(Bloomberg) -- Israel will probably kick off the year with its first interest-rate cut since the global pandemic, markets and most economists agree, in what would be a rare case of divergence from the US Federal Reserve.

The decision on Monday is shaping up to be a close call as the Bank of Israel weighs the implications of fiscal plans related to the Hamas war, which could saddle the country with a bigger debt burden. The conflict has been running for almost three months, with no sign as yet that a resolution is imminent.

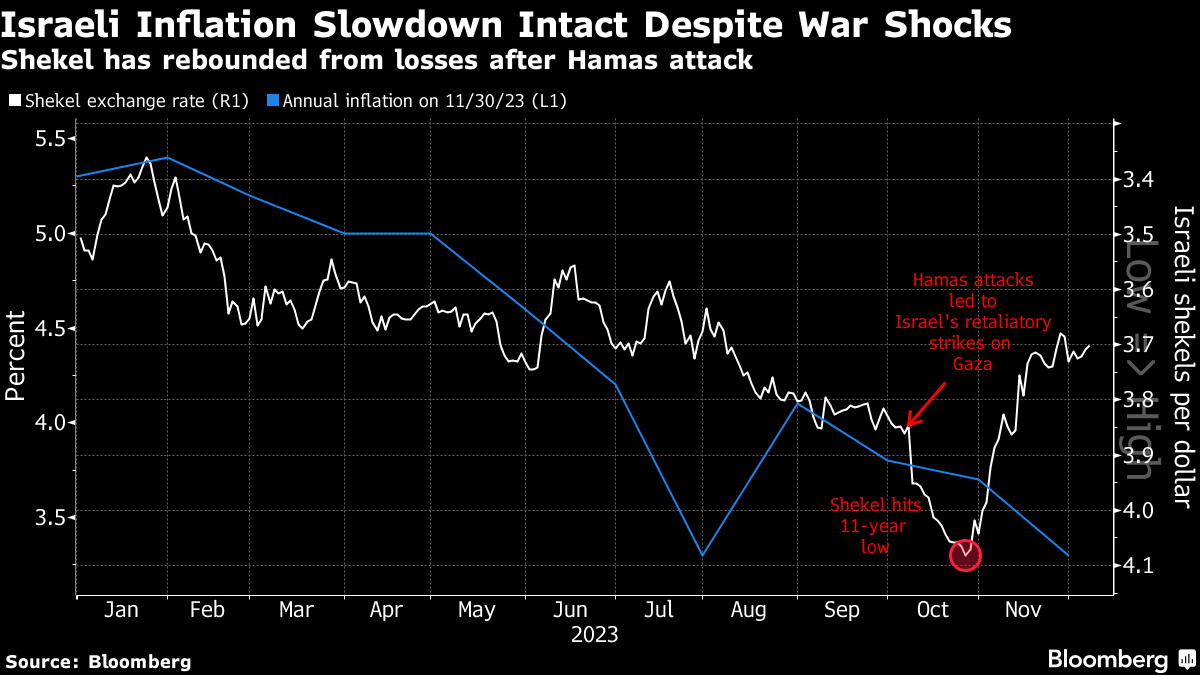

But a rapid recovery in the shekel and three months of slowing inflation have convinced a narrow majority of economists that policymakers will lower the key rate by a quarter-percentage point. In the view of nine of 19 analysts polled by Bloomberg, however, the benchmark will stay at 4.75% for a fifth straight meeting.

Morgan Stanley, which is among global banks predicting the start of monetary easing, put the odds of a 25 basis-point cut at 60%, with smaller probabilities for a hold or a steeper decrease. Markets are betting rates will fall below 3.4% by the end of 2024.

The monetary committee led by Governor Amir Yaron has framed the choice it's facing as a balance between supporting the economy and stabilizing markets following the attack by Hamas on Oct. 7. But priorities might have shifted as local assets recouped their losses and the shekel staged the world's biggest rally versus the dollar in the past two months, gaining over 12%.

“With inflation fairly well-behaved, the shekel strengthening and risk premia gradually normalizing, chances for an earlier start of monetary policy easing have increased,” Anatoliy Shal, an economist at JPMorgan Chase & Co. who predicts a rate cut, said in a note.

The case is building for Israel to deliver some monetary stimulus as inflation converges on the 1%-3% target range for the first time since 2021 and the economy lurches into a contraction.

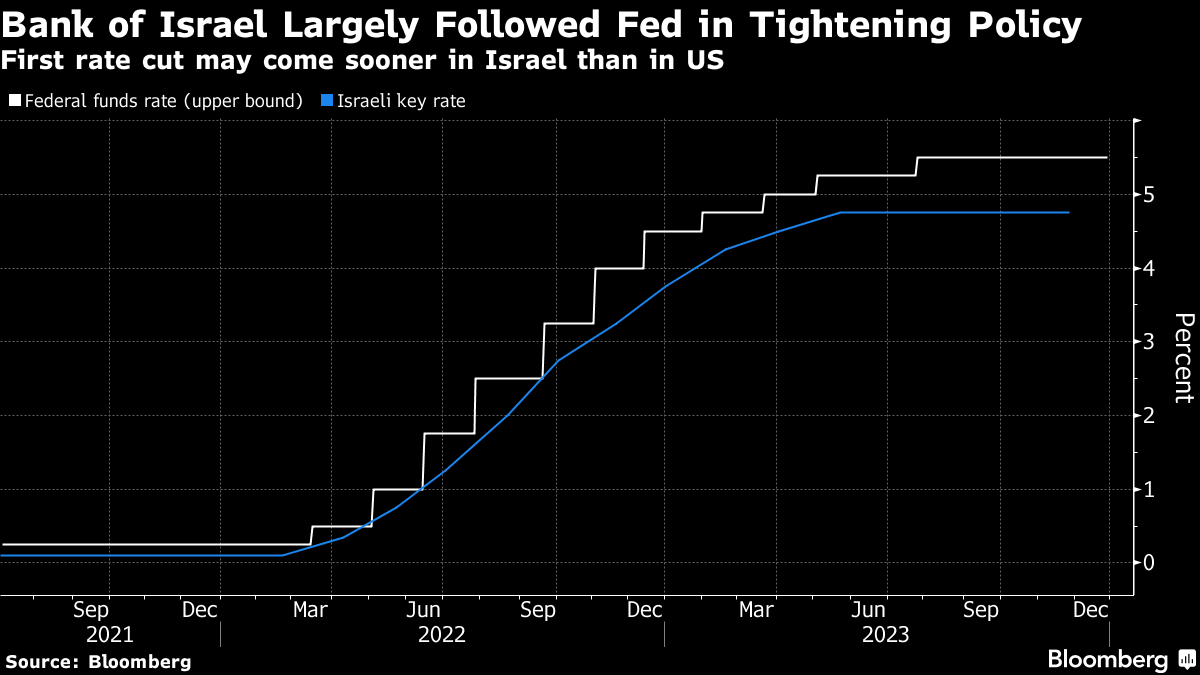

A reduction on the first day of the new year would put the Bank of Israel well ahead of the expected start of monetary easing by the Fed, which it largely followed during a record tightening cycle that's brought local rates to their highest since 2006.

The later timing of the Fed's rate cuts may yet prove an obstacle for Israel, according to Jonathan Katz of Leader Capital Markets, who said Yaron's concern over the government's fiscal discipline could delay easing.

Although the US policy outlook is “not at the forefront of Israel's current rate dilemma, this could be another factor to hold the rate for now,” Katz said. “The possibility of a deterioration in fiscal credibility could weaken the shekel and is viewed by the central bank as inflation inducing.”

Differences with the government may prove critical to what happens next, with Yaron earlier calling for “a responsible fiscal framework” as officials reshape the budget during wartime.

A Finance Ministry report published in December cited a 75 billion-shekel ($21 billion) war bill that will need to be funded with borrowing or budget cuts, combined with higher taxation. The government has so far indicated it's not willing to take steps that the central bank will likely consider sufficient to keep debt in check.

The risk that the war against Hamas could expand into a wider conflict is another reason for caution. Disruption persists across the economy with the deployment of hundreds of thousands of troops, and whole communities evacuated from their homes along Israel's southern and northern borders.

Still, monetary easing for Israel likely remains a question of when, not if, as weak consumer demand holds back inflationary pressure. For now, however, some parts of the market remain on edge, with the cost to insure Israel's sovereign bonds against a default far above its level before the war began.

The Bank of Israel will probably wait to cut rates at the year's second meeting in February “due to its focus on the stability of financial markets, which continue to reflect a relatively high level of risk for Israel,” said Gil Bufman, Bank Leumi's chief economist.

--With assistance from Joel Rinneby.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.