(Bloomberg) -- Traders pared bets on interest-rate cuts from the European Central Bank and Bank of England following key inflation data in the region and ahead of the US jobs report.

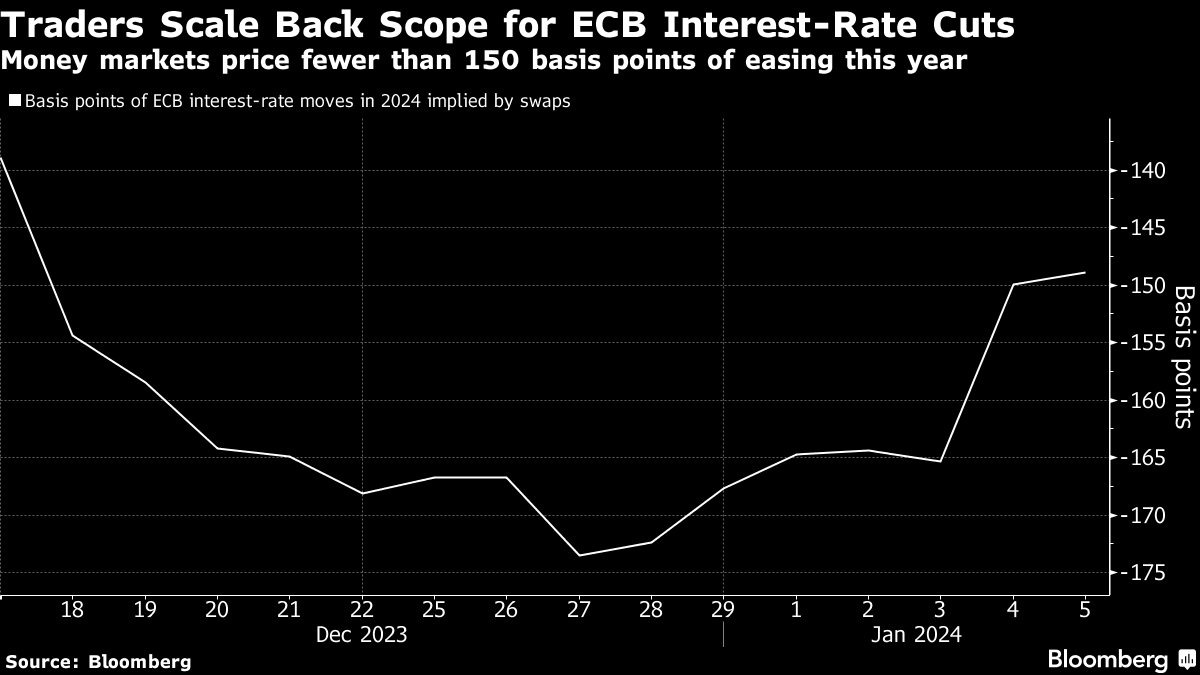

Money markets priced fewer than 150 basis points of monetary-policy easing by the ECB and less than 125 basis points by the BOE in 2024, according to swaps tied to the central bank meeting dates. It's the first time since mid-December that traders bet on fewer than six and five quarter-point cuts respectively.

Investors have been reassessing their expectations for monetary easing from major central banks since late last week, adopting a more cautious tone as the new year started. In late December, the market priced in as much as 174 basis points of ECB rate cuts this year and 150 basis points from the BOE.

“150 basis points of cuts is still ambitious,” said Christoph Rieger, head of rates research at Commerzbank AG. He expects the ECB will only deliver half of that, broadly matching the majority of economists surveyed by Bloomberg. “The gap versus consensus forecasts will probably shrink from both sides.”

Inflation for the euro area sped up again last month, primarily due to energy base effects. Consumer prices rose 2.9% from a year ago, up from 2.4% in November, while a measure of core prices omitting volatile elements fell for a fifth month, to 3.4%, Eurostat said Friday. Both figures matched the median estimates in a Bloomberg survey of economists.

The biggest leg of the repricing came on Thursday, after data showed S&P Global's purchasing managers' index was revised higher for Germany and the UK in December.

Bonds fell for a second consecutive day on Friday, with the German 10-year yield trading four basis points higher at 2.16% and UK counterpart jumping seven basis points to 3.80%.

Money markets have also been paring bets on the extent of rate cuts in the US amid evidence of economic resilience. Friday's nonfarm payrolls data is expected to be strong, showing US employers added 175,000 jobs last month, with the so-called whisper number calling for an increase of 188,000 positions.

Read more: Massive Bearish Treasury Option Trade Bets on Rout Post-Payrolls

Data Thursday showed that US companies ramped up hiring last month, while a separate release showed initial applications for unemployment insurance fell in the final week of 2023 to 202,000, the lowest level since October.

--With assistance from James Hirai and Alexander Weber.

(Updates throughout)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.