(Bloomberg) -- German industrial output extended its slump to a seventh month in December, underlining the struggles gripping Europe's largest economy.

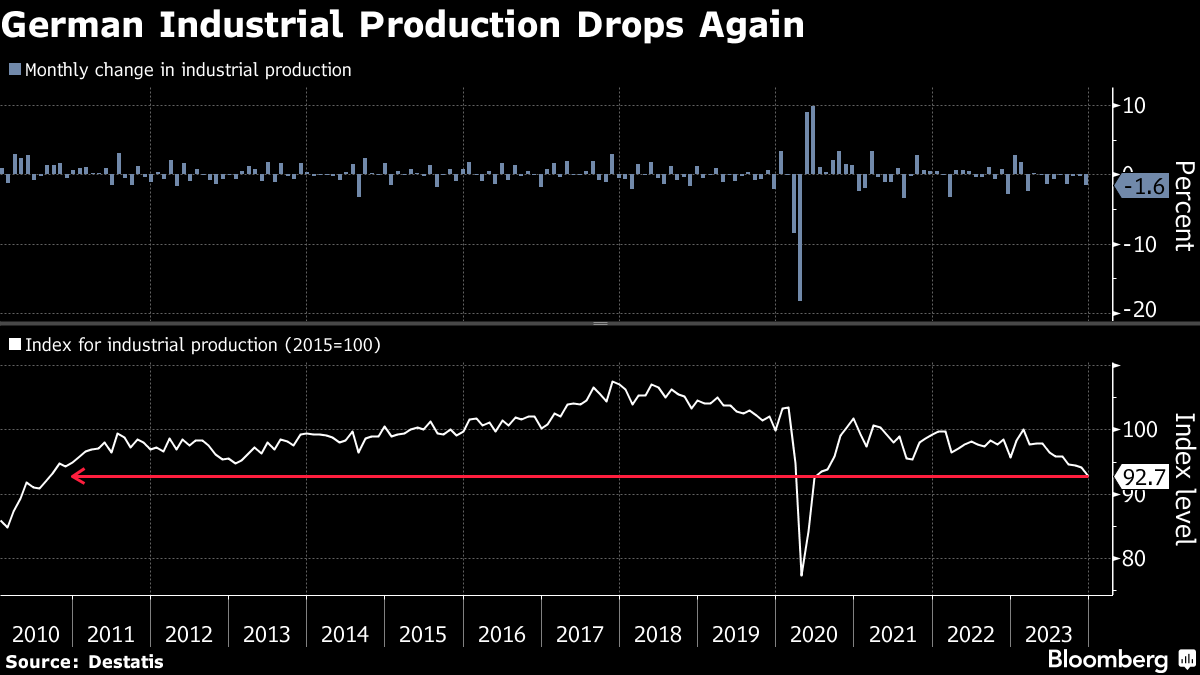

Production fell 1.6% from November, led by chemicals and construction, the statistics office said Wednesday. The drop was far worse than the 0.5% decline predicted by analysts in a Bloomberg survey.

The overall level of production is now at its lowest since June 2020, and stripping out the shock of the pandemic, the last time it was so weak was in 2010.

Germany is facing a potential recession after output shrank 0.3% in the fourth quarter of 2023 and this year began on a shaky footing. The data underscore the difficulty in reviving the economy amid weak global demand, high interest rates and the enduring consequences of the energy crisis.

There was mixed news earlier this week when figures showed an unexpected jump in December factory orders — albeit only thanks to major orders — alongside a continued slide in exports.

The inflation and employment backdrop remains more positive. Consumer-price growth slowed more than expected in January to 3.1% and a drop in joblessness underscored the labor market's surprising resilience.

But Finance Minister Christian Lindner warned that Germany is suffering because of its failure to boost output.

“We are no longer competitive,” he told a Bloomberg event Monday in Frankfurt. “We are getting poorer because we have no growth. We are falling behind.”

--With assistance from Joel Rinneby and Kristian Siedenburg.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.