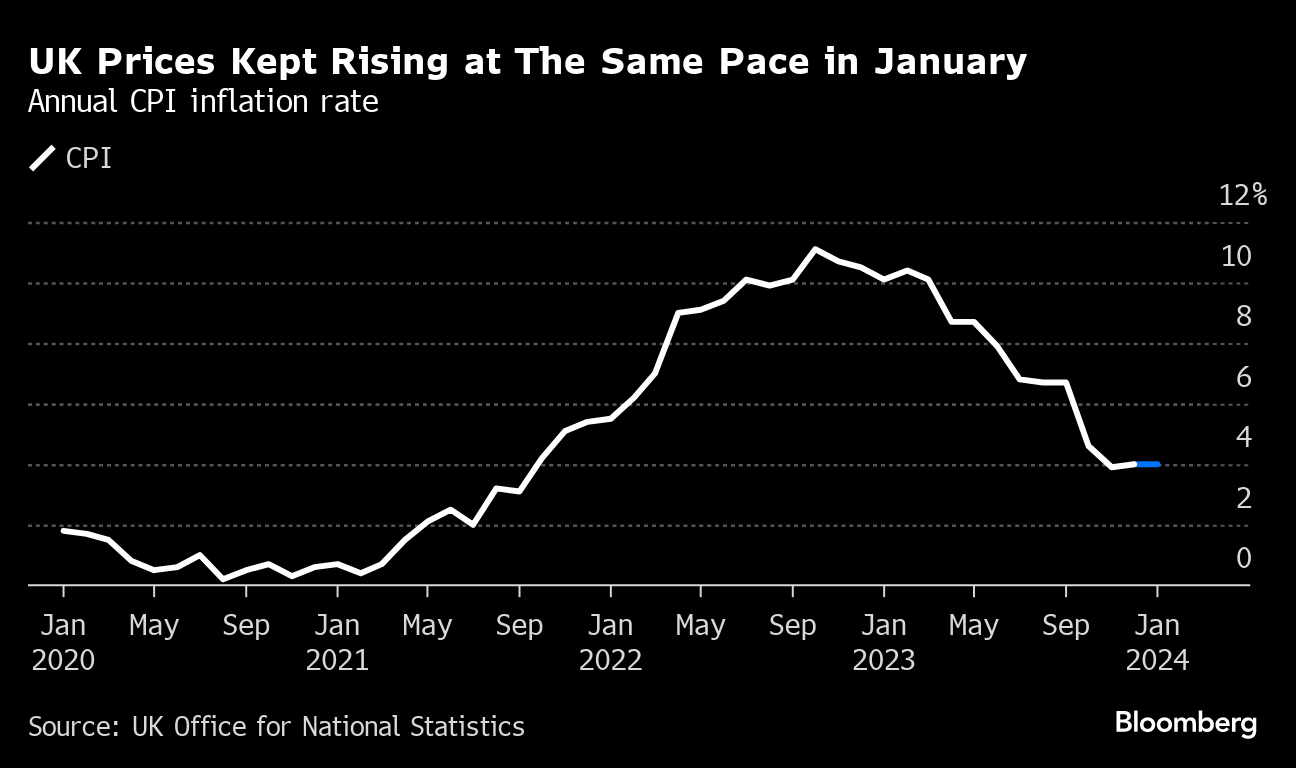

(Bloomberg) -- UK inflation rose less than forecast in January, with underlying price pressures rising less than markets and the Bank of England had feared.

Consumer prices rose 4% compared to a year earlier, the same pace as in December, the Office for National Statistics said Wednesday. The BOE and private-sector economists had expected inflation to tick higher to 4.1%.

Services inflation, which is more directly linked to domestic costs, accelerated to 6.5% in January. The BOE had forecast 6.6%, with the rate set to remain well above that of core goods.

Despite expectations for inflation to fall below the bank's 2% target in the coming months, policymakers are taking a cautious approach to easing amid continuing tightness in the labor market and signs the economy is picking up. The inflation data is at least partially offset by wage figures on Tuesday, which showed pay slowing less than expected, prompting traders to scale back bets on how far the BOE will cut interest rates this year.

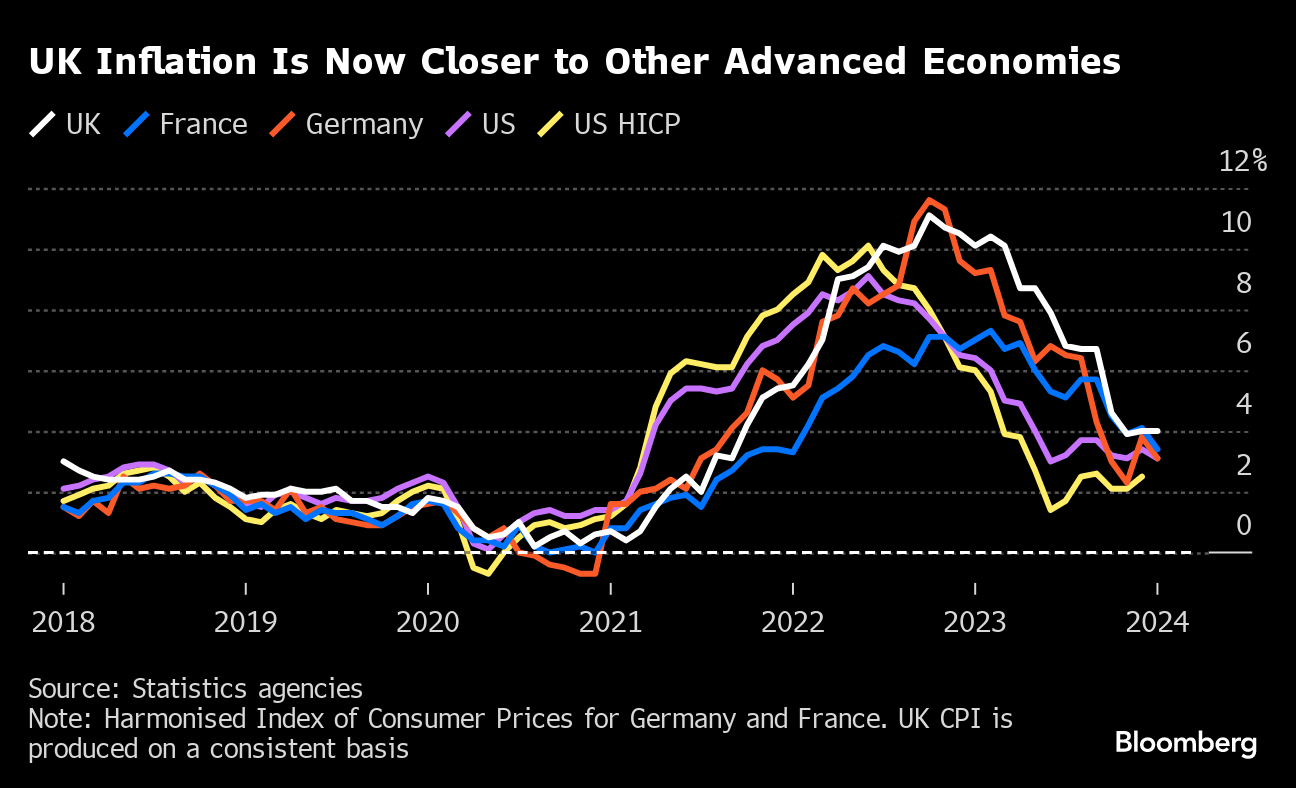

UK the inflation coming in below forecasts in January follows the stronger-than-expected price data from the US on Tuesday, which prompted traders to shift back bets on when the Federal Reserve starts loosening policy. The pound swung to a loss after the release. It traded as much as 0.3% weaker at $1.2556, a one-week low.

“There is a silver lining in the fact that inflation has stayed the same as we are unlikely to see any increases to borrowing and further strains on the purses of the nation,” Nathan Emerson, CEO of Propertymark said.“That being said, the Bank of England made an optimistic projection in February that the rate of inflation would be back down to two per cent, like it was prior to the pandemic, and whilst the figure remains at four per cent, this will be sure to make them cautious about cutting rates.”

BOE Governor Andrew Bailey may give further clues to the bank's policy direction when he takes questions from lawmakers in the House of Lords later Wednesday.

The cost of groceries, clothing, transportation, furniture and household goods also dragged inflation lower. There were also counteracting effects within the basket of goods and services, with household energy prices rising between December and January, as the regulatory cap increased slightly, and the cost of second-hand cars climbed for the first time since May.

“Inflation never falls in a perfect straight line, but the plan is working,” said Jeremy Hunt, Chancellor of the Exchequer. “We have made huge progress in bringing inflation down from 11%, and the Bank of England forecast that it will fall to around 2% in a matter of months.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.