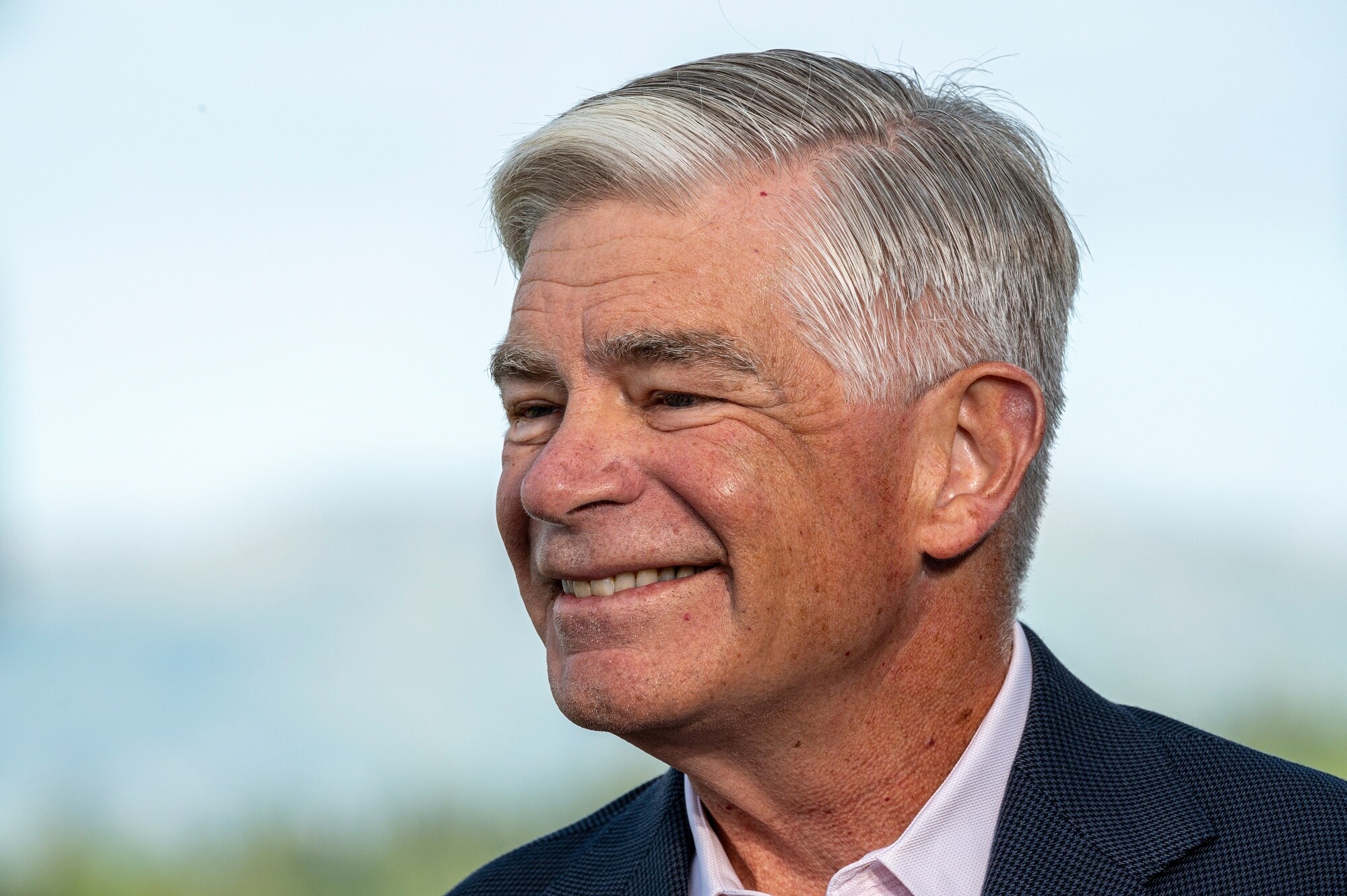

(Bloomberg) -- Federal Reserve Bank of Philadelphia President Patrick Harker said a soft landing for the US economy is in sight, pointing to falling inflation and a still-strong labor market.

“The data point to continued disinflation, to labor markets coming into better balance, and to resilient consumer spending — three elements necessary for us to stick to the soft landing we remain optimistic to achieve,” Harker said Tuesday in a speech at Rowan University in Glassboro, New Jersey.

“Now certainly we haven't touched down, and we're going to have to keep our seatbelts on, but with inflation continuing to fall back to our 2% target, with employment remaining strong, and with consumer sentiment looking up, the runway at our destination is in sight,” he said.

Fed officials have left interest rates unchanged since July and have signaled the central bank's next move is likely a cut. Several officials — including Chair Jerome Powell — have indicated they're not in a rush to do so, helping shift market expectations for the timing of the first interest-rate cut toward May or June.

Harker, who doesn't vote on monetary policy this year, didn't give his view on when the Fed should begin to cut rates in his prepared text. Powell has said twice in the past week that he does not believe policymakers will reach the necessary level of confidence regarding inflation's path to lower rates at its March gathering.

Harker did say in December that the Fed's next policy move should be a cut, but that reductions didn't need to start right away or occur with speed.

The Philadelphia Fed chief noted that the inflation figures released late last month “highlight the ongoing progress in bringing inflation back to target.” The Fed's preferred gauge of underlying inflation cooled to 2.9% in December, the slowest pace in almost three years.

He said he favored “a balanced and dynamic approach” to the economy to achieve a soft landing.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.