(Bloomberg) -- Britain's immediate growth prospects lie in the Bank of England's hands, Chancellor of the Exchequer Jeremy Hunt suggested, comments that may add to pressure on the central bank to start cutting interest rates.

Responding to data showing the UK's economy shrank 0.5% across the final two quarters of 2023 — a worse outcome than the central bank estimated just two weeks ago — Hunt said the “turning point” will come when inflation falls to its 2% target and the BOE “feels it can bring down interest rates.”

“That is the way you get real, long-term growth,” Hunt told broadcasters on Thursday. “Whilst interest rates are over 5%, the highest in 15 years, of course growth is going to be weaker.”

The comments “seemed to infer that monetary policy would come to the aid of some of the economy's ills,” said Simon French, chief UK economist at Panmure Gordon.

Hunt's intervention is notable because British finance ministers typically avoid saying anything that could interpreted as seeking to influence monetary policy, to avoid undermining central bank independence. Yet it also underscores the bind facing the chancellor, who is relying on rate cuts and growth to lift the mood of voters and deliver fiscal space for tax cuts ahead of a UK election due within a year.

“With the economy now in recession and 2% inflation in sight, the political pressure to cut rates is undoubtedly going to mount over the next few months,” said Dan Hanson, chief UK economist at Bloomberg Economics, who first forecast a recession in June last year.

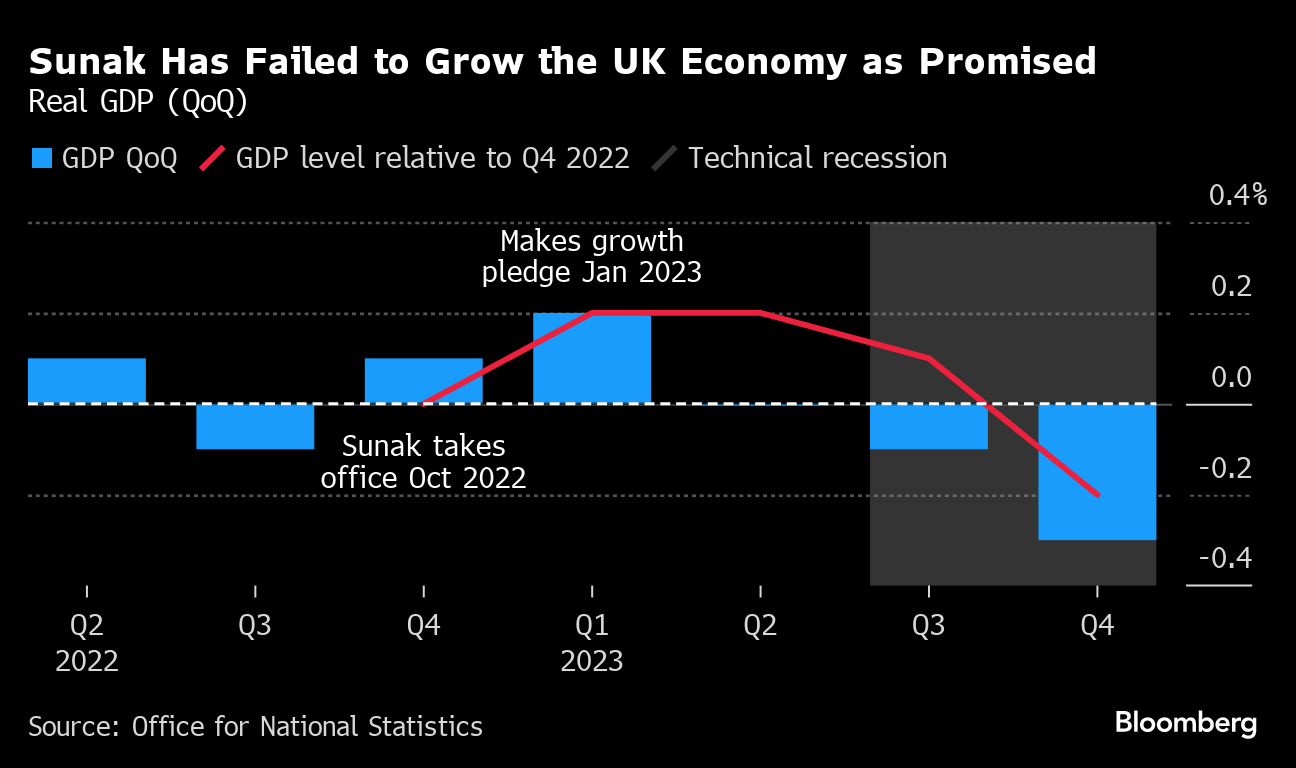

Rishi Sunak's Conservatives, in power for 14 years, are expected to lose a general election later this year to the opposition Labour Party. The prime minister has made growing the economy one of five key promises he wants voters to judge him by. But the data tipping Britain into a technical recession was even weaker when broken down on a per-person basis, and when looking at the private sector alone.

The BOE has raised rates to 5.25% now from 0.1% in December 2021, in the most aggressive rate rising cycle since the late 1980s to tackle an inflation surge that hit double digits. In its forecasts two weeks ago, the bank said two-thirds of the impact had fed through to the economy and pointed to stalling private sector growth as evidence that the medicine is working.

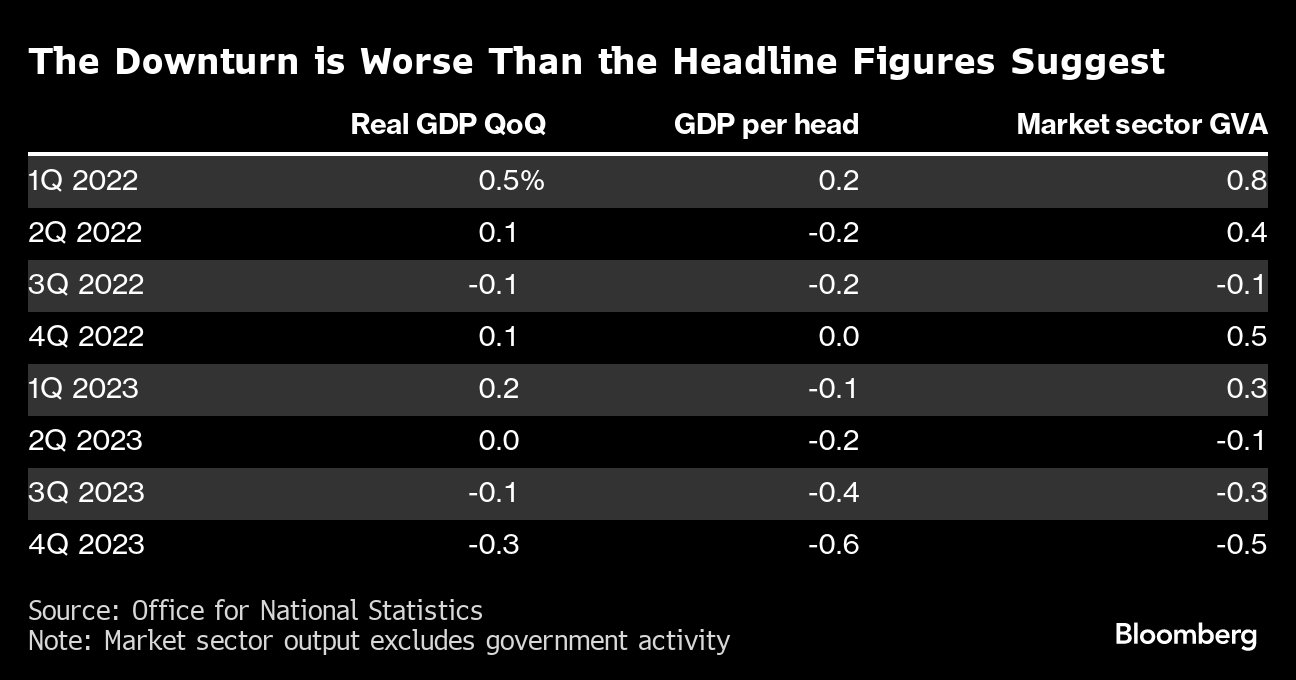

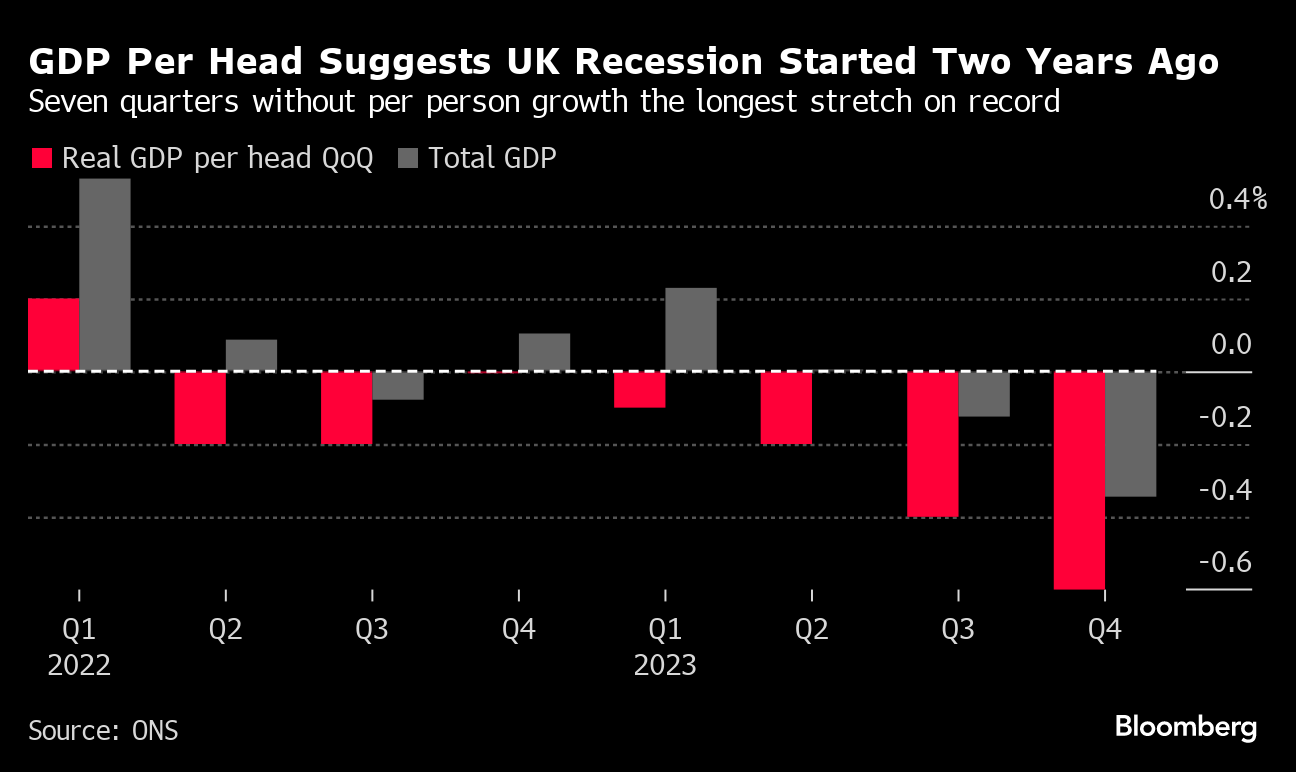

The latest figures showed the trend has continued. The private “market” sector shrank again, and has now contracted 0.9% over the final three quarters of 2023. Based on GDP per capita, a better measure of living standards than aggregate output, the recession has been much deeper. On that metric, the UK downturn began in the second quarter of 2022 — the longest stretch since official records began in 1955 — with a 1.7% drop during the period.

While the BOE has signaled its next move on rates will be downward, it has also said it wants to see more evidence that domestic inflation is receding. It is expected to fall to the 2% target by May, thanks to a 16% drop in the regulated cap on household energy bills, but the central bank is more concerned by sticky inflation in services and wages. Financial markets are pricing in a first cut in August, with a 70% chance of it coming as early as June.

Rates “will need to remain restrictive for some time in order for inflation to sustainably return to target,” Megan Greene, one of the Bank of England's nine rate setters, said Thursday.

Even so, this week's economic data are likely to bring rate cuts into sharper focus, economists said. The BOE had expected the economy to flat-line in the final three months of 2023, but instead it contracted 0.3%. The Office for National Statistics also revised down its estimate of first quarter growth last year by 0.1%.

That means the economy is 0.4% smaller than the bank assumed in its February Monetary Policy Report, said Julian Jessop, economics fellow at the Institute of Economic Affairs. “The monetary policy committee's job is to worry about inflation, not growth, but the case for early rate cuts is now even stronger.”

Sanjay Raja, Deutsche Bank's chief UK economist, said weak growth is likely to ramp up political pressure for early rate cuts. “There's clearly more spare capacity in the economy than assumed in their recent projections,” he said.

“While the Bank of England's focus will likely remain on price data, the bigger drop in output and the politics of being in a technical recession will no doubt become uncomfortable, especially with bank rate at highly restrictive levels.”

The last time Hunt appeared to wade into monetary policy was July last year, when Bloomberg reported his independent economic advisers were concerned the BOE was over-tightening. It raised rates to 5.25% the following month, which was the last increase.

The Bank of England will have one more set of official inflation and wage figures before its next rate decision on March 21.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.