(Bloomberg) -- An Israeli software startup and one of the world's biggest shipping lines are among companies that for the first time are opening up commercial trade routes running through the heart of the Middle East to bypass the Houthi-menaced Red Sea.

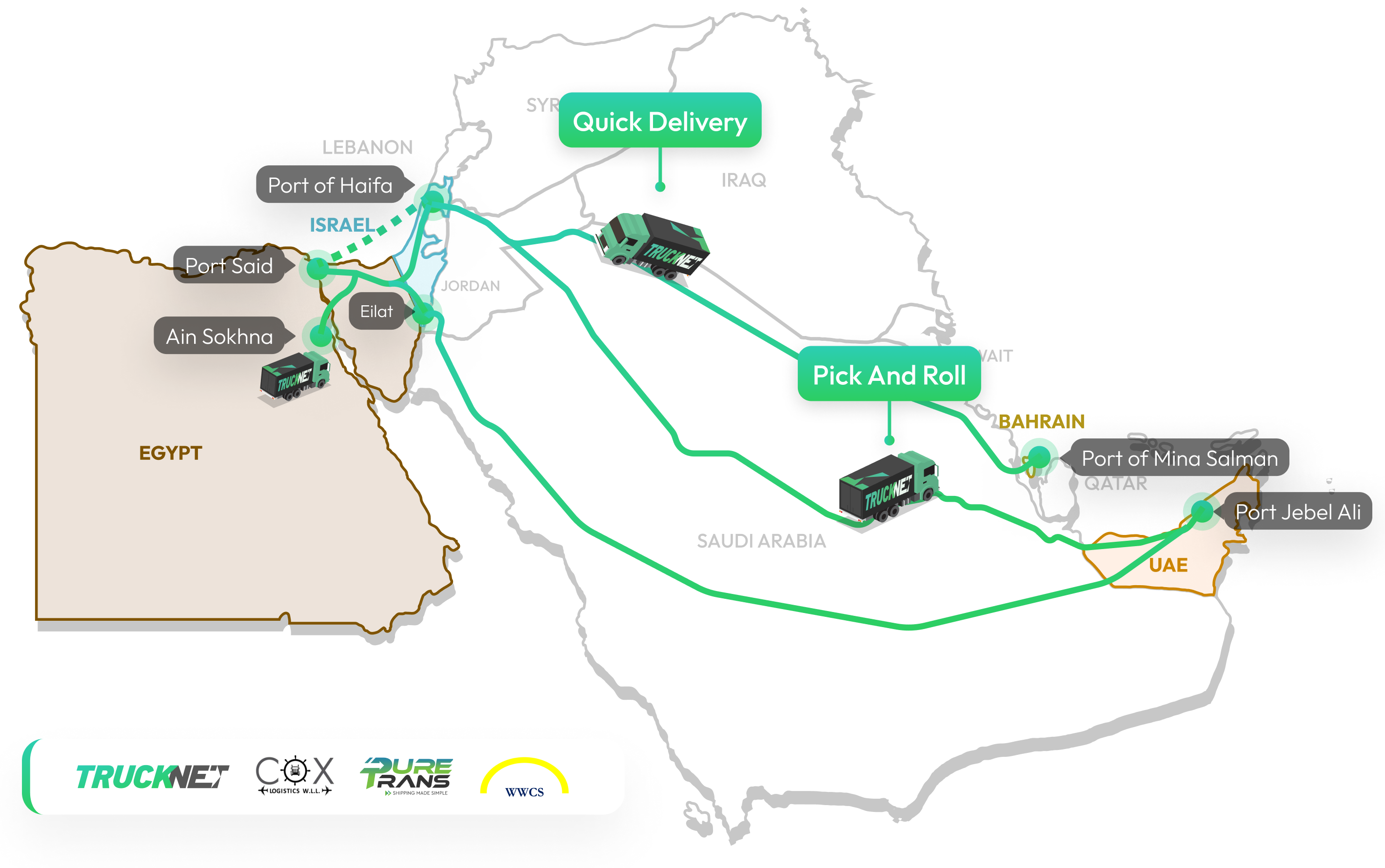

Trucknet Enterprise Ltd. is sending goods including food, plastics, chemicals and electricals from ports in the United Arab Emirates and Bahrain, through Saudi Arabia and Jordan, on to Israel and further to Europe, Chief Executive Officer Hanan Fridman said. Hapag-Lloyd AG, the world's No. 5 container carrier, is looking to link Dubai's Jebel Ali and two eastern Saudi ports with Jeddah on the west coast. Another of its options connects Jebel Ali with Jordan.

The routes offer an immediate solution to shipments trying to avoid the Houthi hot zone around the Bab el-Mandeb strait in the southern Red Sea, where months of missile and drone attacks have forced many commercial vessels to divert to a longer route around Africa. It's disrupted crucial trade flows, raised freight costs and the impact is starting to filter through the global economy.

Companies have been forced to look for ambitious alternatives. Trucknet's route has not previously been attempted on a commercial scale due to strained relations between Israel and Arab nations. While the UAE-Bahrain-Israel Abraham Accords three years ago eased their ties, attempts to normalize relations between Saudi Arabia and Tel Aviv stalled with the war in Gaza.

Cargo from India, Thailand, South Korea and China has been sent by trucks in recent weeks, Fridman said. Goods destined for Asia are also moving in the opposite direction, helping lower overall costs.

The route's long-term viability, however, will depend on stability in the region. The volumes trucks can carry are also significantly smaller than those transported by ships. Still, the land route offers an alternative for some goods, Fridman said.

Hapag-Lloyd spokesman Nils Haupt acknowledged that its planned links are a short-term solution for shippers moving a limited amount of cargo – “not thousands of containers.” The land bridge is neither fast nor easy, he said, but it might help boost the flow of trade through ports in the region like Jeddah that are effectively cut off from their usual links to the global economy.

The drive from Jebel Ali port to Israel's trade gateway in Haifa takes about three to four days compared with a voyage of 10 days or more around Africa's Cape of Good Hope, which will increase the appeal, according to research this week from S&P Global Market Intelligence.

“The land bridge, while carrying a not-insignificant quantity of traffic, will remain a niche solution for shipments specifically to Israel,” said Chris Rogers, head of the supply-chain research group at S&P Global.

Ready to Move

Trucknet is running its route with companies including Dubai's PureTrans FZCO, Bahrain's Cox Logistics and WWCS in Egypt, according to its website. Test runs from the Gulf region to Israel started earlier this year, and when the Houthis began to threaten ships in the Red Sea following Israel's war with Hamas, Trucknet was ready to push ahead with its plan.

“We did some pilot runs in November. The first cargoes went through in December,” Fridman said, declining to say how many trucks have traveled the route or how much cargo has been transported. The company provides a digital platform to match freight with empty space on trucks, with real-time visibility for the entire route.

“We just have to match the cargoes that are bound for Europe and the cargoes that are bound for Asia,” Fridman said.

Trial Run

The new routes may also serve as a trial run for the much bigger India-Middle East-Europe Economic Corridor. Progress on that US-backed project, announced at a Group of 20 summit in India last year, has stalled since the Israel-Hamas war.

But there are many hurdles. The US government and others have long tried to promote trade and economic linkages across the Middle East as a way to sooth rivalries. The current war and it's fallout have made the diplomatic hurdles to such trade cooperation tougher to overcome.

“Gulf Cooperation Council states may be hesitant to promote the route as the Houthis have not yet threatened UAE or Saudi maritime assets,” S&P Global analysts wrote in their research note. “A road route via Saudi Arabia and Jordan also would increase risks of cross-border attacks on cargo by Iran-aligned Iraq-based or Syria-based militants.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.