(Bloomberg) -- Federal Reserve officials maintained their outlook for three interest-rate cuts this year and moved toward slowing the pace of reducing their bond holdings, suggesting they aren't alarmed by a recent uptick in inflation.

Officials decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5%, the highest since 2001, for a fifth straight meeting. Policymakers signaled they remain on track to cut rates this year for the first time since March 2020, but they now see just three reductions in 2025, down from four forecast in December, based on the median projection.

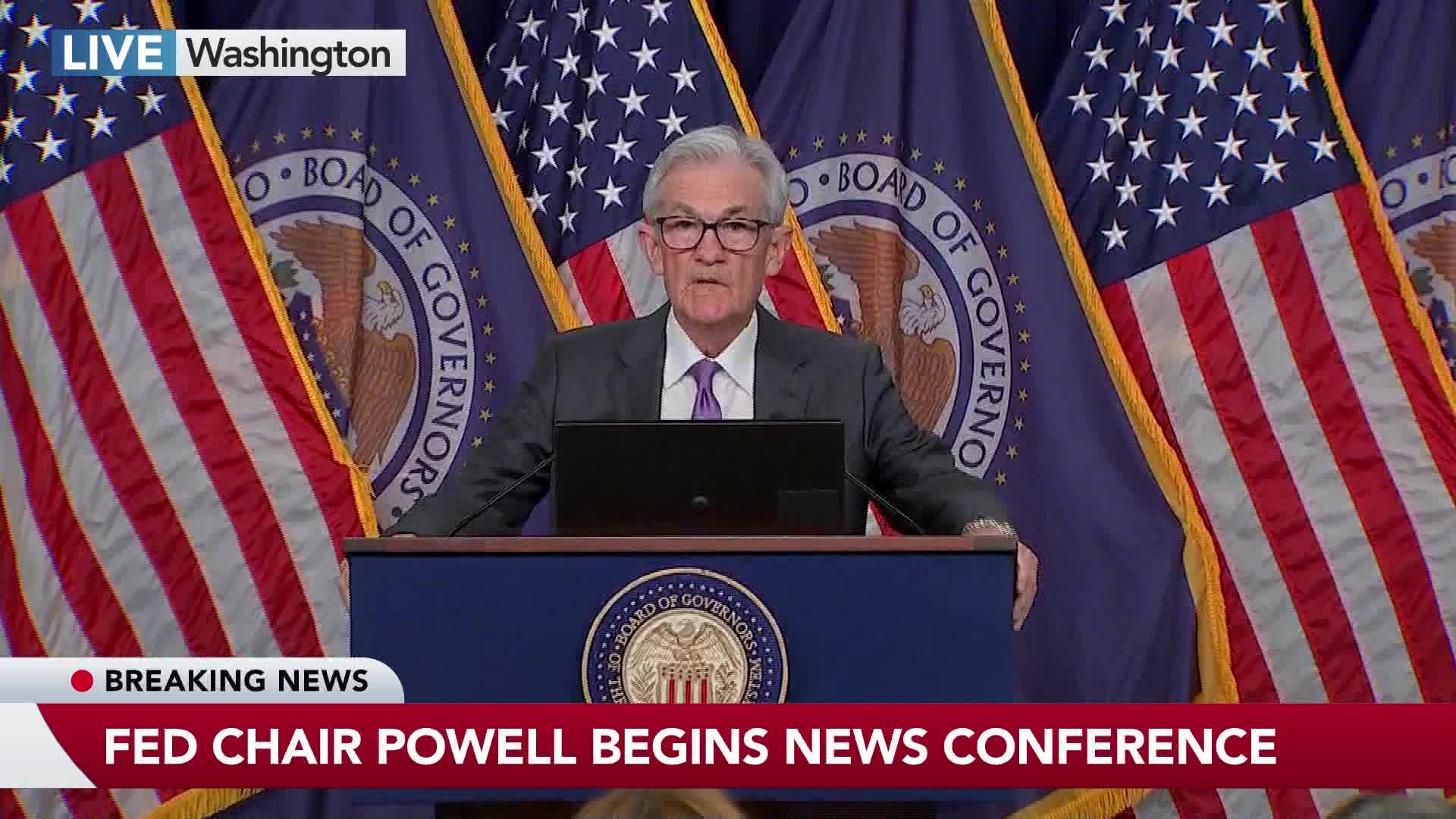

Chair Jerome Powell, speaking to reporters after the Fed's decision Wednesday, demurred when asked whether officials would lower rates at their coming meetings in May or June, repeating that the first reduction would likely be “at some point this year.”

He largely shrugged off recent data showing an uptick in inflation in recent months, saying, “It is still likely in most people's view that we will achieve that confidence and there will be rate cuts.”

At the same time, he said the data supported the Fed's cautious approach to the first rate cut, and added that policymakers are still looking for more evidence that inflation is headed toward their 2% goal.

Powell also said it would be appropriate to slow the pace of the Fed's balance-sheet unwind “fairly soon,” after policymakers held a discussion on their asset portfolio this week.

“The decision to slow the pace of runoff does not mean our balance sheet will shrink, but allows us to approach that ultimate level more gradually,” he said. “In particular, slowing the pace of runoff will help ensure a smooth transition, reducing the possibility of money markets experiencing stress.”

The S&P 500 index of US stocks rose, while Treasury yields and the Bloomberg Dollar index fell. Traders boosted the probability that the Fed would begin rate cuts in June.

The Fed's post-meeting statement was nearly identical to January's, maintaining the guidance that rate cuts won't be appropriate until officials have more confidence inflation is moving sustainably toward their 2% target.

The Federal Open Market Committee also reiterated its intention to continue reducing its balance sheet by as much as $95 billion per month. Some officials, including Dallas Fed President Lorie Logan, have called for an eventual slowing of the pace at which the Fed is shrinking its portfolio of assets.

Follow the reaction in real time on Bloomberg's TOPLive blog

After raising the benchmark federal funds rate more than five percentage points starting in March 2022, Fed officials have emphasized they're in no rush to lower borrowing costs until they are certain inflation is contained.

Powell said higher-than-expected inflation figures at the start of the year didn't change the broader story that price gains were slowing on a “sometimes-bumpy road.” At the same time, the data didn't add confidence and policymakers are still seeking greater assurance that inflation is moving closer to the Fed's 2% goal.

“It's going to be a bumpy ride,” Powell said. “We've consistently said that. Now we have bumps.”

“That is why we are approaching this question carefully,” he added.

Market Expectations

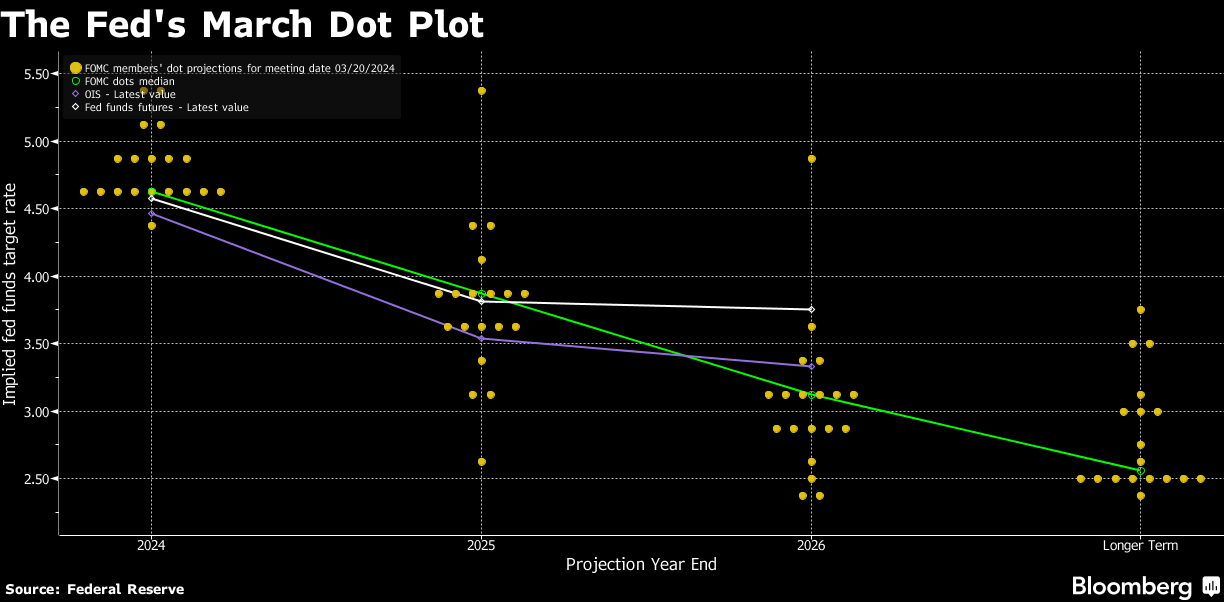

While policymakers see the federal funds rate reaching 4.6% by the end of 2024, according to their median rate projection, individuals' expectations were split. The Fed's “dot plot” showed 10 officials saw three or more quarter-point cuts this year, while nine anticipated two or fewer.

Fed officials have emphasized the projections are not a predetermined plan, and that the individual forecasts are subject to change based on incoming data for inflation and the labor market. A key measure of consumer prices has risen more than economists expected the past two months, while the US unemployment rate has edged up to a two-year high that officials still regard as low.

Policymakers also lifted slightly their forecasts for where they see rates settling over the long term, boosting their median estimate to 2.6% from 2.5%, following speculation from economists that higher rates may persist in the post-pandemic environment. The change implies rates will need to stay higher for longer in the future.

Policymakers updated their projections for inflation and economic growth for 2024, raising their forecast for underlying inflation to 2.6% from 2.4%, and boosting the growth forecast to 2.1% from 1.4%. They also lowered their unemployment rate projection slightly, to 4% from 4.1%, for 2024.

Click here for an interactive version of Bloomberg Economics' NLP Fedspeak Index

--With assistance from Chris Middleton, Alex Harris, Vince Golle, Matthew Boesler and Liz Capo McCormick.

(Updates with additional Powell comments starting in third paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.