It looks as if India is taking a break from its second most favourite sport— IPO flipping. Starting mid-October, a very visible fatigue has set into retail as well as overall subscriptions of initial public offers. With markets turning volatile, IPO investors might take in a breather too, as listing gains have turned slim.

This is bad news for flip investors who apply in large numbers for a new issue, and if allotted via lottery, sell on the first few days. The regulator has also reduced the time lag between application, allotment and listing. As the funds used to apply for an IPO comes back to hands quicker, it's a good game to recycle money. This game, however, hinges on listing day gains. The recent news has not been encouraging.

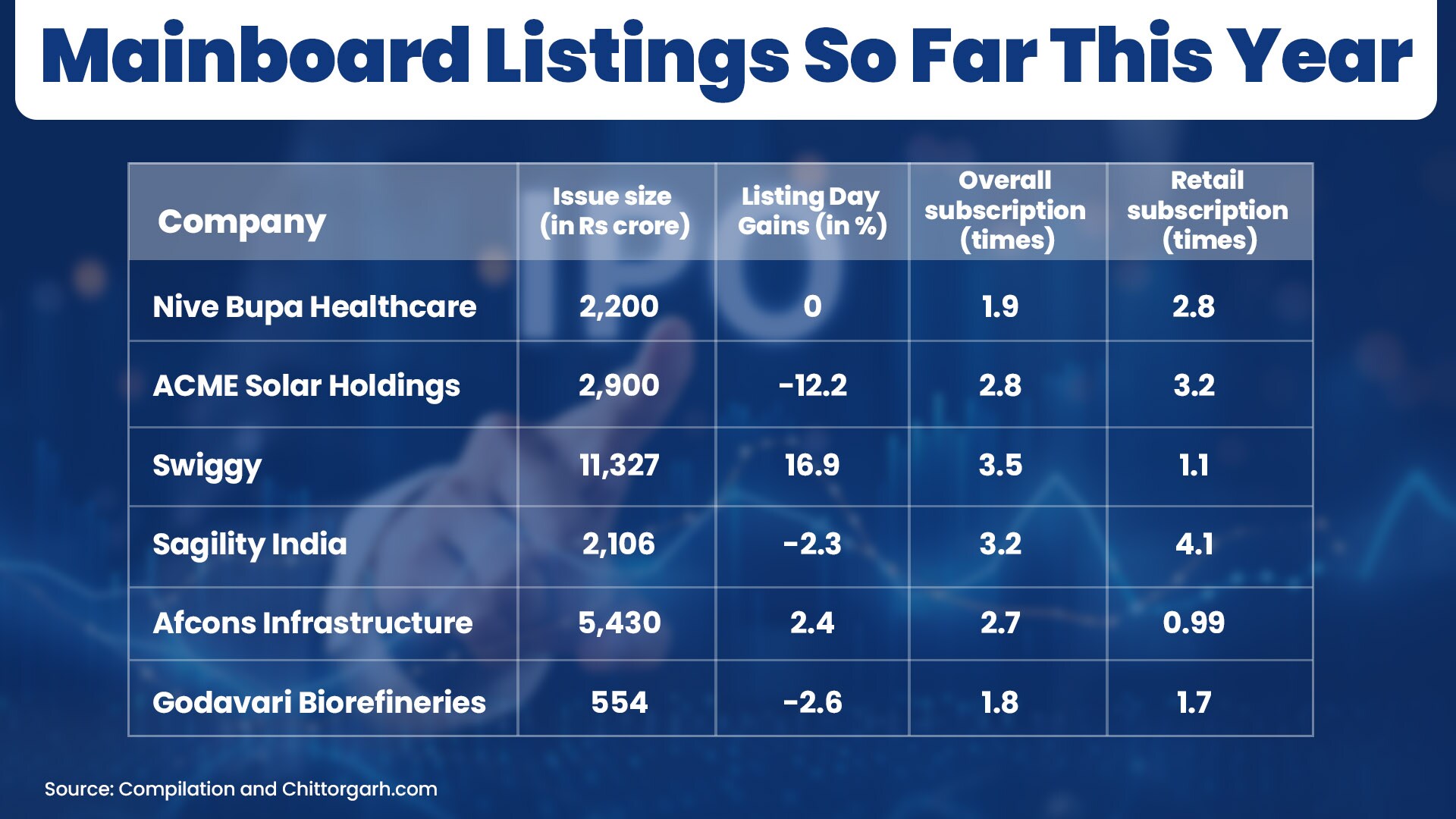

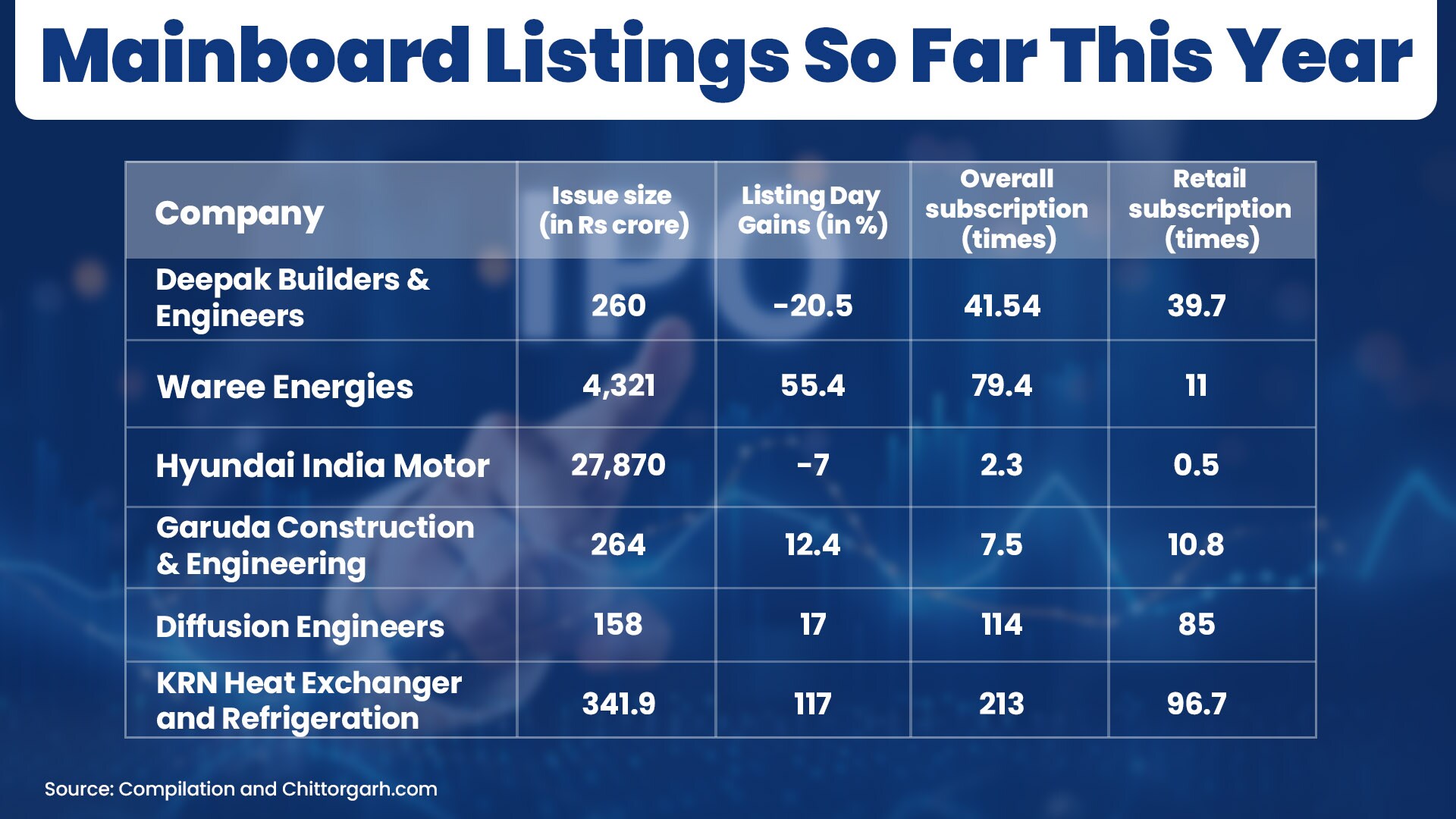

Recently listed Niva Bupa Health Insurance Co. gave no listing day gains. ACME Solar Holdings Ltd. saw stock dive by 12% below its issue price on day one. While Swiggy IPO gained on the later hours of listing day, many others like Sagility India Pvt., Deepak Builders & Engineers Ltd. and even Hyundai Motors India Ltd. saw negative listing day gains.

That's a far cry from the good days that IPO flippers have seen. Waree Energy Ltd. saw listing day gains of 55%, while KRN Heat Exchanger and Refrigeration Ltd. saw investor money double on listing day. Around the same time last year, IPOs like Tata Technologies Ltd. and Vibhor Steel Tubes Ltd. gave stellar returns of 163% and 193%, respectively. As of fiscal 2024, the average listing gains of IPOs were 29%, as per PrimeDatabase.

(Source: NDTV Profit)

(Source: NDTV Profit)

Selling In The First Week

A large number of investors enter the primary market game to invest and make a quick buck. A few months back, markets regulator SEBI Chairperson Madhabi Puri Buch said that 68% of non-institutional investors; and 43% of retail investors flip their trades in the first week of the debut of a new stock.

Now that markets have turned volatile and ‘minimum guarantee' of listing gains have withered away, there might be a long pause in the IPO frenzy that has gone on for around two years, experts predict.

“The IPO frenzy has lulled out a bit. The grey market premium indications are also coming down. With secondary markets falling, the profit pool is becoming smaller too. We have seen a few big IPOs like Hyundai and Swiggy not creating as much buzz. There is a clear fatigue in the market, but it may not be long-lasting. The sentiment can reverse,” said Saksham Malik, founder of Rabbit Invest, an investment platform.

IPOs Will Pause Not Pivot

While relentless FII selling in October and November has turned the markets volatile, few experts are of the opinion that its impact on the primary market will be long lasting.

“Due to FII selling, markets are volatile and listing gains are muted. It will have a short term impact on the IPO market. As of now, we are seeing a few launches meant to happen in November, being pushed to December. There is no major impact beyond that,” said Munish Aggarwal, head of equity capital markets at Equirus.

Investment bankers say that there has been no change in the long-term plans of companies looking to file for DRHPs and those who are on the drawing board. “FIIs are the mainstay of IPOs. They're the support system, but I do not think they're exiting India for good. The markets are volatile but on an upward trajectory. The India growth story hasn't changed,” said Malik.

Stock market experts say that even if FII selling stabilises, it will be good news for the IPO markets. The market might not shut down, unless there is a large-scale crash. Most experts do not foresee such a crash due to the steady buying of domestic investors, as well as stabilisation expected after the new US government settles in January-February next year.

IPO Investors Sitting On Good Gains

In the recent Union Budget, Finance Minister Nirmala Sitharaman has increased the short term capital gains tax to 20% from 15% earlier. That too has not deterred the pool of IPO flippers.

“Unless someone is borrowing money to invest in an IPO, the current listing gains are good enough even after the tax. And a large number of investors have made a lot of money investing in IPOs,” said Aggarwal.

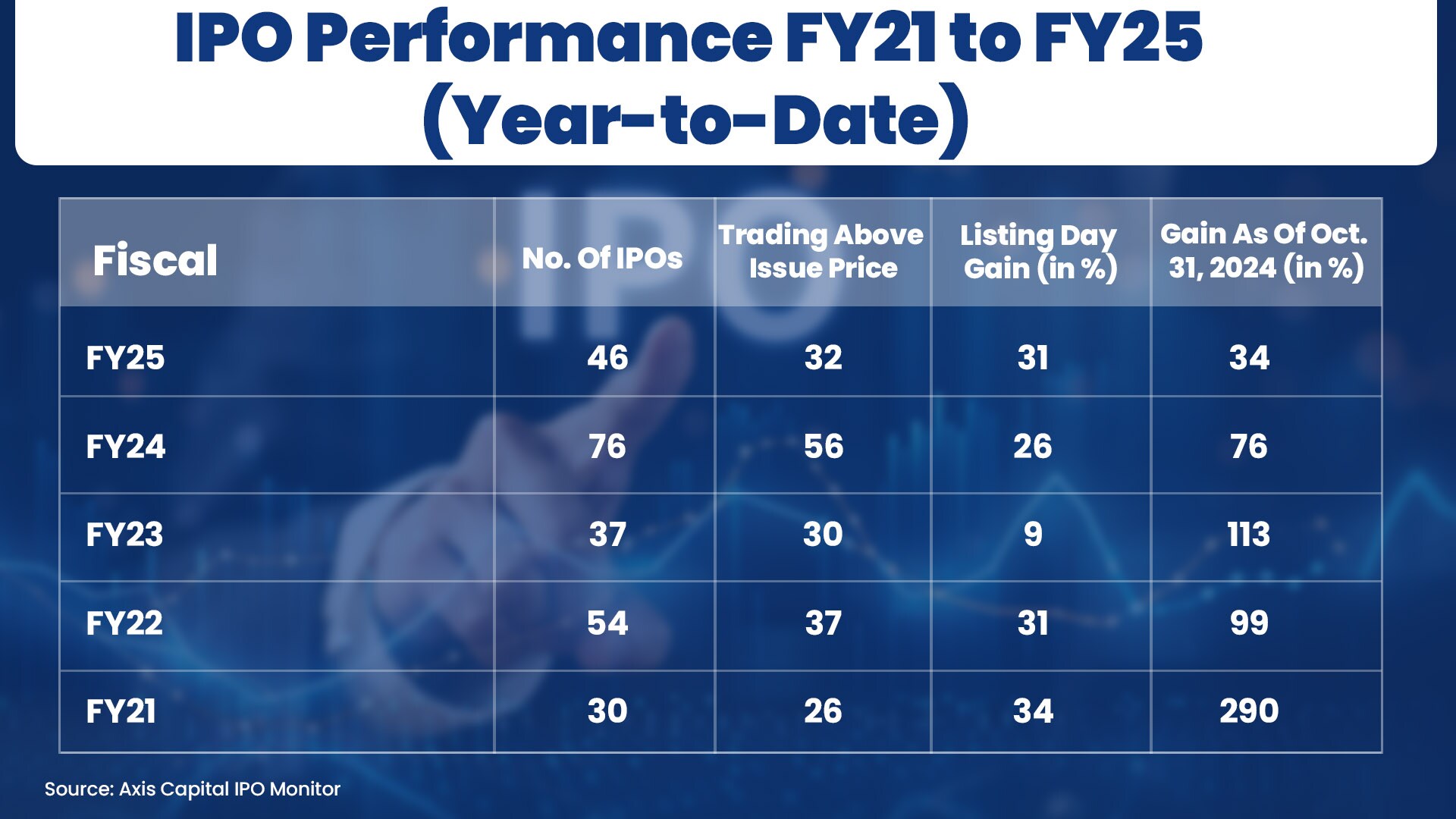

Even after the recent lull, IPO investors who are in the market for the last five fiscals are sitting on good gains. For 236 IPOs (FY21 to FY25) showed an average listing gain of 27% as calculated for the retail bucket, with current gains reaching to 105% as of Oct. 31, 2024, as per Axis Capital's IPO monitor for November.

(Source: NDTV Profit)

There are many companies geared up to launch their IPOs. As many as 61 companies have filed DRHPs with SEBI and are awaiting clearance. And, 25 companies where DRHPs have been cleared by SEBI as of November, as per Axis Capital.

It clearly shows that there are many IPOs that intend to hit the market in the next one year. As for investors, there are many who have gained more than lost money from IPOs and will come back to play the game—whether they'd win or lose—no one knows.

Katya Naidu is a senior business journalist who writes about equity markets, startups, energy, infrastructure, real estate and healthcare.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.