(Bloomberg) -- US job growth last month topped all estimates, the unemployment rate unexpectedly declined and wage growth accelerated, reducing the odds the Federal Reserve will opt for another big interest-rate cut in November.

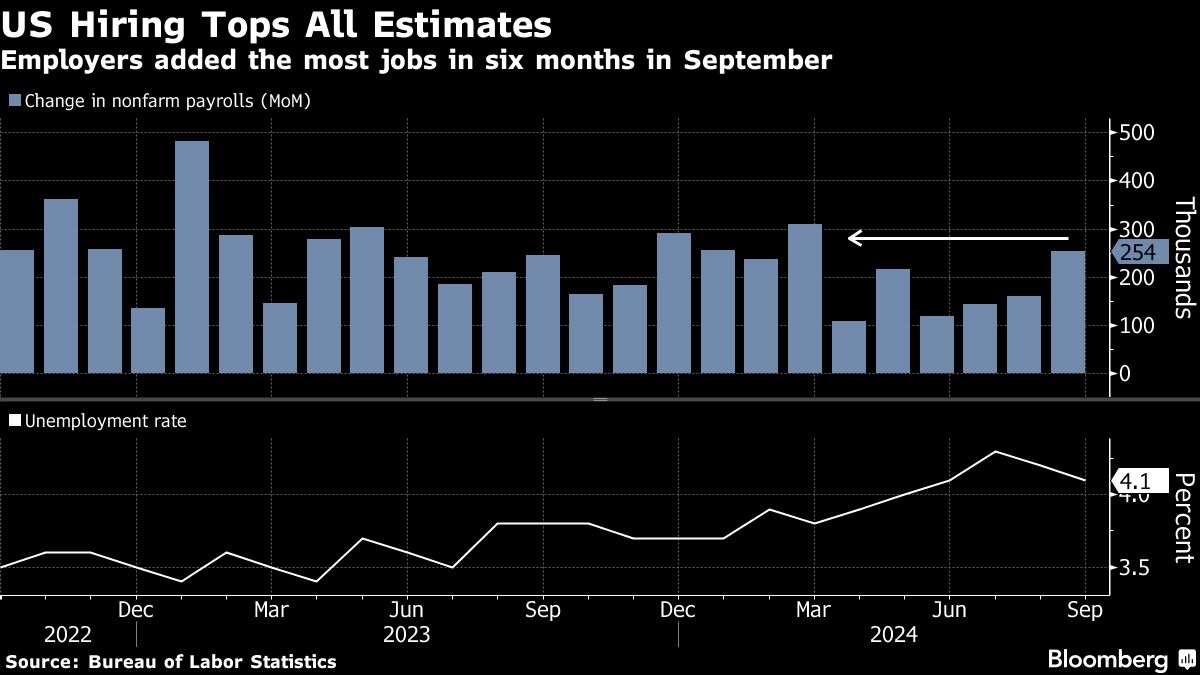

Nonfarm payrolls increased 254,000 in September, the most in six months, following an upwardly revised 72,000 advance over the prior two months. The unemployment rate fell to 4.1% and hourly earnings increased 4% from a year earlier, according to Bureau of Labor Statistics' figures released Friday.

Combined with data earlier this week showing that demand for workers is still healthy while layoffs remain low, the payrolls report is likely to alleviate concerns that the labor market is deteriorating. The figures also showed fewer Americans were working part-time for economic reasons and people who recently lost their jobs were able to find work elsewhere.

Fed Chair Jerome Powell this week reaffirmed that shielding the labor market was part of the reason why the Fed decided to kick off its easing cycle with a larger rate cut in September. The data are a welcome development for Powell and his colleagues who desire no further cooling in the job market.

The S&P 500 opened higher, and the dollar and Treasury yields rose after the figures. Pricing in the swaps market showed traders paring bets on a Fed interest-rate cut larger than a quarter-point in November.

Follow the reaction in real time here on Bloomberg's TOPLive blog

The Fed has “a better chance of getting this right and not being behind the curve given this report,” said Laura Rosner-Warburton, a senior economist at MacroPolicy Perspectives, noting the figures lower the odds of another half-point cut.

The solid report is good news for Vice President Kamala Harris as she heads into the final weeks of a presidential election race that has focused on voters' views on the economy. Americans have been growing wary of job prospects at the same time as they contend with a high cost of living.

Fed officials also pay close attention to wage growth, as it can help inform expectations for consumer spending — the main engine of the economy. Hourly earnings rose from a year ago by the most in four months. Wage growth for production and nonsupervisory employees cooled to 3.9%.

The gain in hiring last month was driven by leisure and hospitality, as well as health care and government. The payrolls diffusion index, which measures the breadth of changes in private employment, rose to the highest since the start of the year. Manufacturers, however, cut jobs for a second month.

October Report

The October jobs report, which will be released Nov. 1, will include the impact of a walkout last month by some 33,000 Boeing Co. factory workers. Another large strike, by US dockworkers, ended after three days and likely won't have a direct effect on the month's payrolls count.

However, another wrinkle is Hurricane Helene, which cut a path of death and destruction across a swath of the US Southeast. Parts of the region are struggling to reopen roads and reconnect power, indicating business will take time recover.

What Bloomberg Economics Says...

“We think the prospect of soft landing for the economy has brightened... It's probably premature to conclude that the Federal Reserve's 50-basis-point rate cut has already stabilized the labor market. What's more likely is that the Fed's next move will be a 25-bp cut in November.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou. To read the full note, click here

The latest jobs report showed the so-called underemployment rate — which includes those working part-time for economic reasons and discouraged workers — fell to 7.7% in September, the first decline in nearly a year.

The participation rate — the share of the population that is working or looking for work — held at 62.7% for a third month. The rate for workers ages 25-54, also known as prime-age workers, dropped to 83.8%.

While layoffs haven't been a main feature of the labor-market cooling in the US, they're picking up in other countries. Samsung Electronics Co. is laying off workers in Southeast Asia and Oceania as part of a plan to reduce global headcount, and Volkswagen AG is both trimming positions in China and mulling plant closures at home in Germany.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.