(Bloomberg) -- Gold is facing a major test of investor appetite as the Federal Reserve commences a long-awaited pivot to rate cuts.

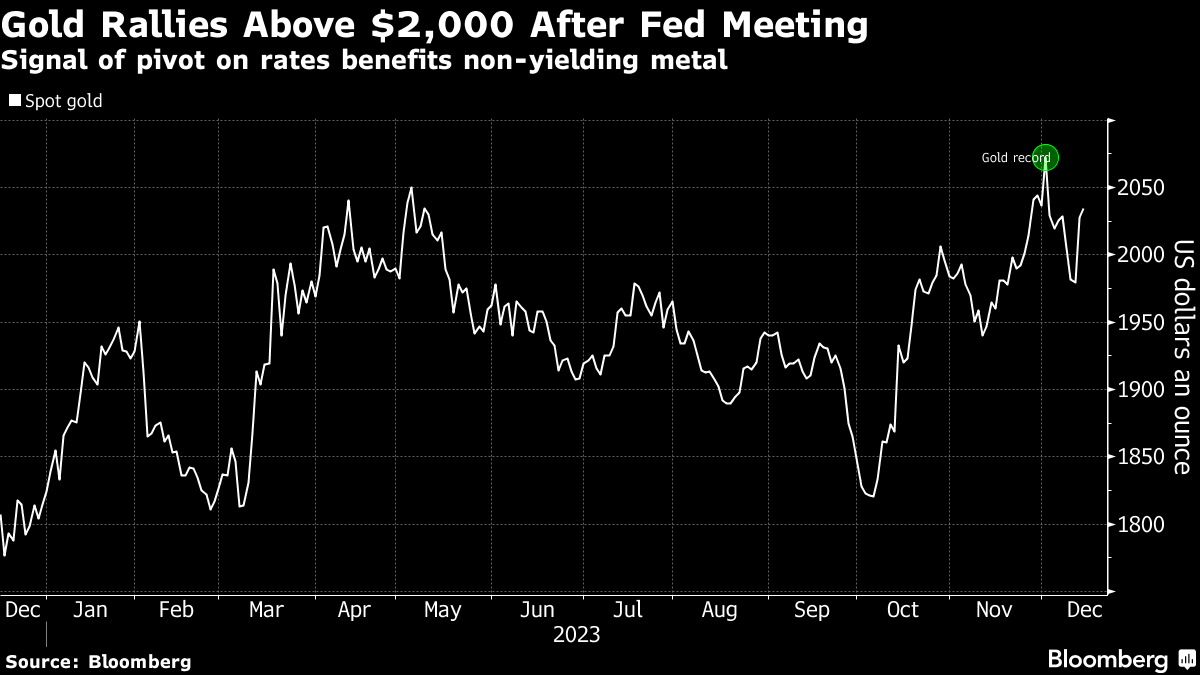

The precious metal surged on Wednesday after Fed policymakers said they expected to lower rates by 75 basis points next year. Cooling inflation had already pushed investors to position for easing, spurring bullion to briefly spike to a record last week.

With monetary loosening now definitively on the agenda, gold traders will be watching for the return of big-money investors who could set the stage for a more sustainable rally after two years on the sidelines. They long shunned non-interest bearing bullion, as inflation-adjusted Treasury yields surged to the highest since the financial crisis.

That caused persistent outflows from gold-backed exchange-traded funds that's been a major headwind to the precious metal. But with bond yields dropping as the Fed signals easing in 2024, that could be about to change.

“The return of an environment that's conducive to financial inflows for gold is clearly happening,” said Marcus Garvey, head of commodities strategy at Macquarie Group Ltd. “Into next year, I'm still very bullish.”

To be sure, with prices just under $100 shy of the record set last week in a chaotic trading session, investors may be wary of getting into the market. Gold is also still trading at a significant premium to real Treasury yields — one of its biggest drivers — on a historical basis.

That premium has persisted for well over a year, thanks to record buying by central banks that helped mop up sales from investors. It appeared to be on the verge of closing in September as gold tumbled, before Hamas's attack on Israel caused prices to spike amid a wave of short covering.

Even as concerns about the conflict spilling over have faded, gold has continued to trade at elevated levels, setting a high base for prices to rally from. Even a small-scale resumption in ETF purchases would have a major impact on sentiment.

“With central banks hoovering more than 1,000 tons out of the market for a second year, the selling from ETF investors has been easily absorbed,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “What happens when they both potentially turn buyers next year?”

The extent of any new buying will likely be dictated by the pace of the Fed's rate cuts in the new year. Currently swaps traders are pricing in nearly twice as much easing as the central bank signaled on Wednesday, potentially leaving gold vulnerable to pullbacks if it takes a cautious approach.

“There is no need for a rapid reversal in US monetary policy,” said Carsten Menke, an analyst at Julius Baer Group Ltd. “We therefore see gold and silver prices on a soft footing.”

Attention will remain firmly on US economic data next year, with stronger than expected inflation or robust jobs numbers likely to disappoint those betting on multiple rate cuts.

“The market will inevitably face disappointment in terms of the path from here to rate cuts at some point,” said Macquarie's Garvey. “I imagine we keep having two steps forward, one step back.”

Spot gold climbed 0.4% to $2,035.47 an ounce at 2:23 p.m. in London.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.