(Bloomberg) -- US hiring slowed markedly in July and the unemployment rate rose to the highest level in nearly three years, suggesting a faster deterioration in the labor market than previously thought and putting the Federal Reserve solidly on a path to cutting interest rates in September.

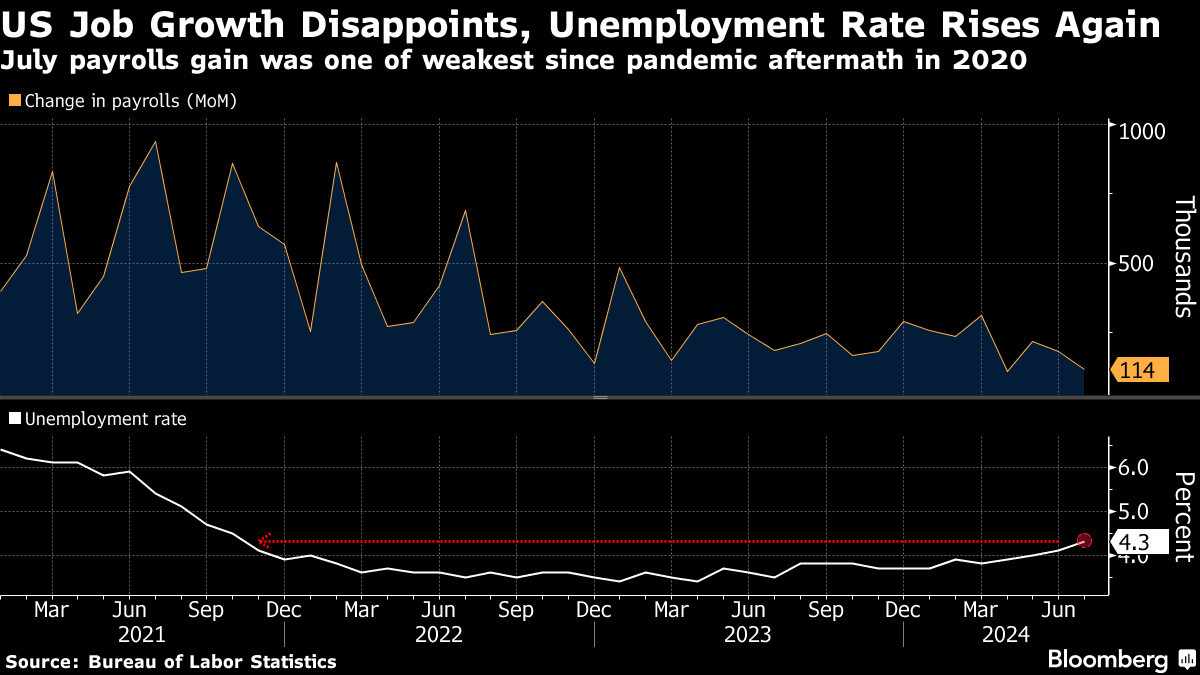

Nonfarm payrolls rose by 114,000 last month after downward revisions to prior two months, the Bureau of Labor Statistics said Friday. That was lower than all but one forecast in a Bloomberg survey of economists and one of the weakest prints since the pandemic. Average hourly earnings also came in below forecast.

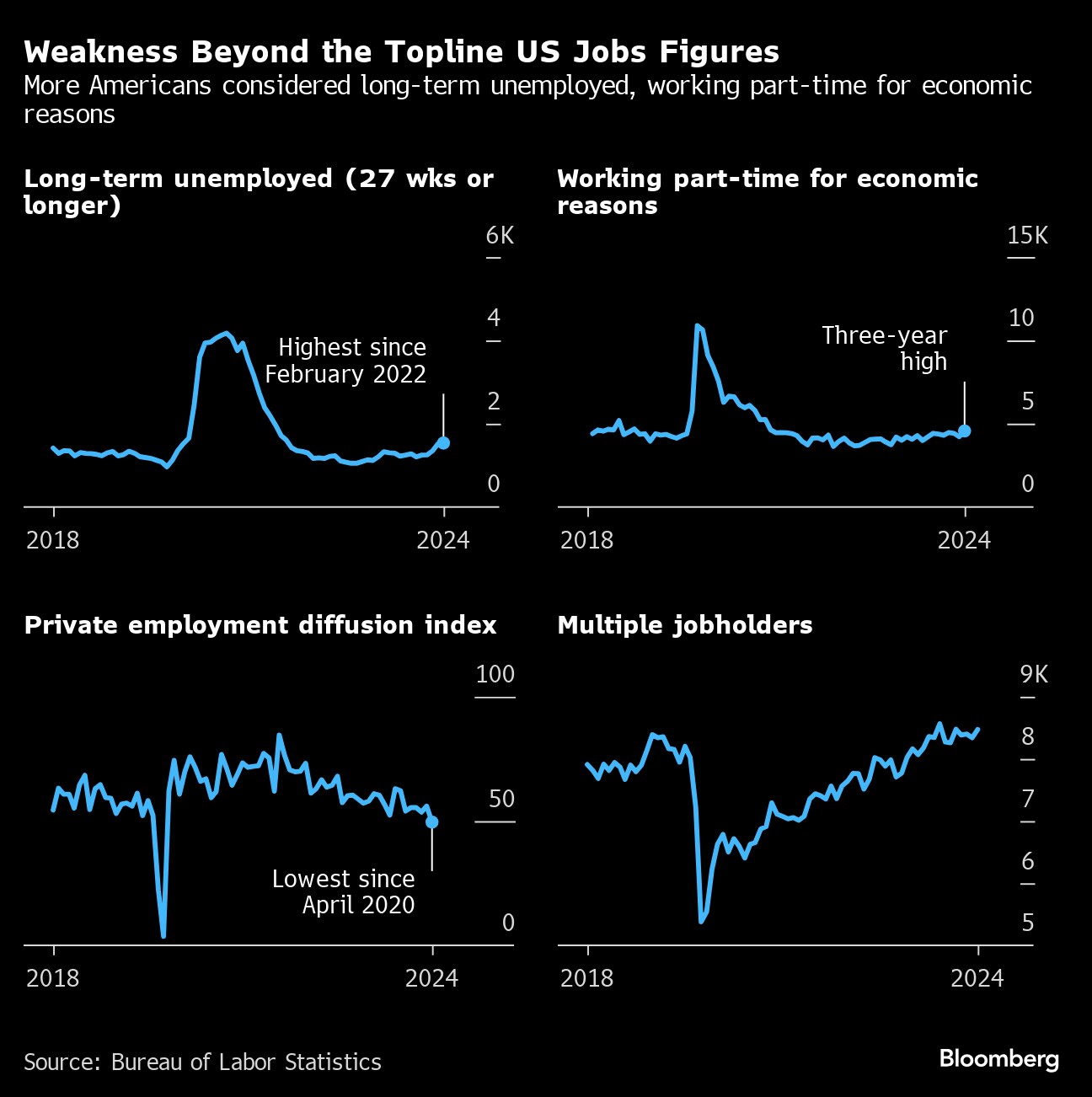

The unemployment rate unexpected climbed for a fourth month to 4.3%. That reflected more people losing and leaving their jobs, rather than new workers entering the labor force. However, people who had previously worked did come back, which helped drive up participation.

Follow the reaction in real time here on Bloomberg's TOPLive blog

The jobs report adds to a week of disappointing data that raise concerns of a more abrupt downshift in the economy, prompting a stock market sell-off and pushing down Treasury yields. The figures may give Fed officials some reason to believe that their policies are cooling the labor market too much rather than reverting to its healthy pre-pandemic trend.

Chair Jerome Powell spoke Wednesday after the central bank held interest rates at a two-decade high, saying officials are now more focused on the other side of their dual mandate and want to prevent undue harm to the labor market since inflation has largely come down from its pandemic peak.

He also indicated policymakers are on course to start lowering borrowing costs as soon as September. Traders are close to pricing in a half-point rate cut at that meeting.

“This environment just means accelerating cuts,” said Derek Tang, economist with LH Meyer/Monetary Policy Analytics. “The Fed was already leaning to recession avoidance, or what they call sustaining the expansion. With this report, it will become even more lopsided, with inflation upside risk relegated to a near memory.”

What Bloomberg Economics Says...

“The cooling in the labor market is showing little sign of stabilizing. At the current pace, it will go beyond the “gradual normalization” Powell described after the July FOMC meeting. We expect the unemployment rate to continue rising, reaching 4.5% by year end.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou. To read the full note, click here

Hurricane Beryl hit Texas on July 8, which landed during the reference period for both surveys that make up the jobs report. The BLS said it had “no discernible effect” on the data, though the number of people who said they didn't work because of bad weather surged.

The rise in the unemployment rate triggered a famous recession indicator known as the “Sahm rule” — which has a perfect track record over the past half-century. The mastermind behind the gauge, former Fed economist Claudia Sahm, said on Bloomberg Radio after the report that while the US isn't in a recession, “we're not headed in a good direction.”

Sahm has recently said forecasters should also be looking at the pickup in participation and to what extent it's skewing the unemployment data. She's noted that participation has been rising fast as Americans return to the workforce and immigrants flock to the country.

The participation rate — the share of the population that is working or looking for work — ticked up to 62.7% in July. The rate for workers ages 25-54, also known as prime-age workers, climbed further to 84%, still the highest since 2001.

The slowdown in payrolls reflected cuts in information and car manufacturing. Temporary help positions also declined, which is often looked at as a precursor to a downturn. Meantime, healthcare continued to lead job growth.

The diffusion index, which measures the breadth of job growth, declined to the weakest since the immediate aftermath of the pandemic.

Average hourly earnings rose 3.6% in July from a year ago, the slowest in three years. Wages for production and nonsupervisory employees, which covers the majority of workers, decelerated as well. Data from other sources earlier in the week also pointed to slower pay growth.

--With assistance from Chris Middleton, Matthew Boesler, Cécile Daurat, Michael Mackenzie, Steve Matthews and Mark Niquette.

(Adds second graphic, Bloomberg Economics comment)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.