(Bloomberg) -- The US service sector came close to stagnating at the end of 2023 as a gauge of employment showed the biggest contraction in more than three years.

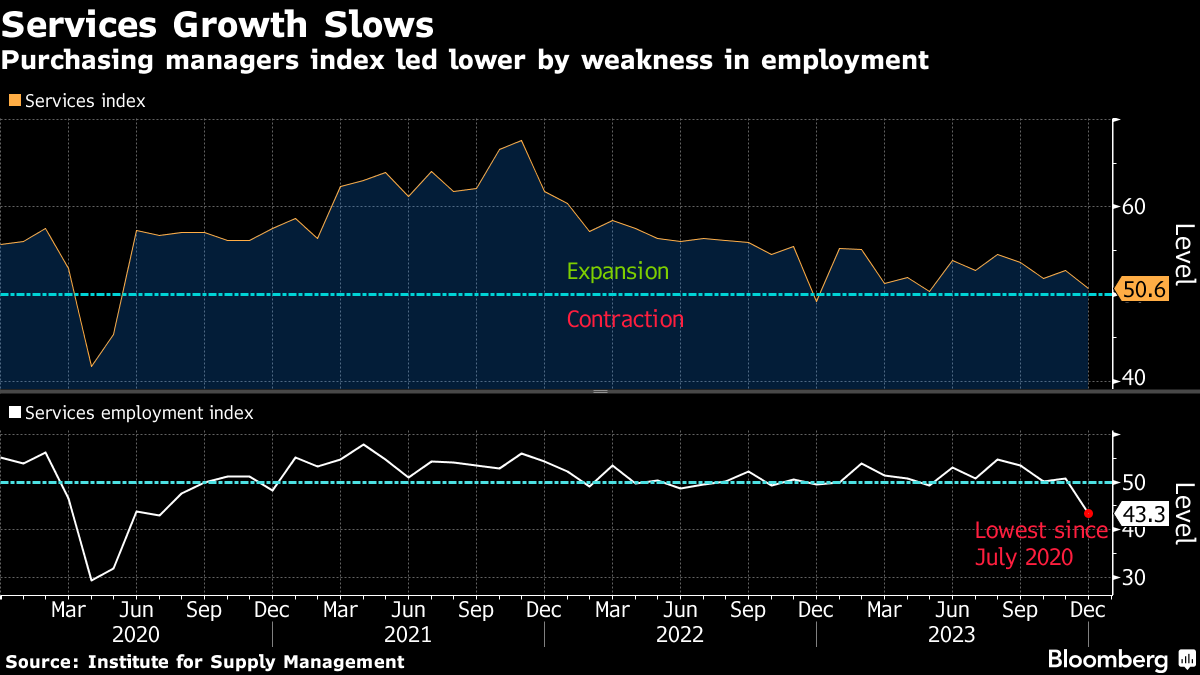

The Institute for Supply Management's overall gauge of services decreased 2.1 points, the most since March, to 50.6 in December. The index, while remaining above the 50 level that indicates expansion, was the second-weakest of the year.

The December reading was lower than all estimates in a Bloomberg survey of economists. A sustained slowdown in services would raise concerns about the risk of a broader cooling of the US economy. Earlier this week, the ISM said its manufacturing index remained in contraction territory for a 14th month.

The gauge of employment among service providers plunged 7.4 points to 43.3, the lowest level since July 2020 and a sign of dissipating momentum in the US labor market.

A separate report Friday from the government showed private payrolls picked up in December after downwardly revised advances in the prior two months. The three-month average of 115,000 matched the smallest since mid-2020.

The ISM report also showed a gauge of new orders placed with service providers slipped to a three-month low, suggesting a more tempered outlook for demand.

“There are concerns related to economic uncertainty, geopolitical events and labor constraints,” Anthony Nieves, chair of the Institute for Supply Management Services Business Survey Committee, said in a statement.

In a call with reporters on Friday, Nieves said, “Overall, 2024 should continue down a path of growth for the services sector.”

Nine industries reported expansion in December, including accommodation and food services, health care and transportation and warehousing. Nine sectors also reported decreasing activity, led by real estate and entertainment and recreation.

While the topline purchasing managers number declined, the business activity index, which parallels ISM's factory output gauge, expanded at a faster pace in December.

Select ISM Industry Comments

“Business conditions are generally good, except for a short supply of major electrical components.” — Educational Services

“Revenues remain strong but labor is still constrained, and suppliers are floating price increases beginning January 1, which will likely further reduce already low operating margins.” — Health Care

“If interest rates go down, investment borrowing will increase, as will orders for services.” — Information

“Production and sales are up, and prices are down.” — Mining

“Companies are taking a wait-and-see approach to increasing labor costs as they continue to try to do more work with less people.” — Professional, Scientific & Technical Services

“Final push for the holidays. The supply chain and sales are strong — pricing stable.” — Retail Trade

“There is more stability in the supply chain for the first time since early 2020. Overall level of business activity is still relatively high.” — Utilities

The ISM's measure of sentiment about inventory levels also fell nearly 7 points after surging in November to the highest level since the onset of the pandemic. The index of inventories eased below 50, suggesting providers see better balance between supply and demand.

A metric of prices paid for materials fell to a five-month low of 57.4, indicating that costs are still rising but at a slower pace.

--With assistance from Kristy Scheuble.

(Adds select ISM industry comments)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.