(Bloomberg) -- The rupiah looks poised to weaken heading into 2024, as uncertainty ahead of Indonesia's national elections in February plays on investors' minds.

The currency may trade around 15,800 a dollar in the first quarter next year, according to BNY Mellon Corp., HSBC Holdings Plc. and PT Bank Mandiri. It closed at 15,493 Friday.

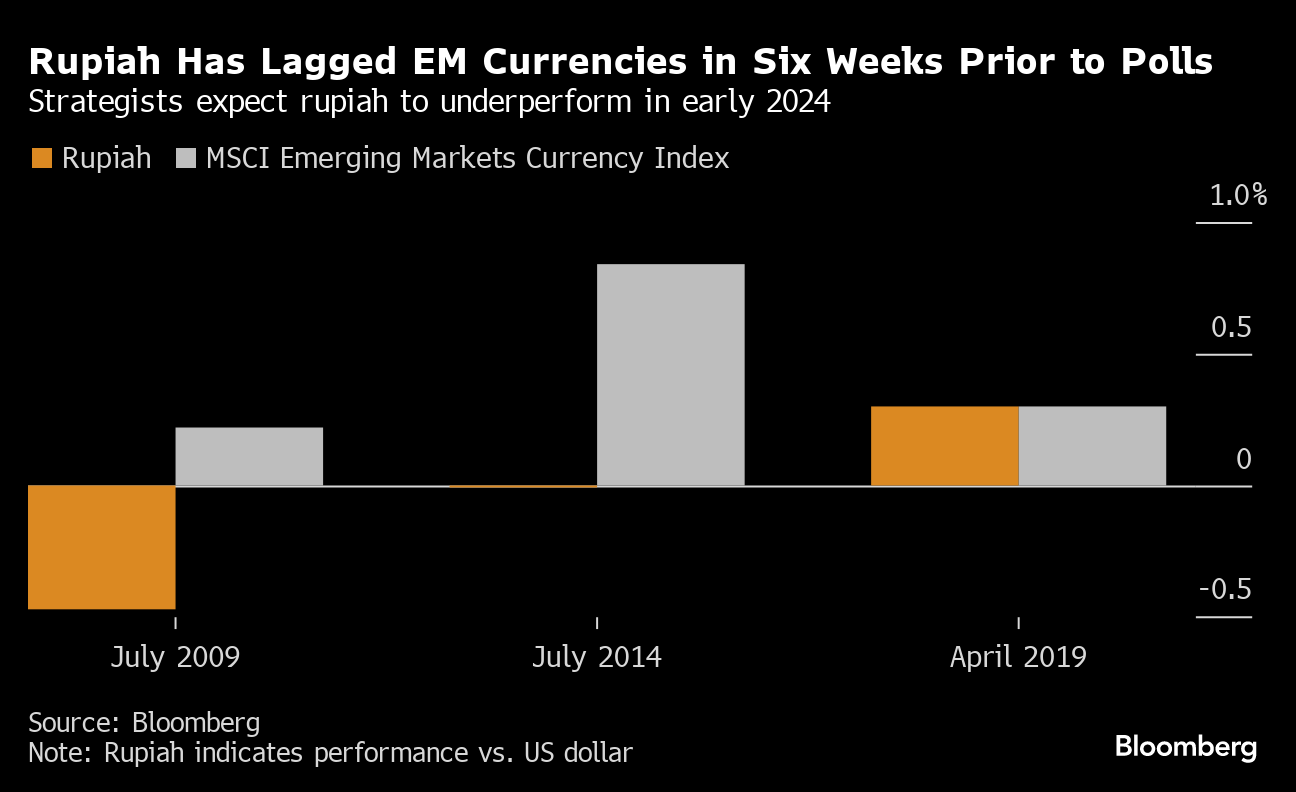

Historically, the rupiah has underperformed peers in the run-up to the elections. The concerns this time are also stemming from a change of guard after a decade. Worries over political stability and policy continuity may weigh on the currency as the nation prepares to choose President Joko Widodo's successor.

Read: A Guide to Indonesia's Elections as Candidates Lay Out Pledges

“During the past three elections, the rupiah consistently underperformed select EM peers in the four to six weeks prior,” said Joey Chew, head of Asian FX research at HSBC. While the currency “catches up” after an election, the rebound may be delayed as opinion polls suggest a second round of voting in late June will be needed to determine a winner, delaying inflows, she said.

The impact is already visible on the rupiah, which has gone from being Asia's best performer earlier in the year to weaken the most against the dollar this quarter. The rupiah has fallen nearly 0.3% during the period despite a weaker greenback. In contrast, the MSCI Emerging Market Currency Index saw a gain of about 3.5%.

While foreign investors have pulled out nearly $600 million from Indonesian equities since October, inflows of about $900 million in bonds provided a cushion. The outlook, however, doesn't appear bright, with a Bloomberg scorecard showing the nation's sovereign debt ranking near the bottom among emerging economies.

Runoff Poll

The upcoming elections may decide the rupiah's trajectory by indicating if the new government will stick to Widodo's policies, which helped lift the nation's export earnings and trim the current account deficit, supporting the currency.

Jokowi, as the president is widely known, will complete 10 years in office next year. During his term, Indonesia's fiscal deficit narrowed sharply from a record high in the pandemic, and the economy grew faster than many regional peers.

Leading candidates, Prabowo Subianto and Ganjar Pranowo, have so far pledged to continue Widodo's economic policies. Rival contestant Anies Baswedan has vowed to walk back some of those, including a plan to establish a new capital.

The official declaration of the winner will be made in March. But if no candidate gets more than 50% of the votes, a runoff poll will be held in June.

“The main risks are from an extended lag between elections and new government formation which could still expose the rupiah to policy uncertainty,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon. The central bank will stay on hold through the elections “and that should provide a buffer against any political uncertainty in the months ahead,” he said.

Here are the key Asian economic events this week:

- Monday, Dec. 18: Singapore non-oil exports

- Tuesday, Dec. 19: Bank of Japan rate decision, RBA December policy meeting minutes, Philippines balance of payments

- Wednesday, Dec. 20: China 1- and 5-year loan prime rate, Taiwan export orders

- Thursday, Dec. 21: Bank Indonesia rate decision, South Korea producer prices and trade data

- Friday, Dec. 22: Malaysia inflation, Japan inflation, Taiwan unemployment, Thailand foreign reserves

--With assistance from Claire Jiao.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.