(Bloomberg) -- Emerging-market assets fell on Monday as investors fled risk after mixed US economic data on Friday raised doubts over whether the Federal Reserve was on track to lower interest rates soon.

The gauge for emerging-market equities retreated below 1,000 index points to the lowest since Dec. 25, mostly weighed down by Asian stocks with sentiment remaining negative in China. Still, HSBC Holdings economists led by Jing Liu wrote that “2024 will be better” for the world's second-largest economy, with a soft landing in the property sector, enhanced fiscal policy coordination and easing inflationary pressures among macro themes to support growth.

The index for emerging-market currencies also declined, dropping 0.1% as of 11:50 a.m. in London, led by losses in Thailand, Chile and Turkey.

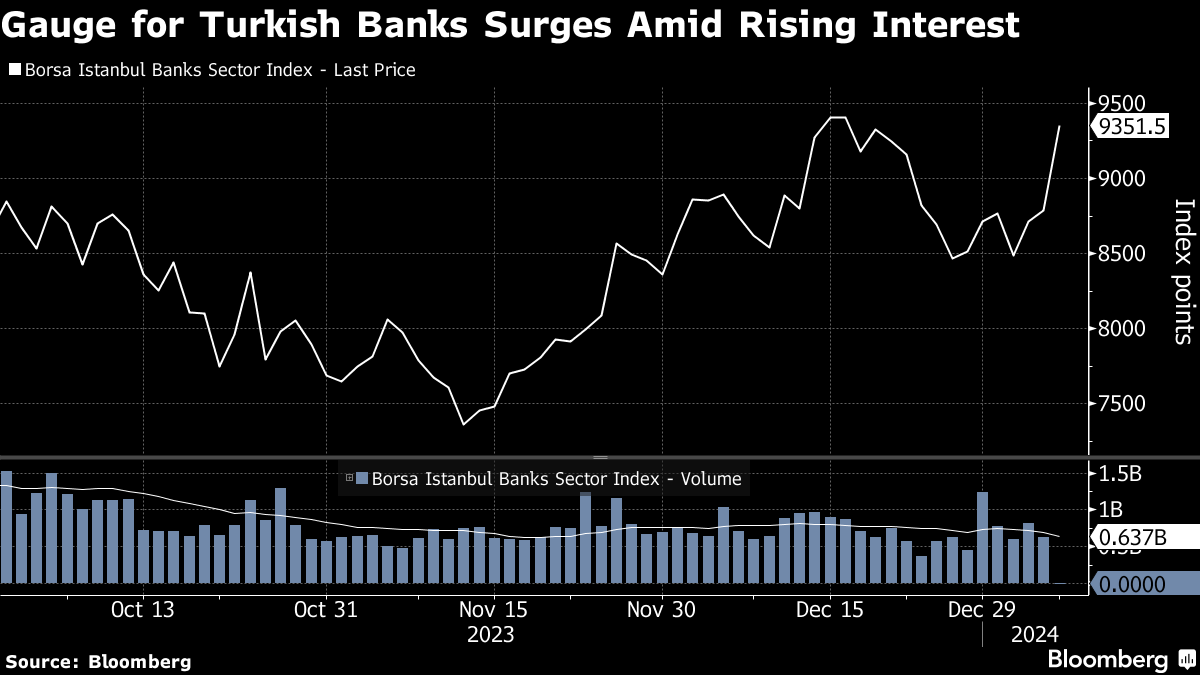

Turkish bank stocks surged after Bank of America Securities noted an increase in investor interest. The MSCI Inc. gauge for Turkish financial services providers advanced as much as 6.2% on Monday, while the Borsa Istanbul alternative that tracks Turkish-listed banks rose as much as 6.5%, its biggest gain since October.

The Thai baht led emerging-market currency declines, dropping more than 1% to a near three-week low after Prime Minister Srettha Thavisin urged the central bank to consider lowering borrowing costs to support the economy. Thailand's pace of recovery from the pandemic has been among Southeast Asia's slowest.

Saudi Arabia emerged as a new entrant to the list of developing-nation borrowers tapping bond investors at a record pace for the beginning of a year. The kingdom is set to issue a three-part dollar bond, joining the likes of Mexico, Indonesia and Poland, which have issued almost $25 billion of bonds between them so far in 2024.

Read more: Saudi Arabia Is Set to Add to Rush of Emerging-Market Bond Deals

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.