The Competition Commission of India approved the proposed internal realignment within the multi-billion dollar Godrej Group on Tuesday.

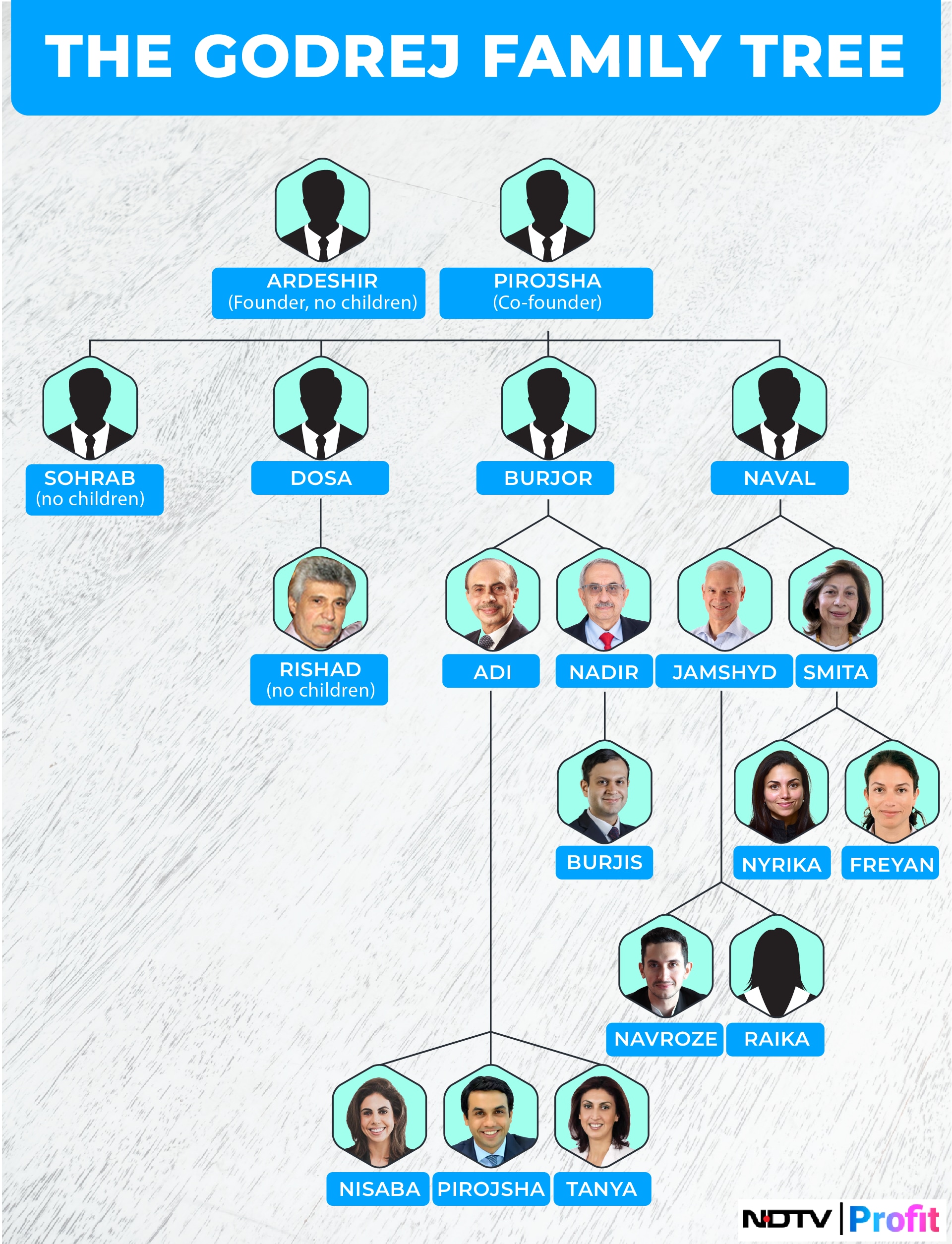

"The proposed combination relates to realignment of interests, legal ownership, and management of various entities within the Godrej group pursuant to an inter-se arrangement between the members of the Family Branches viz Adi Godrej and family (ABG Family), Nadir Godrej and family (NBG Family), Jamshyd Godrej and family (JNG Family) and Smita Crishna and family (SVC Family)," CCI said in a release.

Such realignment will take place under the Family Settlement Agreement (FSA) dated April 30, 2024, executed by the family branches, it added.

The Godrej family, which is at the helm of a $5.7 billion sprawling empire, reached an amicable agreement in April to divide the group into two, a rare occurrence in the increasingly contentious world of family business splits.

Adi Godrej — the head of the family — and his brother Nadir Godrej will retain control of the five listed companies of the Godrej Group with interests in consumer goods, real estate, agriculture, chemicals, and gourmet retail, according to a stock exchange filing late on Tuesday. The cousins, Jamshyd and Smita, will receive the unlisted Godrej & Boyce Mfg. Co. along with its affiliates and a vast land bank. Nyrika Holkar, Pirojsha Godrej has risen as the key next generation leaders of the two businesses.

In total, 26 members are involved in the family settlement agreement. According to a statement issued by the group, both groups will continue to utilise the 'Godrej' brand and are "committed to strengthening their shared heritage". There is no requirement to pay royalties for utilising the brand.

The division of the 127-year-old conglomerate was agreed upon to honour the differing viewpoints within the family over business strategies, especially among the younger generation. There have been no apparent undercurrents despite the differences, according to a person with knowledge of the matter who spoke on the condition of anonymity.

The two factions of the Godrej family have historically owned shares in various companies within the group and served on each other's boards. However, to facilitate a clean separation, they have decided to transfer their equity interests after resigning from their respective board positions.

Some family members may still own a small number of shares in the other family's companies, but they will not have special privileges as owners.

The settlement also makes it clear that shares held by either group in any of the companies will not be transferred to competitors except with the prior permission of the other group.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.