India's primary market has grabbed headlines this week, following the rising frenzy in the initial public offerings of small and medium companies along with a change in overseas investors' outlook towards fresh issues.

There is more to it. Listing of small companies remains very lucrative despite the increasing probe by the markets regulator. Most public issues consist of offer for sale with very limited proceeds locked for capital expansion. Equity markets have become costly, and so foreign investors have targeted the primary market.

NDTV Profit breaks down the layers to help understand the dynamics in Asia's third-largest primary and secondary market.

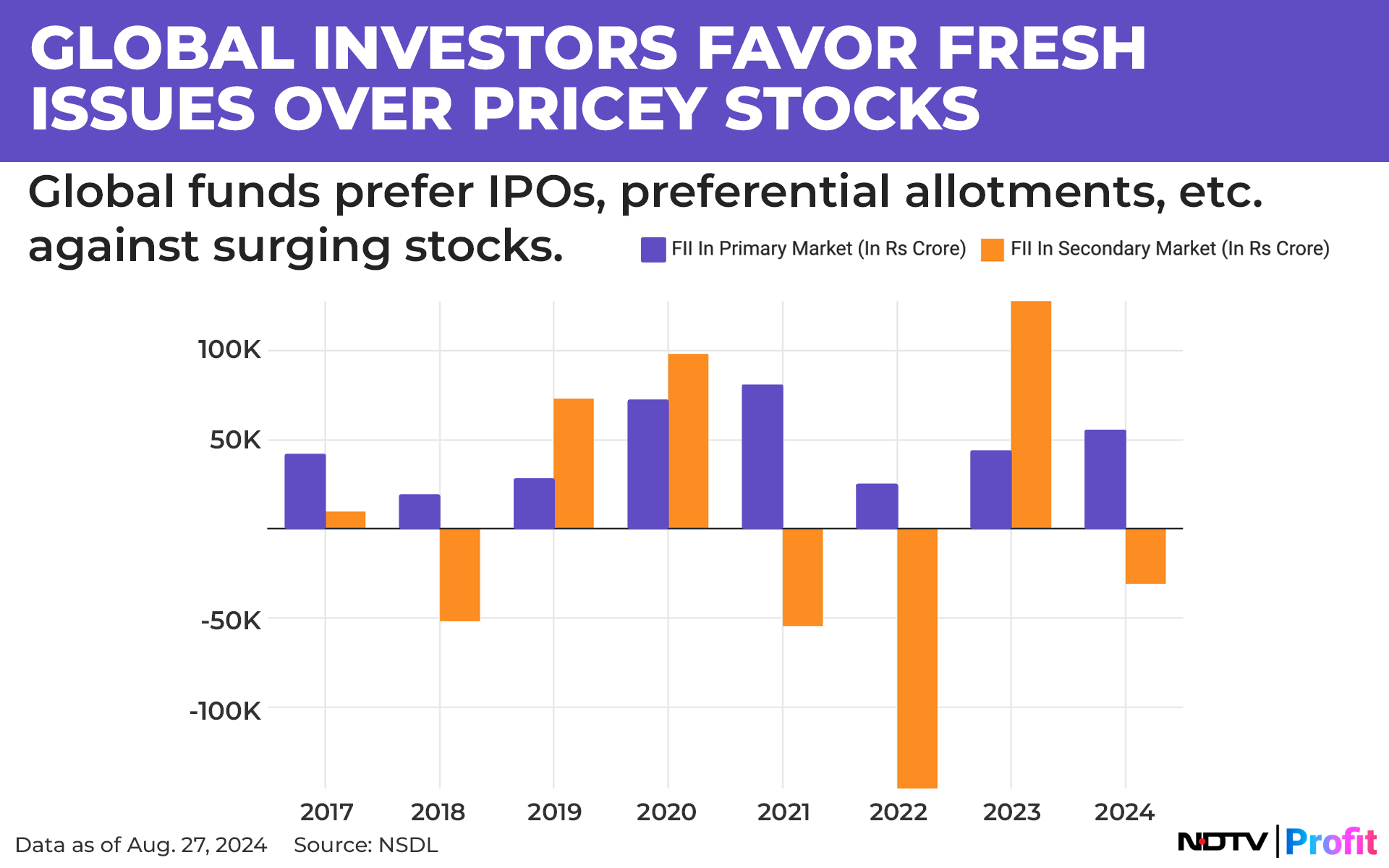

Foreign investors have changed focus from secondary to primary markets as stocks have become costlier across the board. So far this year, overseas funds have bought shares worth Rs 54,782.4 crore in the primary market which consists of initial public offerings, preferential allotments and sales to large investors. Meanwhile, they have sold stocks worth Rs 30,670.3 crore in the secondary market.

.png)

India's benchmark indices—the NSE Nifty 50 and the S&P BSE Sensex—have risen 15% and 13.2% respectively so far this year, making them the fifth and seventh best-performing Asian indices.

The mid-cap benchmark is valued over Nifty 50 and the small-cap stocks, continue to gain more despite froth concerns. The price-to-equity ratio of the Nifty is valued at 24.4, while that of the small-cap and the mid-cap index is at 33.6 and 45.8, respectively.

The foreign inflows in the primary marker have hit the highest since 2021 while they have sold in the secondary market after pocketing in the previous year.

There's a surge in IPOs as companies line up to go public in 2024 as a confluence of factors has boosted India's primary market, according to Pantomath Capital Advisors Pvt. "The biggest reason is India's strong macro environment, which has raised investor confidence."

The healthy performance of several new stocks in the last couple of years has also drawn investors to new IPOs, Pantomath Capital said.

In another interesting trend, two-thirds of IPOs this year have been offer for sale from private equity investors and promoters. Of the remaining one-third, only 20% of the proceeds are intended for capex, said Ashish Gupta, chief investment officer of Axis Asset Management, in a report.

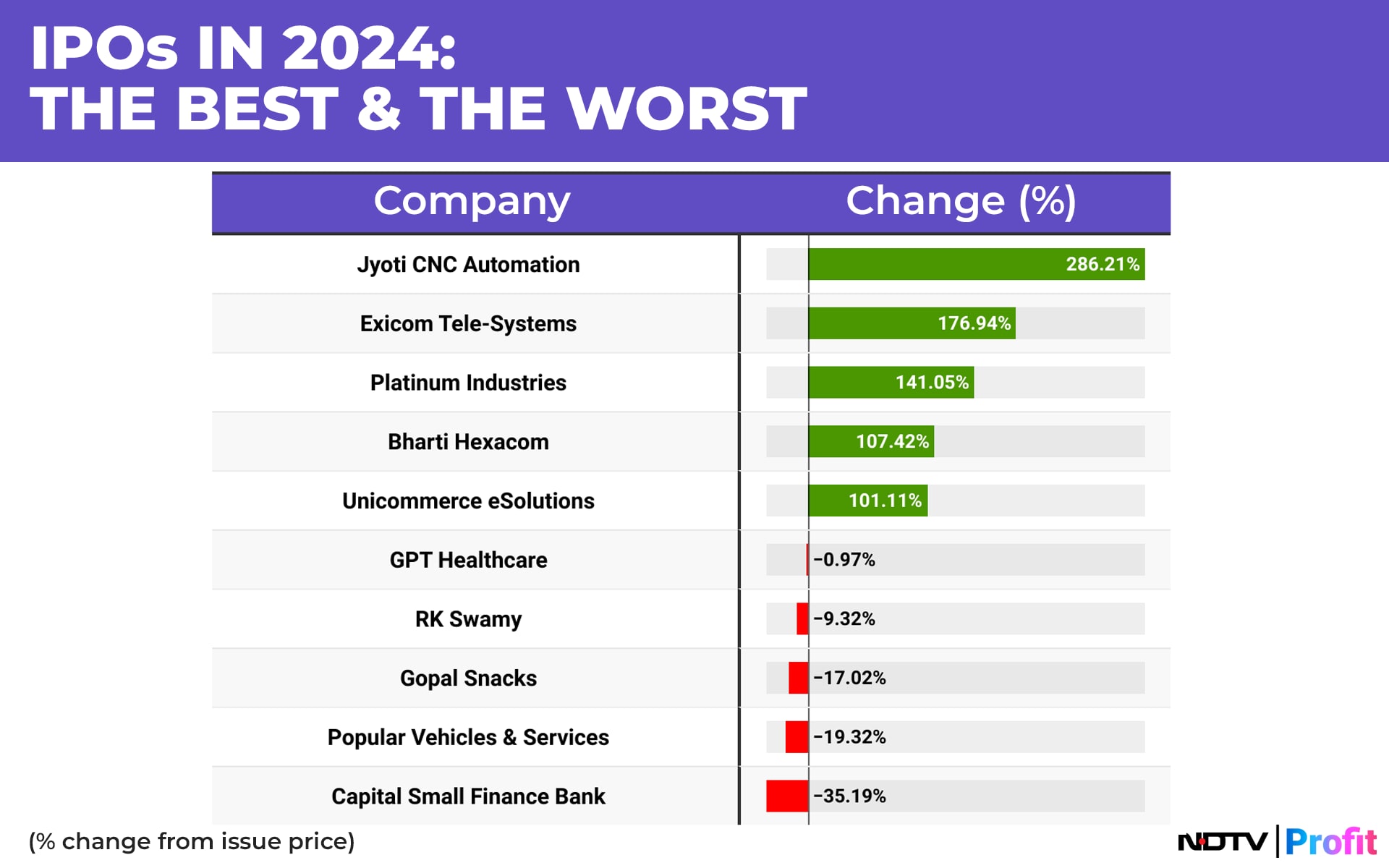

Among the companies that have debuted this year in the mainboard space, Jyoti CNC Automation Ltd.—with over 280% returns—has been the top performer. Exicom Tele-Systems Ltd., Platinum Industries Ltd., Bharti Hexacom and Unicommerce eSolutions are the other top IPOs with over 100% gains.

Capital Small Finance Bank, Popular Vehicles & Services Ltd. and Gopal Snacks Ltd. have been the loss-making IPOs so far this year.

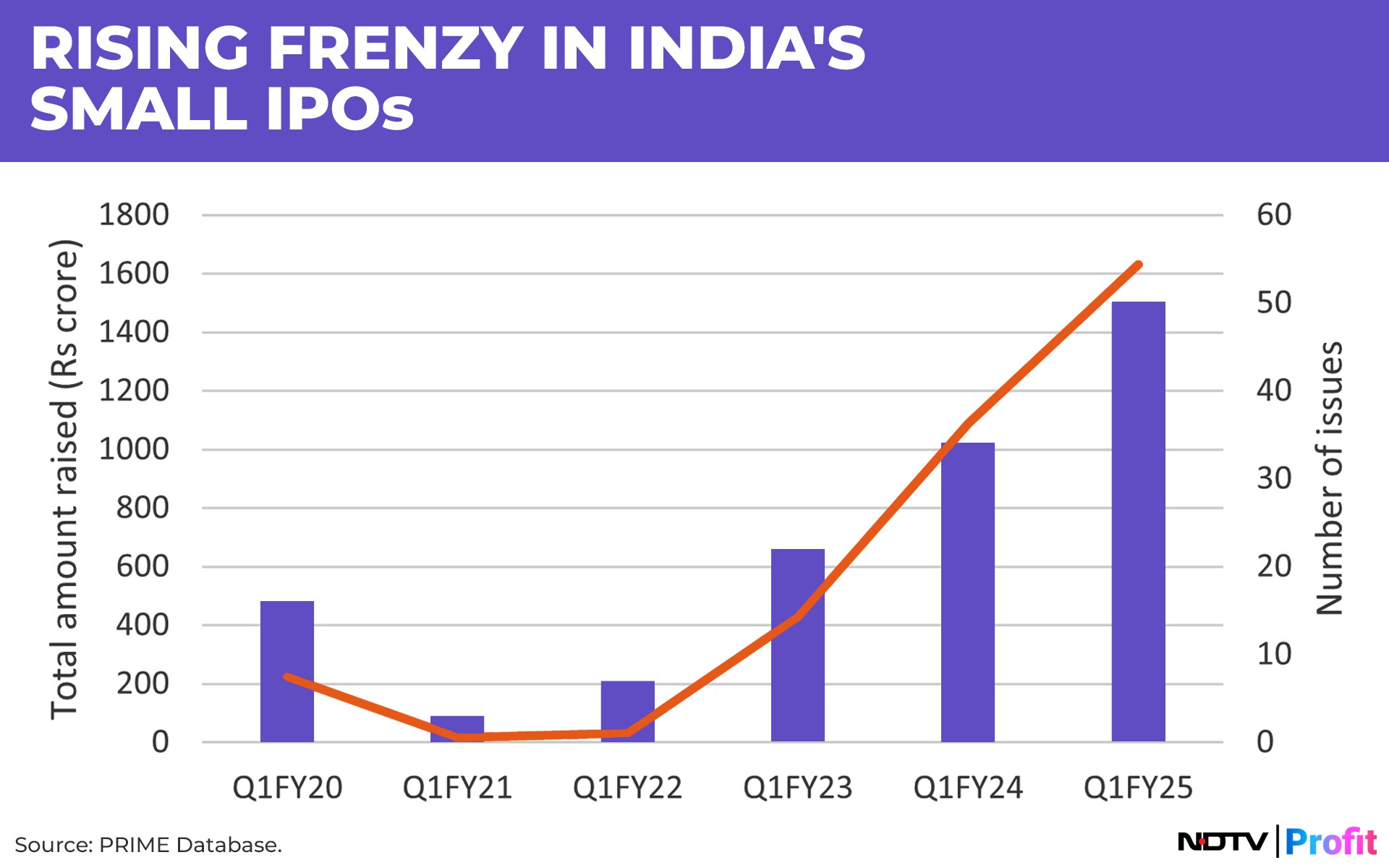

The focus now shifts to the rising mania in the country's SME issues and listings. The total amount raised via the initial public offering in the SME space doubled in the first six months, compared to the same period last year with 117 companies participating, a surge of over 60%.

In terms of the number and total funds raised, the first quarter of the current financial year is the highest in the last five years, with 50 companies raising Rs 1,632.3 crore, according to data from Prime Database.

Despite regulatory scrutiny looming over the debut price, SME IPOs have been one of the easiest ways to quickly double investors' wealth since July—when the 90% cap for listing was set. About 15 of the 33 listings, or nearly one in two companies, doubled in value on the day of the debut.

Liquidity, FOMO Effect and retail participation are the key drivers for the recent surge in SME stocks and strong listings gains, according to Vaibhav Porwal, co-founder, Dezerv.

The frenzy in this space is only limited to listing days, as shares tend to drop right after their debut. Many of the SME companies listed this year were trading below their listing day price, according to exchange data.

SMEs contribute substantially to India's GDP and employment generation and access to the capital market is a development and has to be encouraged, said V K Vijayakumar, chief investment strategist, Geojit Financial Services Ltd. "But recent developments indicate excesses...Experience tells us that speculative excesses lead to tears."

.png)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.