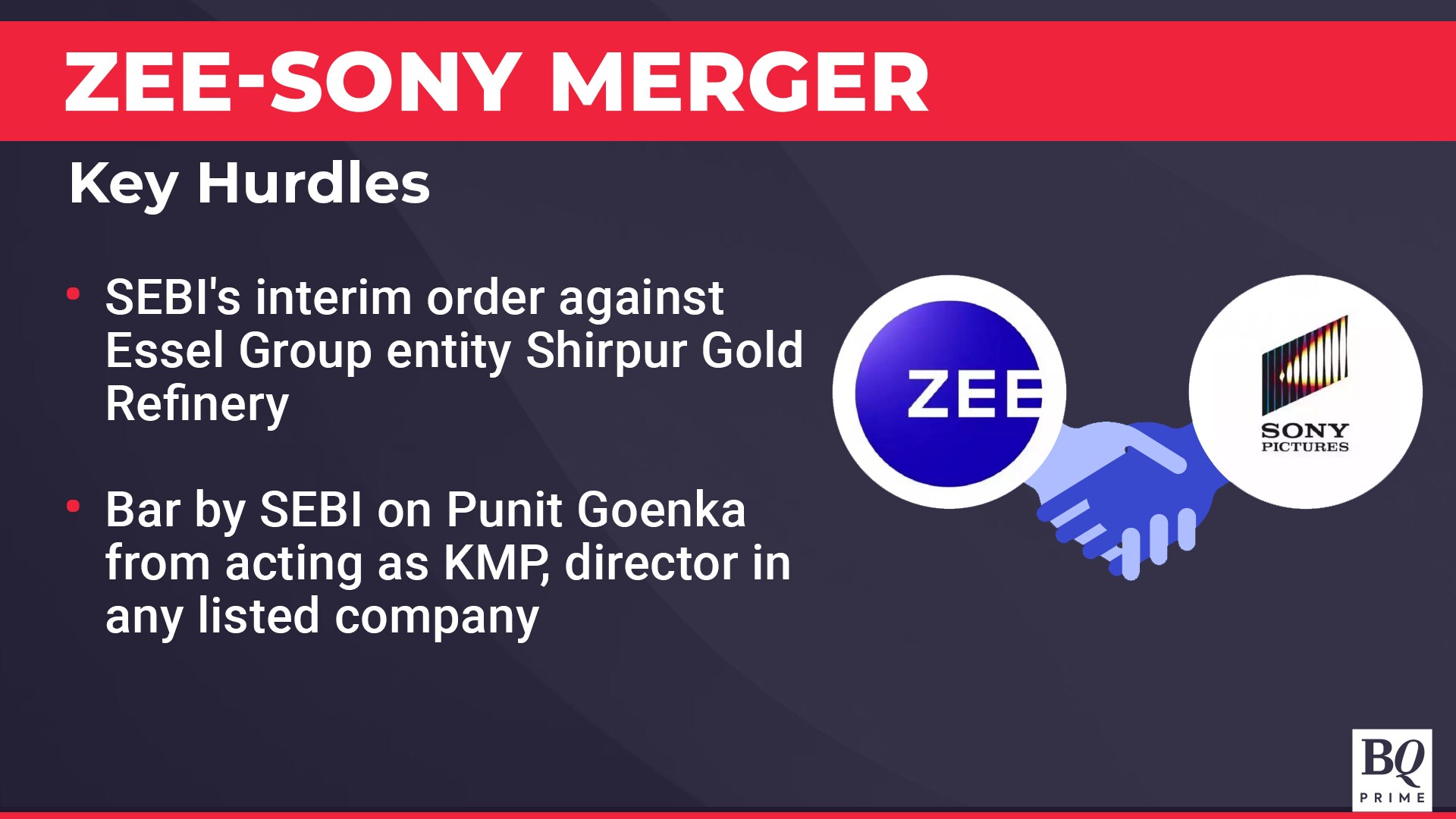

To recap, as Zee's chief executive officer and managing director, Goenka along with the company's Chairman Emeritus Subash Chandra, is in the line of regulatory fire. Both have been barred by the Securities and Exchange Board of India from acting as key managerial personnel or director on board of any listed company via an interim order.

Goenka and Chandra are currently in appeal against this direction before the Securities Appellate Tribunal.

Besides this interim order, Zee's proposed merger with Culver Max International Pvt. (Sony Pictures), is currently facing two other hurdles:

SEBI's interim order against Essel Group entity Shirpur Gold Refinery Ltd. Here, the regulator has alleged fund diversion by Shirpur, a listed company owned by Jayneer Infrapower and Multiventures Pvt. Punit Goenka and his brother Amit Goenka own 48% each in Jayneer.

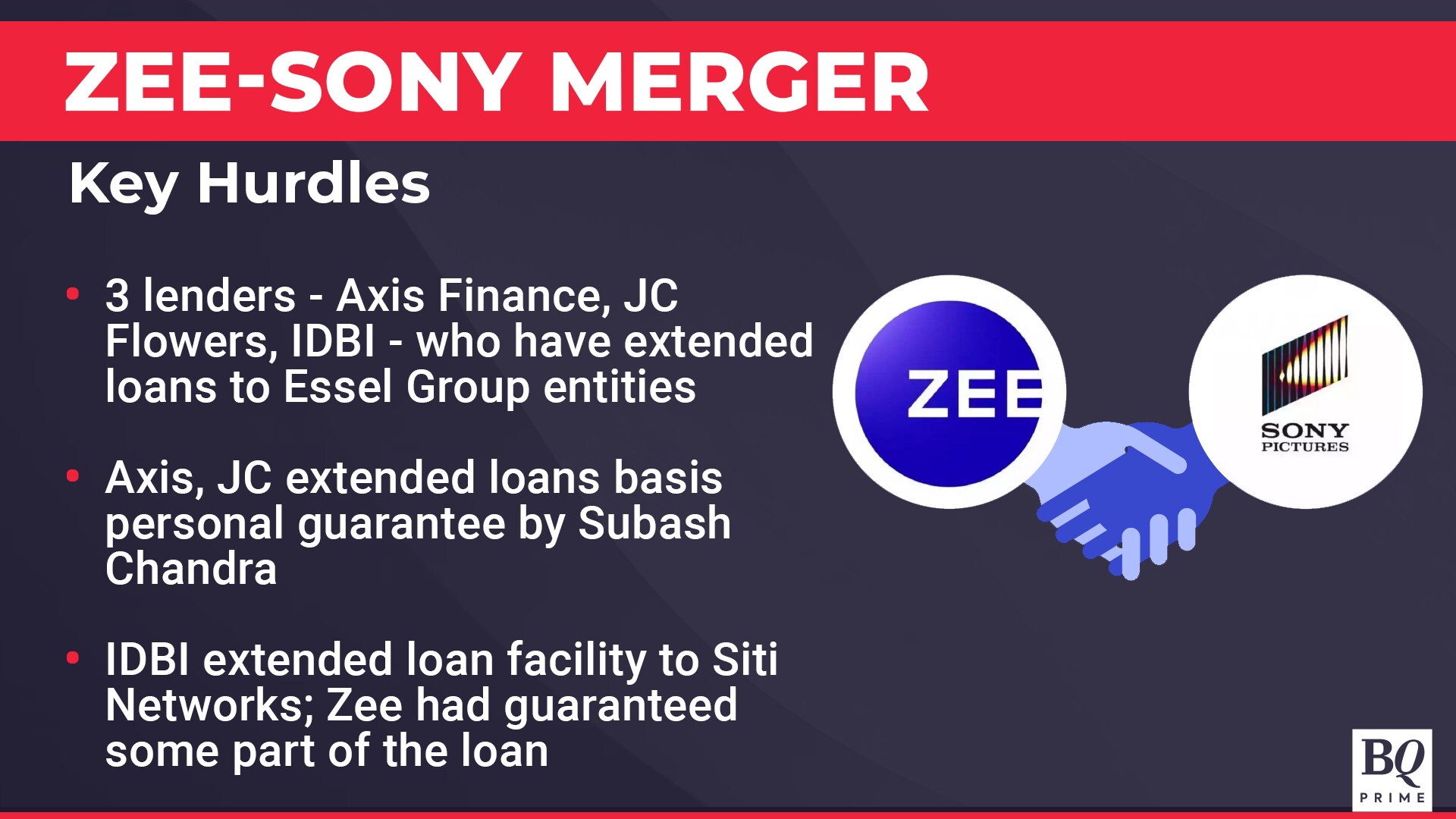

Three lenders—Axis Finance, JC Flowers, and IDBI Bank—who are opposing the merger before the National Company Law Tribunal. Axis Finance and JC Flowers' case is that the non-compete agreement, if executed, would result in alienation of assets held by Chandra, who is a personal guarantor to various loans advanced by both the lenders. IDBI Bank chose to take the insolvency route claiming Zee owes it Rs 150 crore as a guarantor to the loan extended to Siti Networks Ltd. The NCLT had dismissed this claim but the bank may choose to appeal.

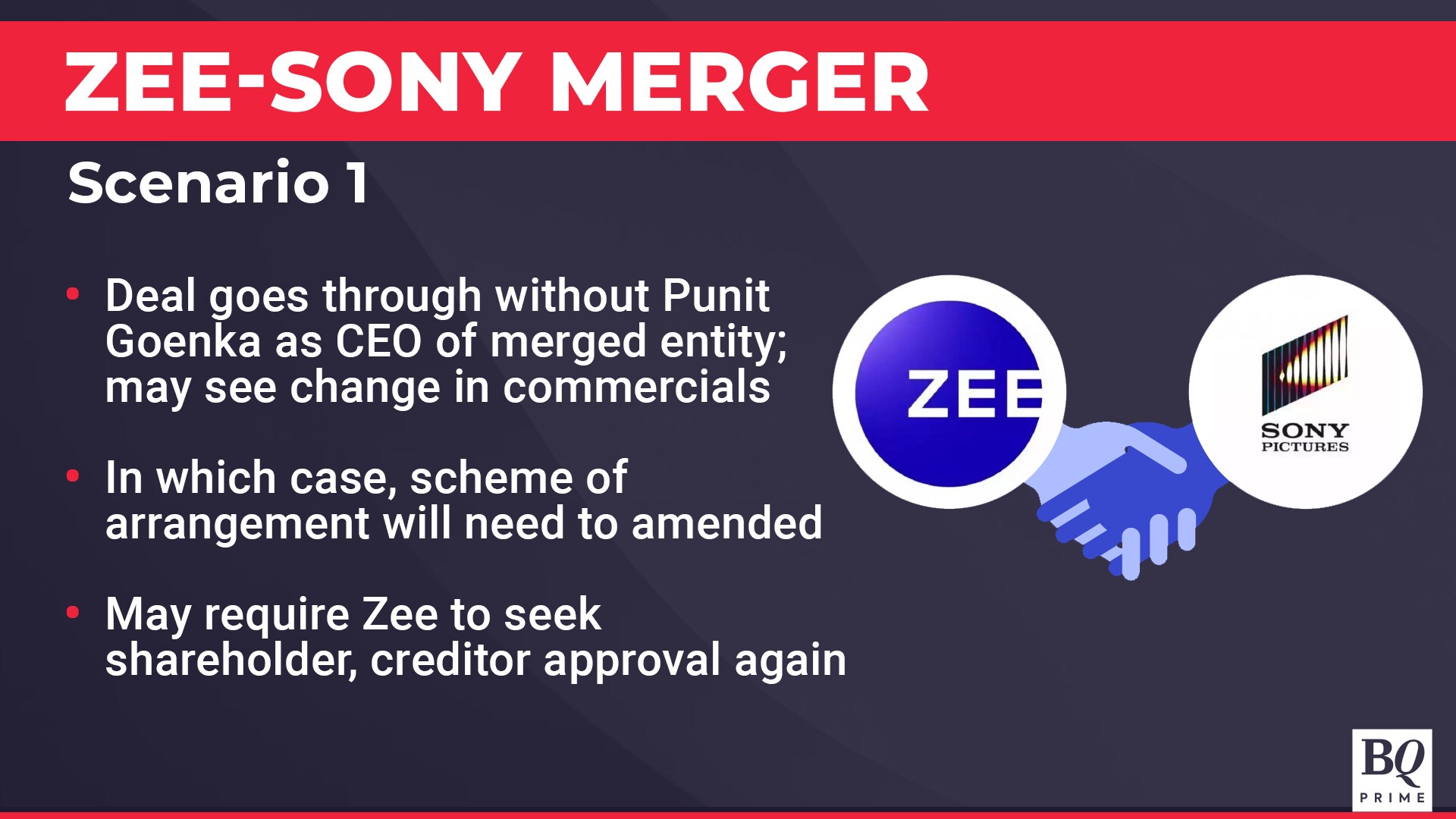

Zee-Sony Merger: Scenario 1

Goenka's statements indicate that he's confident that the merger will sail through. Sony hasn't indicated otherwise either, except to say it's monitoring the regulatory developments closely.

In which case, one scenario could be changes to the scheme of arrangement, in which a key clause says that Goenka will be the managing director and chief executive officer of the merged entity for five years, from the day the deal becomes effective.

This could mean going back to the shareholders, creditors and regulators for approval.

The clause is framed as an integral part of the scheme, says Rajat Sethi, partner at S&R Associates. "It'll be a material amendment to the scheme."

It will set the clock back on shareholder, creditor approval. Perhaps, even the exchanges and SEBI. Timing, of course, will be critical. If the parties lose time, greater the risk of other parties coming in with a bid or objectors seeking to press further.Rajat Sethi, Partner, S&R Associates

This scenario could also result in changes to the deal commercials; two key clauses in particular.

One, that allows Zee's promoters to increase their shareholding from the current 4% to 20%. According to the scheme, Goenka as the managing director of the merged entity will get "consultative rights" on certain matters, as long as Essel Group promoters/affiliates have a 1% shareholding in it. "This may need to be amended if they will no longer have MD position," Sethi said.

Two, the non-compete fee of Rs 1,100 crore to Subhash Chandra. According to the scheme, Essel Mauritius—an Essel Group entity—will receive a non-compete fee of Rs 1,100 crore from Sony Group entity, SPE Mauritius. If Goenka agrees to not being the managing director in the merged entity, this figure may be renegotiated.

Either way, if the change to the scheme and the commercials are made, Zee will have to approach the NCLT with a request to do so.

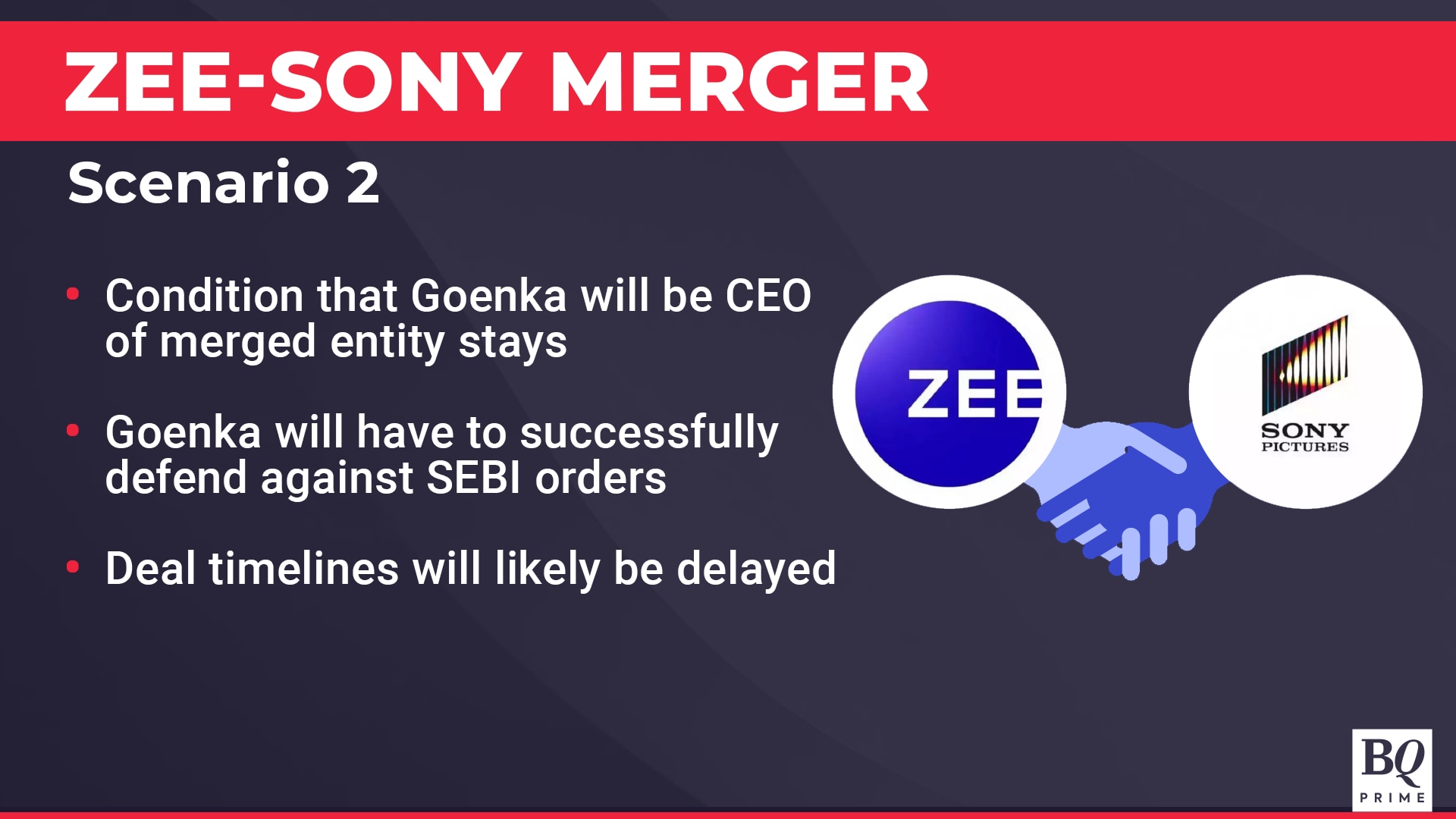

Zee-Sony Merger: Scenario 2

The other possibility is that Goenka decides to litigate against the SEBI proceedings till the end, and Sony is willing to wait.

Sethi said that since the clause providing for Goenka to be at the helm of the merged entity is an important part of the deal, he would want to take the investigations against him to their logical conclusion before giving up.

For Sony, the target is a priced asset. They will do whatever it takes to conclude the transaction. I believe as a sophisticated party, it's safe to assume that Sony hasn't been blindsided. Not specifically the directions against Goenka which have now come, but Sony would have expected the merger to be an intense process.Rajat Sethi, Partner, S&R Associates

According to another M&A lawyer, who spoke on the condition of anonymity, Sony would have accounted for some of these facts in the valuation when it did the due diligence. The acquirer values the business and its potential; not cash that is with the target or that may have gone out of it. This lawyer, too, expects the clause pertaining to Goenka to be the only way to save the deal.

Goenka is yet to respond to BQ Prime's request for a comment on the two scenarios.

Watch the full interview with Sethi here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.