(Bloomberg) -- European Central Bank President Christine Lagarde said policymakers mustn't get complacent following the recent slump in inflation toward 2% — signaling that investor bets on imminent interest-rate reductions may be premature.

“We should absolutely not lower our guard,” she told reporters Thursday in Frankfurt after the ECB left borrowing costs unchanged for a second meeting. “We did not discuss rate cuts at all.”

Lagarde cited enduring upside risks to consumer prices that include corporate profitability and ongoing negotiations over wages. On the pressure around salaries, she said that “when we look at the data that we have now, it is not declining.”

The ECB's rate announcement mirrored decisions during the past day by the Federal Reserve and the Bank of England. But while Fed Chair Jerome Powell supercharged global wagers on loosening by saying discussions on the topic have begun, Lagarde joined the BOE in offering pushback.

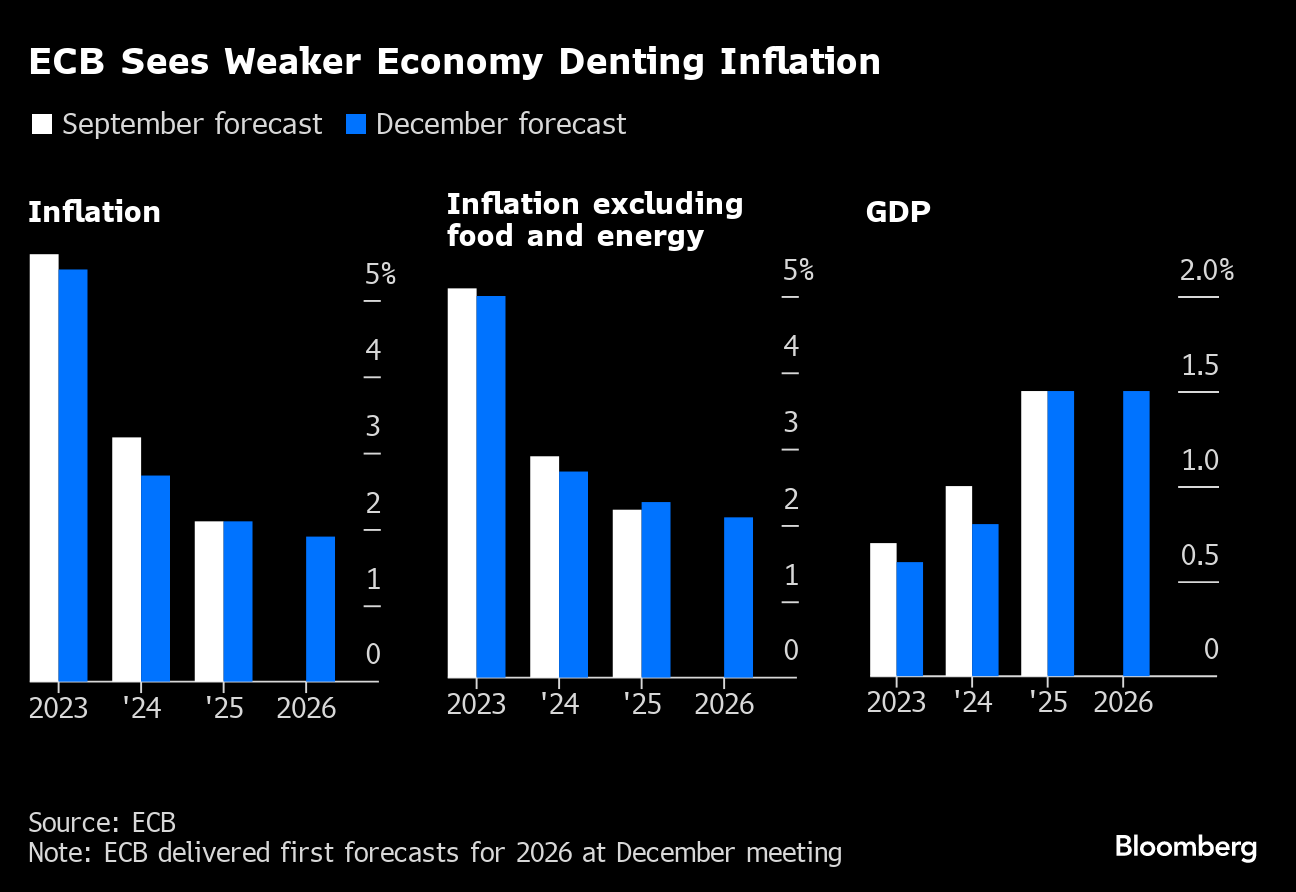

Her comments came despite new quarterly projections showing a weaker economy softening the outlook for consumer prices during next year following a temporary uptick in the months ahead.

The ECB dropped wording that inflation is “expected to remain too high for too long,” saying instead that it will “decline gradually over the course of next year.”

The euro held steady against the US dollar, while traders pulled back bets on ECB rate cuts next year. They now see 150 basis points of easing compared with about 160 basis points earlier in the session.

- Read the ECB TLIV blog here

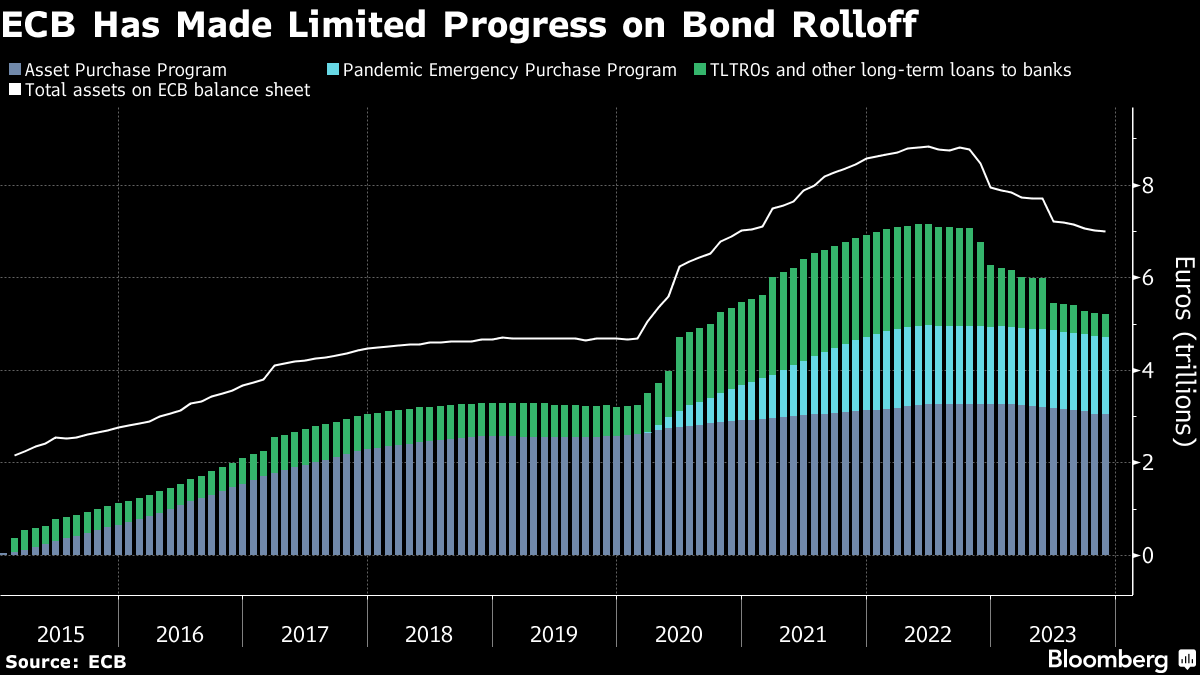

Elsewhere, the spread between Italian and German 10-year yields dropped below 170 basis points after a less-radical-than-anticipated phase out of the ECB's €1.7 trillion ($1.8 trillion) pandemic bond-buying program was unveiled.

The ECB said it intends to reduce PEPP reinvestments by €7.5 billion a month on average over the second half of 2024, before discontinuing them altogether as planned at year-end.

“We believe that it's served its purpose,” Lagarde said. “It was intended for the pandemic. It was an emergency program.”

Behind the enthusiasm for monetary-easing wagers is a steeper-than-expected plunge in inflation, to 2.4% in November. The ECB's latest forecasts offered further grounds for optimism, showing price gains at 2.7% next year and 2.1% in 2025. In 2026, they're seen at 1.9%.

Analysts reckon the economy is suffering its first recession since Covid struck — albeit a far milder downturn. The ECB now sees gross domestic product only advancing by 0.6% this year and 0.8% next.

--With assistance from James Hirai, Naomi Tajitsu, Alessandra Migliaccio, Alexey Anishchuk, Angela Cullen, Ben Sills, Christoph Rauwald, Craig Stirling, Daniel Hornak, James Regan, Kamil Kowalcze, Laura Malsch, Laura Alviž, Sonja Wind, William Horobin and Alice Atkins.

(Updates with more comments from Lagarde in 10th paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.