(Bloomberg) -- The UK government publishes data this week that will show whether a stagnating economy tipped into recession last year, capping a pivotal week for markets and politics.

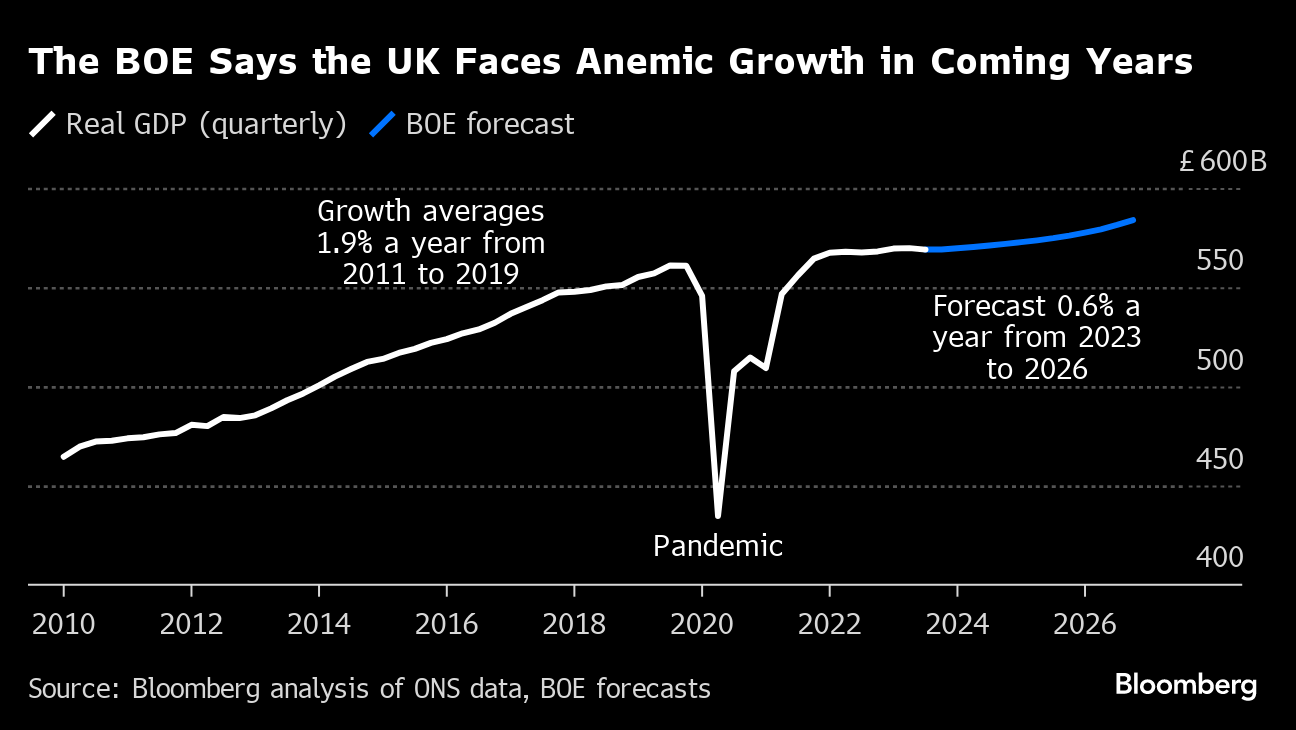

Gross domestic product shrank in the third quarter by 0.1% and flat-lined over October and November. Figures from the Office for National Statistics due on Thursday covering both the month of December and the whole fourth quarter will be decisive, with analysts divided on the outcome.

“The economy has been relatively resilient, but it's lacking in significant momentum,” said Yael Selfin, chief economist at KPMG UK. “This year is likely to be relatively uncertain because we have the elections coming up.”

The BOE is forecasting a flat fourth quarter, which would leave the UK skirting a technical recession — two consecutive periods of contraction — by the narrowest possible margin. The median of economists surveyed by Bloomberg is for GDP to slip 0.1%, with estimates ranging from a drop of 0.2% to a gain of 0.1%.

While the outlook has turned rosier since the start of the year, the economy's performance is a political football. Prime Minister Rishi Sunak will continue to argue the economy has turned a corner, but confirmation of a recession would bring another round of negative headlines that he can ill afford. Labour is likely to point out that at best the UK has seen sputtering growth under the Conservatives.

What's more, the data will be published on the day of two special parliamentary elections that Sunak's governing Conservatives may lose to Labour, an outcome that would cement the narrative that the Tories are likely to lose power at a general election expected in the second half of this year. Labour currently leads by around 20 points in opinion polls.

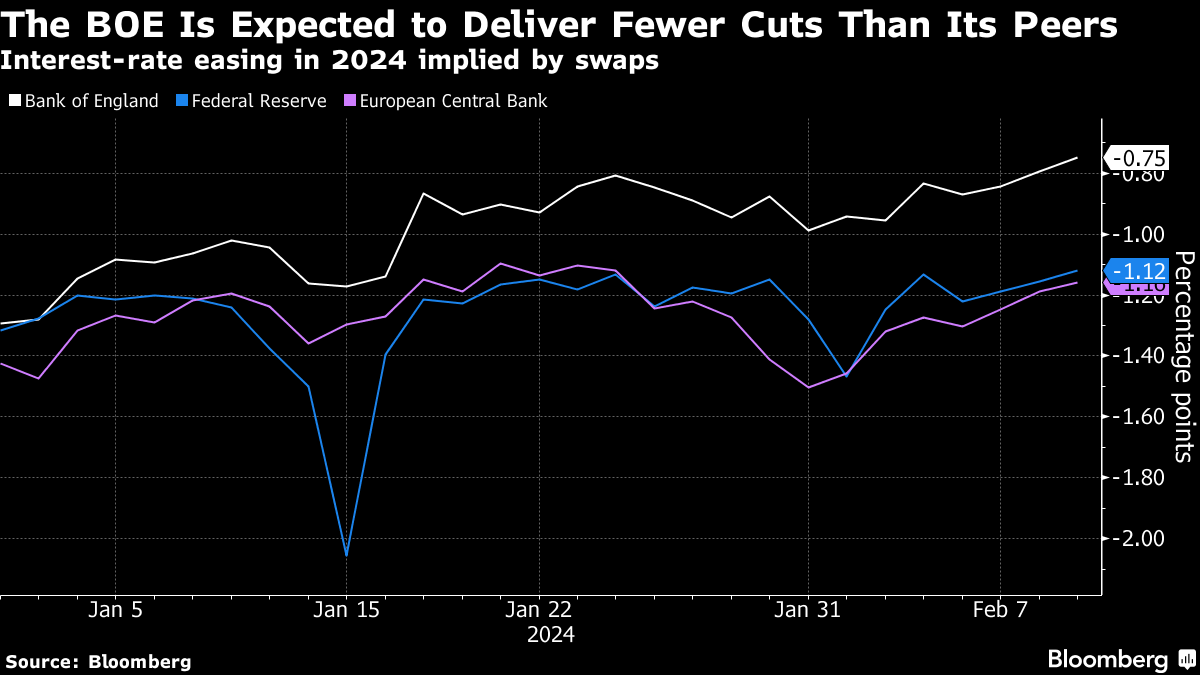

The GDP figures also feed into the Bank of England's decision on how long to keep interest rates at a 16-year high. A recession would complicate the BOE's communication at a moment when Governor Andrew Bailey wants to focus on ensuring inflation falls back to the 2% target.

A recession would “pile the pressure onto them to get to rate cuts sooner,” said Victoria Clarke, chief UK economist at Santander CIB. “The Bank of England will have to work harder to get the message out that its focus is still on getting inflation back sustainably to the 2% target, and not simply to respond to a mild recession.”

Investors are looking more closely at inflation data also due this week. Money markets have trimmed back aggressive bets on interest-rate cuts in recent weeks. They are now pricing in three cuts this year, down from five at the start of January. The timing of the first cut has also been pushed back to June instead of May.

Inflation figures due Wednesday are likely to show a small increase to 4.2% in January from 4% in December, reflecting base effects and higher air fares. But both economists and the BOE expect CPI to drift back to the 2% target in the spring. A strong reading could further rattle markets.

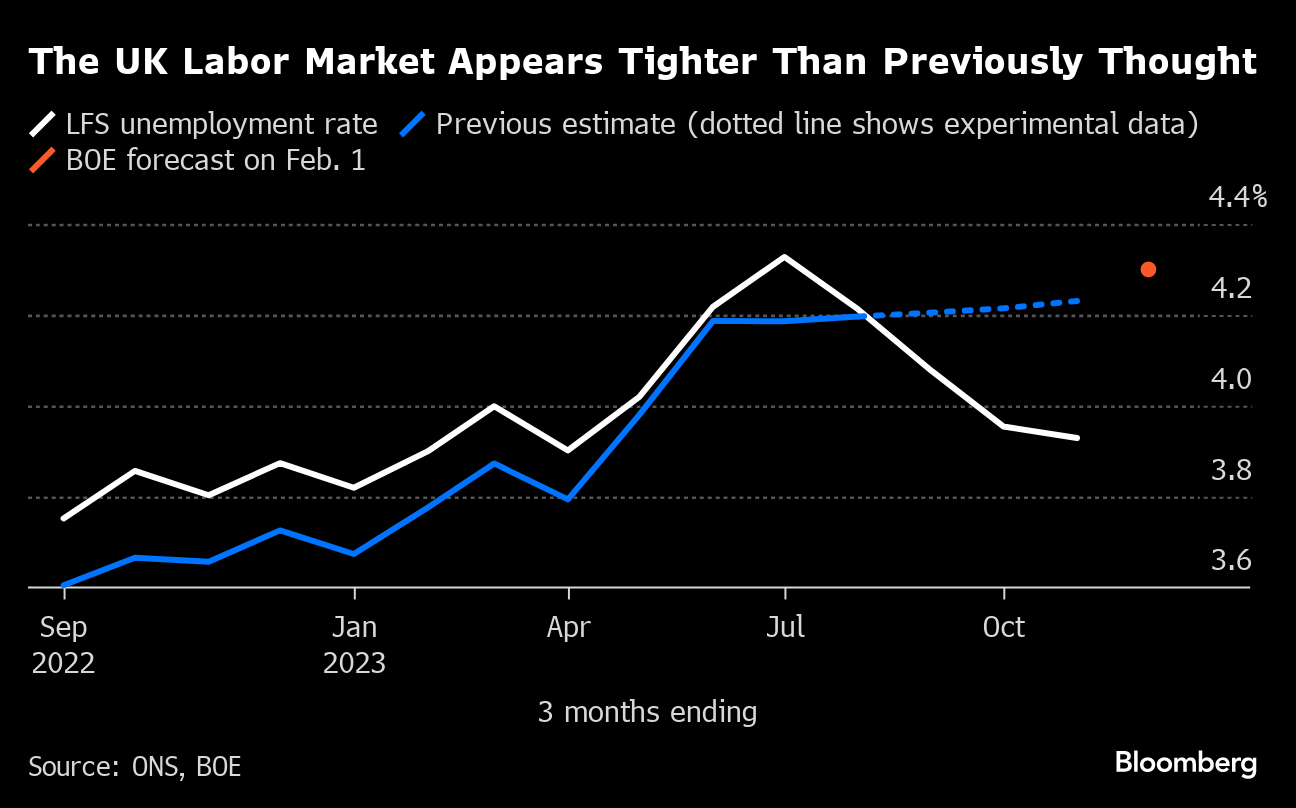

Bailey and the BOE are concerned that the loss of workers since the pandemic is limiting how quickly the economy can grow and fanning upward pressure on inflation as firms ramp up prices in an effort to offset the increased wages they are having to pay for labor.

Last week, new data based on upwardly revised population estimates showed that unemployment was lower than previously thought in the three months through November, at 3.9%, and more people were inactive, neither in work or seeking a job. Labor market figures on Tuesday are expected to show little change in the final three months of the year.

Average earnings excluding bonuses are forecast to have risen 6% from a year earlier. That's down from 6.6% in the quarter through the previous month but still much too strong to be compatible with the 2% inflation target.

“Workers are attempting to bargain back some real earnings power, said Ben Caswell, a senior economist at NIESR. “Firms do not have the bandwidth to absorb larger increases in the real wage going forward.”

The biggest uncertainty is what the ONS will report about GDP for the tail end of 2023. The National Institute of Economic and Social Research, which thinks the UK suffered a recession, expects growth to pick up to 0.9% for 2024 as a whole from 0.3% last year.

Lloyds Bank, Nomura, ING Bank NV, Investec and NatWest all expect a contraction and recession. UBS AG, Oxford Economics Ltd., Merrill Lynch, Credit Agricole and KPMG all see no change or a small gain in the quarter.

What Bloomberg Economics Says ...

“We expect output to post a second consecutive quarterly drop of 0.1%, meeting the definition of a technical recession, which will likely last until early 2024. The BOE is a little more upbeat and forecasts no growth instead. A weak economy will support the central bank's view that the risks from inflation persistence are ebbing, giving it more confidence it can start easing policy in the not-too-distant future.”

—Ana Andrade and Dan Hanson, Bloomberg Economics. Click for the PREVIEW.

So far, the UK has avoided the sharp downturn that many including the BOE had predicted for last year after the quickest series of interest-rate hikes since the 1980s. While the economy didn't sink, it's at the point of stagnation now, and even the most optimistic forecasts are for historically slow growth ahead.

--With assistance from Philip Aldrick, James Hirai, Alex Wickham, Andrew Atkinson and Harumi Ichikura.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.