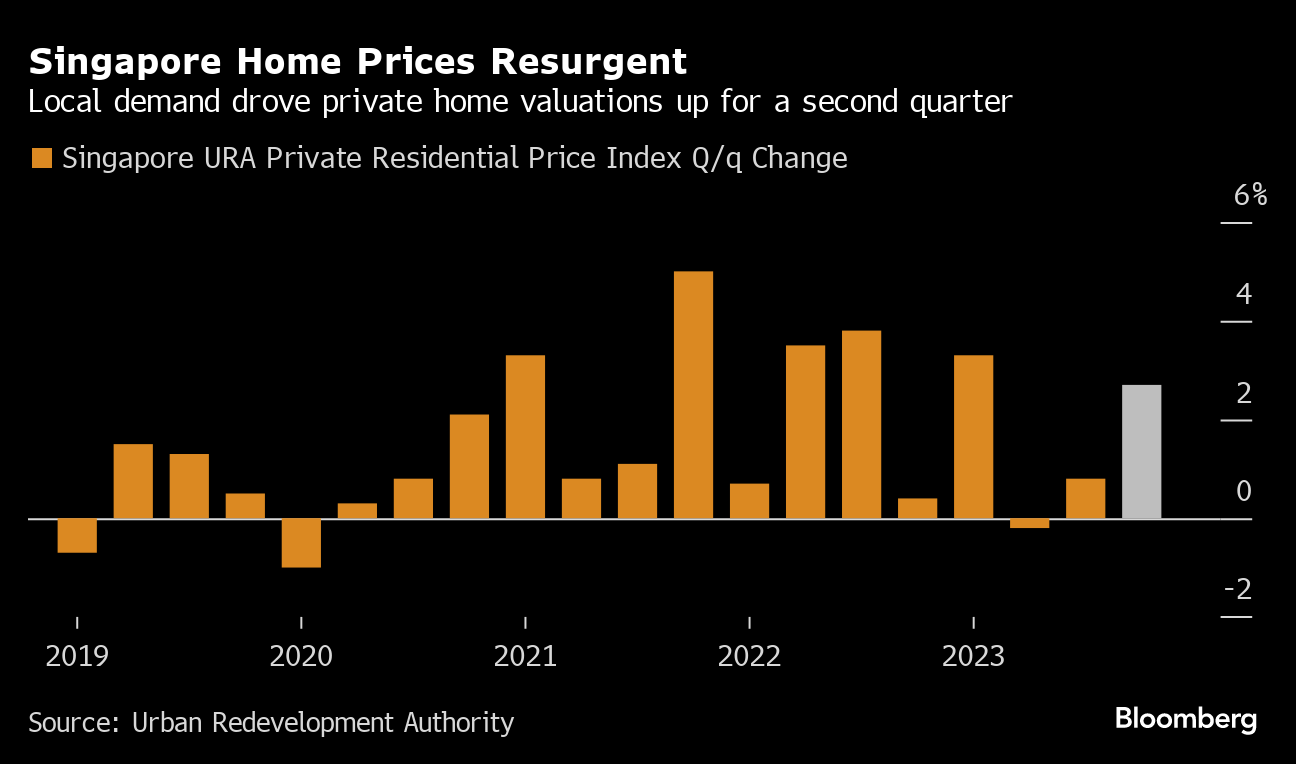

(Bloomberg) -- Singapore home prices rose for a second straight quarter, as local demand continued to prop up the market despite government cooling measures.

Private residential prices climbed 2.7% in the last three months of 2023 from the previous quarter, when they gained 0.8%, according to preliminary estimates released Tuesday by the Urban Redevelopment Authority. Prices increased 6.7% for the whole of last year, slowing from an 8.6% rise in 2022.

Singapore remains one of the most expensive and resilient property markets in the world, as demand withstands rising interest rates that triggered downturns in other major global cities, including rival Hong Kong. Momentum held in the fourth quarter, with a recent development launch in the western suburbs fetching record prices for the area.

Read more: HK Property Market Could Suffer Higher Volatility Than Singapore

The project was close to public transportation and located in a district devoid of new private developments, the reason why it commanded stronger pricing, said Alan Cheong, executive director of research at Savills Plc. Demand is “no longer like a hurricane force, but still blowing,” he said.

Singapore authorities have added curbs to dampen demand and ensure home affordability in recent years. Overseas interest was hit by a doubling of the foreign buyers' stamp duty to 60% last April. Officials are also ramping up supply by selling the most land for private homes in a decade.

Sale transaction volume fell by about 27% in the fourth quarter compared with the previous three months, bringing annual numbers down 15% for the whole of 2023 year-on-year, the URA said. That's the lowest figure since 2016. The agency also warned that domestic mortgage rates are at “elevated levels.”

Analysts expect muted price movements in 2024 as a result. Bloomberg Intelligence expects valuations to remain flat, with some downside risk. Morgan Stanley has gone further, forecasting a drop of 3% this year.

(Updates with analyst comment, URA statement in 4th and 6th paragraphs)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.