The life insurance industry is on the cusp of change. The insurance regulator announced several changes in its master circular on Wednesday, the most significant of which will increase the surrender value policyholders receive.

The surrender value refers to the amount payable to a policyholder who decides to surrender their policy before maturity.

Currently, policyholders receive a low surrender value or none at all for policies surrendered within the first year. However, the latest provisions announced by the Insurance Regulatory and Development Authority now mandate this, offering greater flexibility and possibly reducing misselling.

Recognising the issue of misselling, IRDAI's proposed provisions ensure that policyholders unable to continue paying premiums can get back a portion of the premiums already paid. This benefits those who surrender their policies in the early years, with the special surrender value being equivalent to the present value of the sum assured and paid-up future benefits.

One of the changes in the final regulations is the adjustment in the discounting method. Previously, a 10-year government security (G-sec) rate was used for discounting. Now, the 10-year G-sec rate plus a maximum of 50 basis points is allowed, translating to a about 4.5% benefit to life insurers compared to the earlier draft regulations.

Brokerage Views

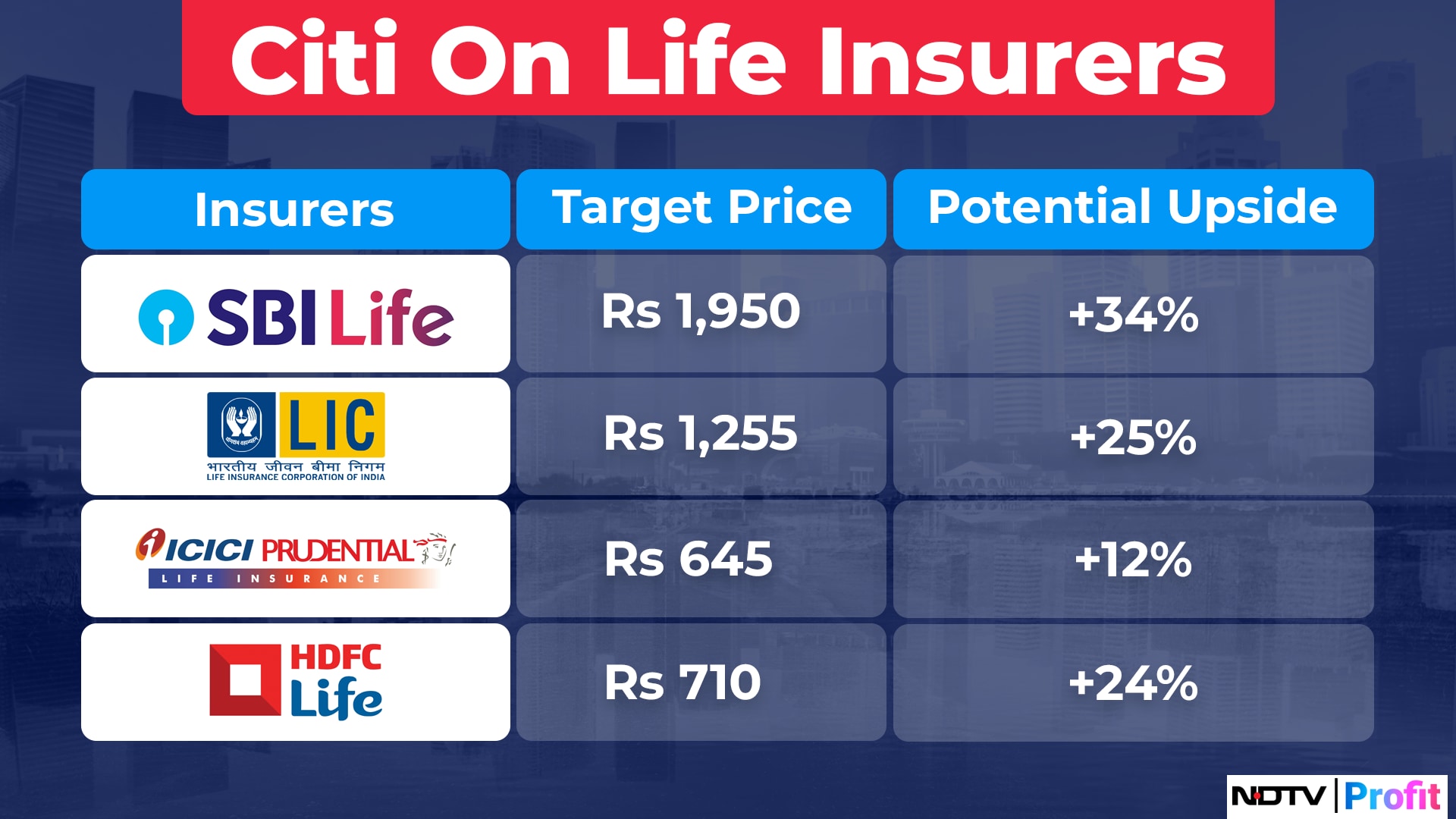

Citi On Life Insurers

Citi notes that, based on the IRDAI notification, the special surrender value is likely to increase for non-linked products. However, the impact of this policy is challenging to assess due to the opacity of disclosures and the incremental strategies of insurers for absorbing the immediate value of new business, or VNB, pressure.

The regulator's move allows for more product innovation, enabling manufacturers to offer differential guaranteed surrender values to customers. During the transition phase, VNB might face pressure, leading to either a drag on margins or slower growth, Citi said.

Nuvama On Life Insurers

The new regulations aim to control misselling and protect policyholder interests by increasing surrender values, according to Nuvama.

This change may necessitate that insurance companies rein in or defer commission payouts and work at lower margins. While larger firms with superior distribution might benefit from lower or deferred commission payouts, the impact on growth is uncertain.

The most affected products are non-linked savings, which contributed significantly to HDFC Life, Max Life (52% each in FY24), and LIC (70% in fiscal 2024).

In summary, the IRDAI's new regulations are set to enhance policyholder benefits, but life insurers may face transitional challenges as they adapt to the new norms.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

.jpg?im=FeatureCrop,algorithm=dnn,width=350)