.jpg?downsize=773:435)

(Bloomberg) -- Britain's economy probably bounced back in November, but not strongly enough to head off the risk of a recession at the tail end of 2023.

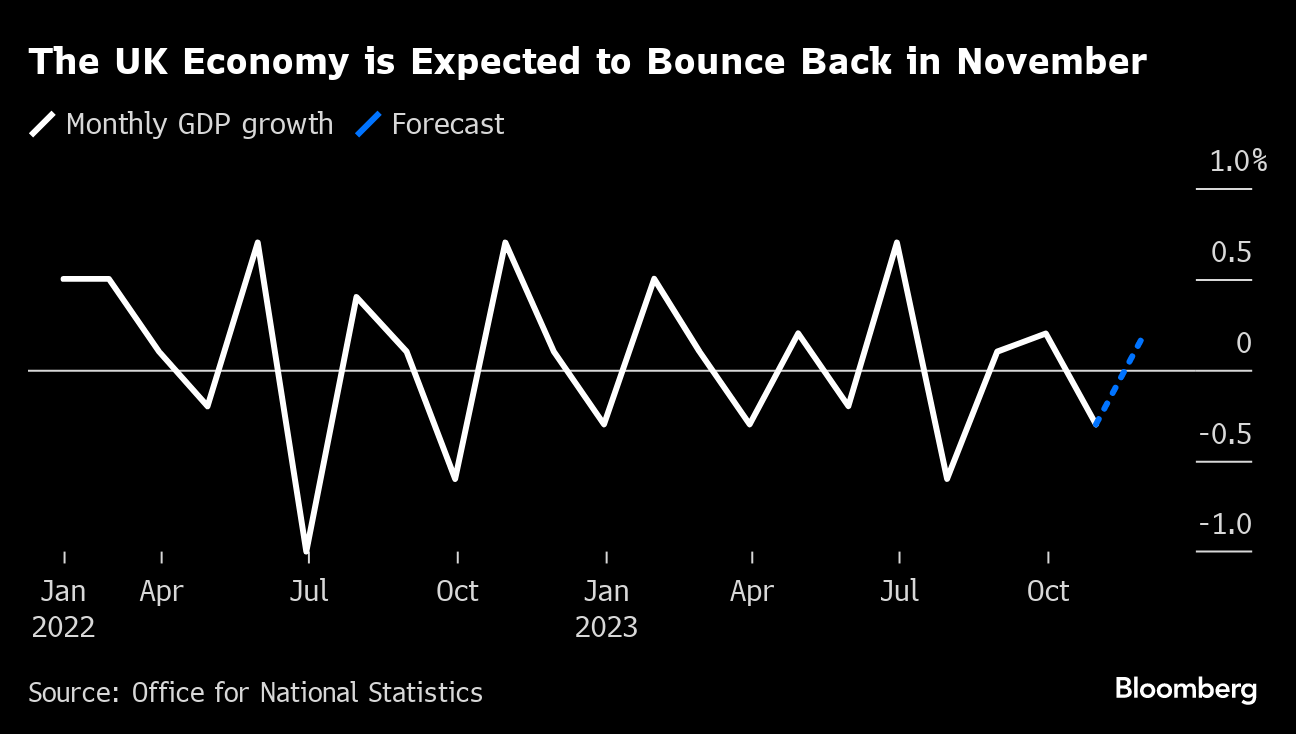

Gross domestic product figures due for release on Friday are likely to show a gain of 0.2% in the month after a 0.3% contraction in October, according to a survey of economists by Bloomberg. It would require a similar bounce in December to prevent the UK from meeting the technical definition for a recession.

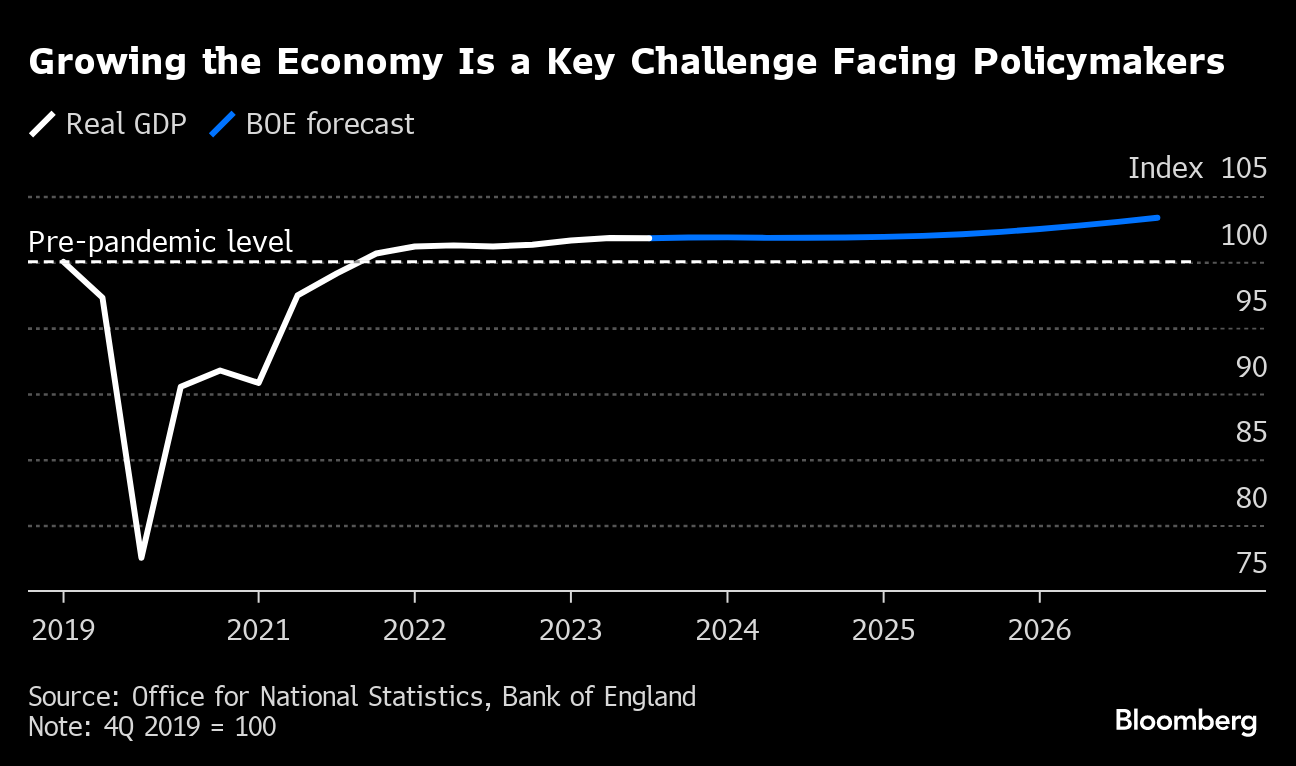

The figures add to the impression that the UK economy is stuck in a neutral gear, wavering between stagnation and a minor contraction. It's a bleak backdrop for Prime Minister Rishi Sunak to fight the next election, though there is some prospect of an improvement later this year.

Bank of England Governor Andrew Bailey on Wednesday pointed out a few factors that have blunted the impact of the highest interest rates in the UK since 2008 in testimony to lawmakers about the outlook for financial stability.

“We have not seen a pronounced increase in unemployment,” Bailey said. “That's relevant because historically one of the drivers of loan losses, particularly in the mortgage market, is unemployment.” He also said the mortgage market is “nowhere near as stretched as it was during the global financial crisis.”

November's GDP reading will likely reflect “a bit of payback after a big fall” in October, said George Buckley, chief UK economist at Nomura. He predicts drop for the fourth quarter overall and questioned the underlying resilience of the economy.

“The current rate of growth that we're seeing in the GDP figures is probably overstating the degree to which the economy is on an underlying basis doing well,” he said. “GDP has actually been pretty resilient given what's been thrown at the economy. How much of that resilience is related to the fact that we are still recovering from Covid.”

What Bloomberg Economics Says...

“The November GDP print will probably show a mild monthly gain, though that won't be enough to prevent a second straight drop in output in the last quarter of 2023. Momentum in the economy is likely to remain weak at the start of 2024, though the prospects for the rest of the year have improved meaningfully over the past month.”

—Ana Andrade, Bloomberg Economics.

However, some tailwinds are brightening the outlook for the rest of 2024. Those include lower inflation, growing real wages and bets on the Bank of England cutting interest rates as soon as the Spring. Survey data have also pointed to some small pick-up in momentum.

Even a tepid economy has proven too inflationary for the BOE, though a weak final quarter of 2023 could fuel expectations on a cut to its key interest rate in May.

The economy suffered a 0.1% drop in GDP in the third quarter, which opens the prospect of a mild technical recession — two consecutive quarters of falling output.

Forecasters expect volatile industrial production and manufacturing output data to be a bright spot in November's figures, though largely due to temporary factors. Both are predicted to see the strongest monthly performance since June.

“We are doing substantially better than last year mostly on the back of the fact that the auto industry has recovered output,” said Nico Palesch, industry economist at Oxford Economics. “For industrial production over the the next couple of months we're expecting something ranging from stagnation to mild decline.”

Economists are bracing for a bumpy start to 2024. Labor strikes in January point to a weak start to the year, which would add to pressure on the BOE to loosen monetary policy. Tax cuts in the run-up to an election and lower interest rates from the BOE could help provide a boost to growth later in the year.

The central bank has stuck by its message that rates will have to stay higher for longer to quell inflation, which remains about double the 2% target. The BOE is expecting a flat final three months of 2023 and was too optimistic about the third quarter.

“Our view is that inflation is going to keep falling and that over the course of the year they're (the BOE) going to start being increasingly worried about growth,” Palesch said. “To a certain extent you can see manufacturing as part of that picture. Manufacturing isn't providing a source of growth.”

--With assistance from Andrew Atkinson and Harumi Ichikura.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.