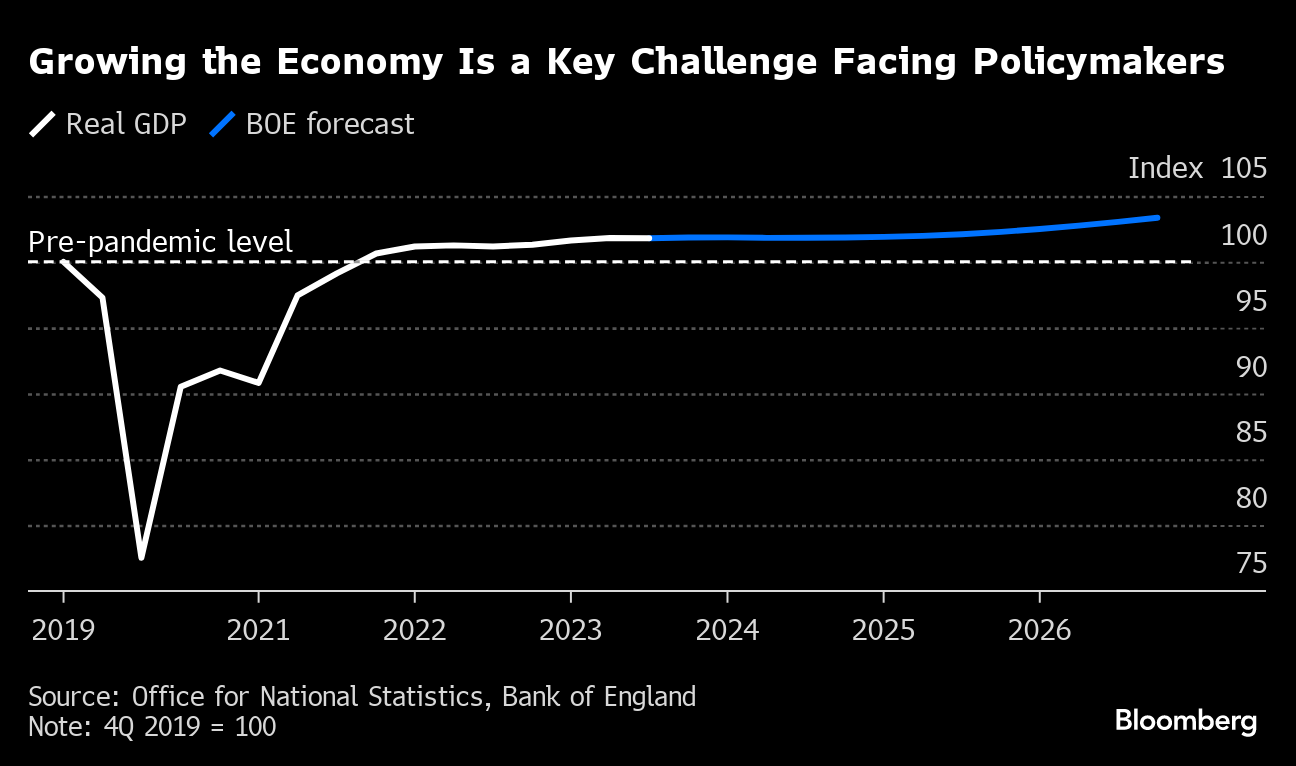

(Bloomberg) -- Recession fears may stalk Britain's economy once again, with the threat of a downgrade this week to previous GDP estimates that had raised hopes that the country may have avoided a contraction.

While initial estimates of UK gross-domestic product in the three months through September showed zero growth, retail sales have since come in weaker than first thought. That may be all that it would take to shave a couple tenths of a percentage point off of growth when revised data is released on Friday.

Even a change that minor could revive talk of a technical recession — defined as two consecutive quarters of contraction — in the second half of the year. It would be a bleak backdrop for Prime Minister Rishi Sunak's desire to win reelection next year and also fan speculation the Bank of England will soon turn toward cutting interest rates.

Almost all forecasters expect no change to the initial estimate, although some, including Dan Hanson, senior UK economist at Bloomberg Economics, see a chance of a downgrade.

“The ONS is likely to confirm that GDP stagnated in the third quarter, but we do think there is some risk output is revised lower,” Hanson said. “The first estimate showed GDP fell, just not by enough to tip the rounding, and since then the retail sales data has been revised down. The statistics wouldn't need to find much more weakness for GDP to register a 0.1% fall.”

While recent data for the eurozone has turned decisively darker, fanning talk of rate cuts and recession, the picture in the UK is much more mixed.

Optimism in business and consumer surveys contrast with a dour picture painted by mounting insolvencies, stalling retail sales in the run-up to Christmas and a warning of slowing demand from the BOE's network of agents.

“Growth is likely to remain marginal over the next year, meaning that it wouldn't take much of a deterioration in sentiment or economic conditions to tip the UK into a recession,” said Thomas Pugh, economist at RSM UK.

It leaves the UK's near-term outlook ranging from tepid growth to a minor recession. Friday's report on GDP will determine whether there was a downturn in the third quarter, with a bigger-than-expected contraction in October's figures posted last week pointing toward a poor fourth quarter.

There are plenty of signs that Britain will pull through without a recession. Easing inflation and the return of real wage growth for the first time in almost two years are improving consumer and business confidence.

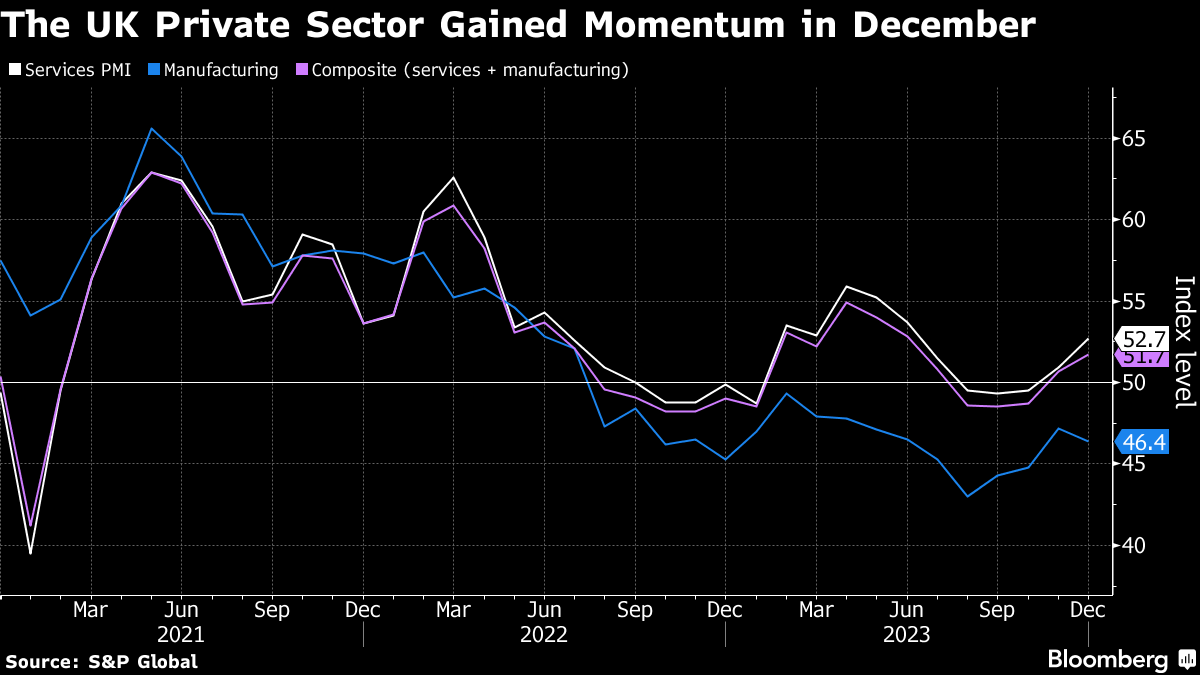

- Data on Friday showed the purchasing managers' survey measuring private sector activity jumping to a six-month high in December, driven by a more resilient services.

- UK household confidence also ticked up in GfK's gauge to its second-highest reading since Russia's invasion of Ukraine sent energy and grocery bills soaring.

- The housing market is continuing to show surprising resilience with prices rising month-on-month in November, according to Halifax and Nationwide.

Chris Hare, economist at HSBC, said the PMI “would represent a prospective improvement relative to the lackluster ‘hard' UK data,” such as the weak GDP figures for the third quarter and October.

“There are reasons to expect a gradual rise in UK growth,” Hare said. “After all, the cost of living squeeze is past its worst, with real household incomes now rising, while the dovish shift in market rate expectations has eased borrowing cost pressures.”

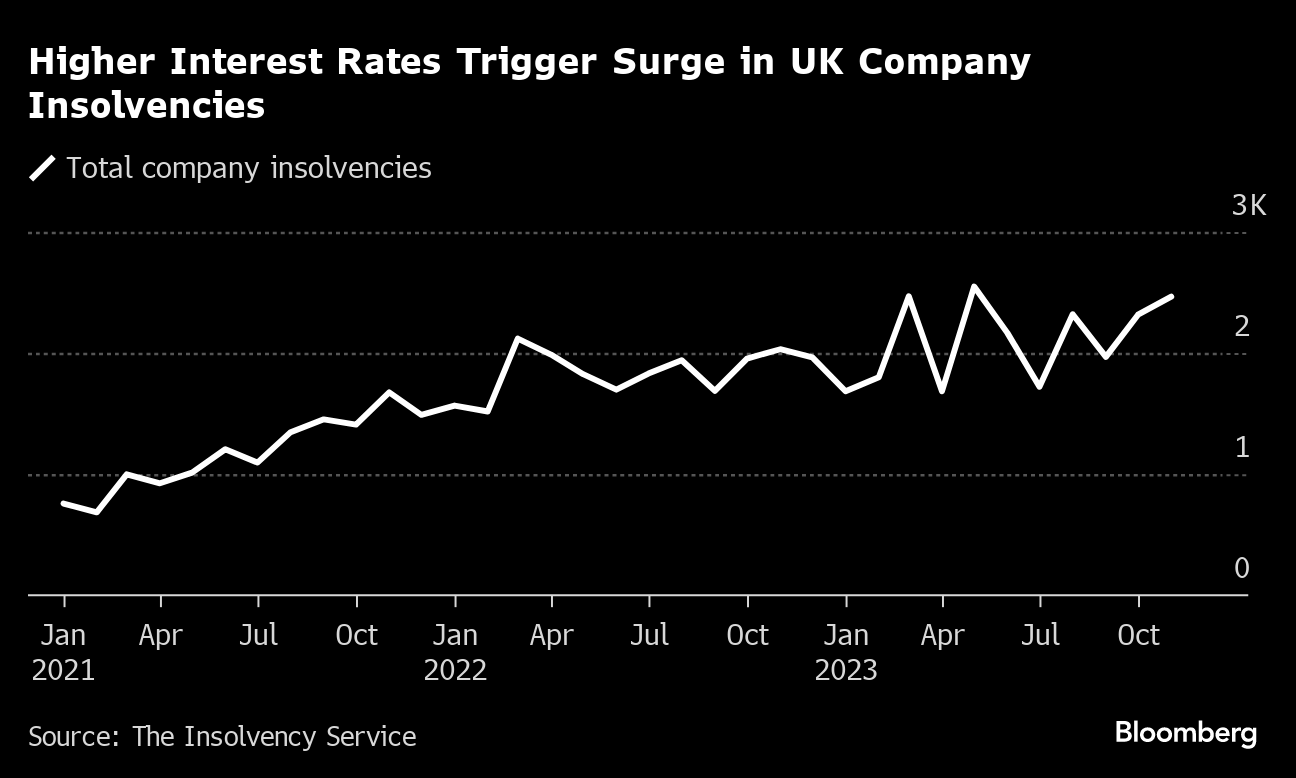

However, the impact of 14 back-to-back interest rate increases is continuing to eat into the disposable income of consumers and mount pressure on businesses. Another risk is the deteriorating jobs market. Those pressures are starting to show up more clearly in data.

- New figures last week showed insolvencies were a fifth higher than a year ago in November.

- Retail sales have struggled in the run-up to Christmas in official and survey data.

- The jobs search engine Adzuna found that job vacancies have slipped below 1 million for the first time since May 2021.

- The Bank of England said intelligence from its agents suggest that demand weakened slightly in recent weeks. It cut its fourth quarter GDP forecast to zero growth.

This week's data may tip the balance. On GDP, most economists don't try to second-guess the estimates made by the Office for National Statistics. Figures due Friday are the second estimate for the third-quarter and will reflect cuts to retail sales results.

Retail sales figures also due Friday may show a 0.4% month-on-month rebound for November. Inflation data earlier in the week could show the lowest price pressures in two years, with the headline Consumer Prices Index expected to slide to 4.3% in November from 4.6% the month before.

“A soft inflation print next Wednesday might nudge the MPC towards cutting rates a bit sooner than our forecast of late in 2024,” said Ruth Gregory, deputy chief UK economist at Capital Economics. “But we still think investors are over-estimating how quickly the Bank will cut rates.”

--With assistance from Harumi Ichikura.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.