(Bloomberg) -- German industrial output unexpectedly declined in November, underscoring the persisting manufacturing woes in Europe's largest economy.

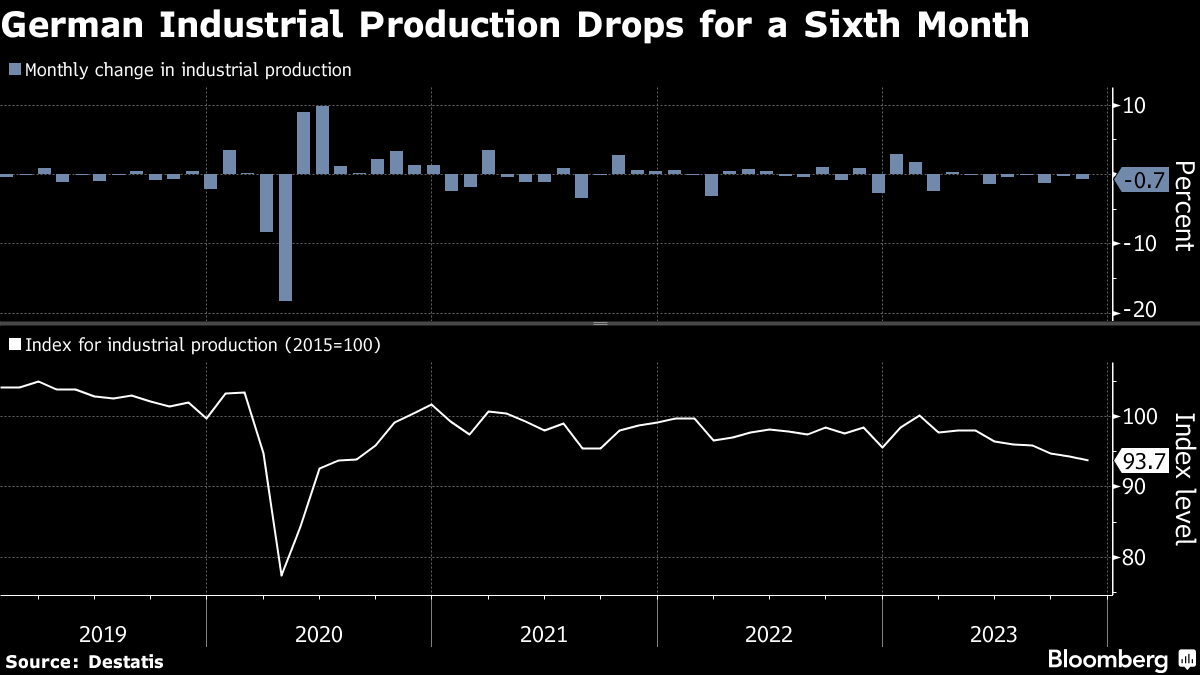

Production declined 0.7% from October, led by capital goods, and intermediate goods, the statistics office said Tuesday. That's the sixth consecutive drop and defies economists in a Bloomberg survey, who'd predicted a 0.3% increase.

Germany probably ended 2023 with its first recession since the pandemic, as analysts reckon data will reveal a second straight contraction in output in the fourth quarter.

Manufacturers — Germany's economic backbone — are struggling from costly energy, higher global interest rates and a slowdown in China.

What Bloomberg Economics Says...

“Disappointing November production data and the recent business expectations deterioration point to a bumpy start to the year for industry. We maintain our baseline view for a slight GDP increase in the first quarter of 2024, driven by a higher dynamic in the service sectors. There is substantial risk, however, that a more pronounced industry weakness will drag the economy down again in 1Q24.”

—Martin Ademmer, economist. For full React, click here

The figures come a day after a reading for factory orders also fell short of expectations. Additionally, with the government strait-jacketed over ramping up investment and train strikes looming this week, few economists anticipate much of a pickup this year.

German railway operator Deutsche Bahn AG's attempt to halt strikes — due Wednesday-Friday — via a court injunction was rejected by Frankfurt's labor court on Monday.

--With assistance from Joel Rinneby and Kristian Siedenburg.

(Updates with Bloomberg Economics in after fourth, details on train strike in final paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.