(Bloomberg) -- Recent economic figures and aggressive market bets on rapid interest-rate cuts mean the European Central Bank should be patient before loosening borrowing costs, according to Executive Board member Isabel Schnabel.

Citing sticky services inflation, a resilient labor market, a notable loosening of financial conditions and tensions in the Red Sea, “this cautions against adjusting the policy stance soon,” she said in a Financial Times interview.

“It means we must be patient and cautious because we know also from historical experience that inflation can flare up again,” Schnabel said.

ECB policymakers are in a holding pattern while they wait for additional data to see if inflation and wage developments will allow them to start cutting rates. Markets are betting such a move will happen as early as April, though officials appear to be leaning more toward June.

“Recent incoming data do not allay my concerns that the last mile may be the most difficult one. We see sticky services inflation. We see a resilient labor market. At the same time we see a notable loosening of financial conditions because markets are aggressively pricing the central banks' pivot. On top of that, recent events in the Red Sea have sparked fears of renewed supply chain disruptions.”

— Schnabel in the Financial Times

“I would argue that we are now entering a critical phase where the calibration and transmission of monetary policy become especially important because it is all about containing the second-round effects,” Schnabel said.

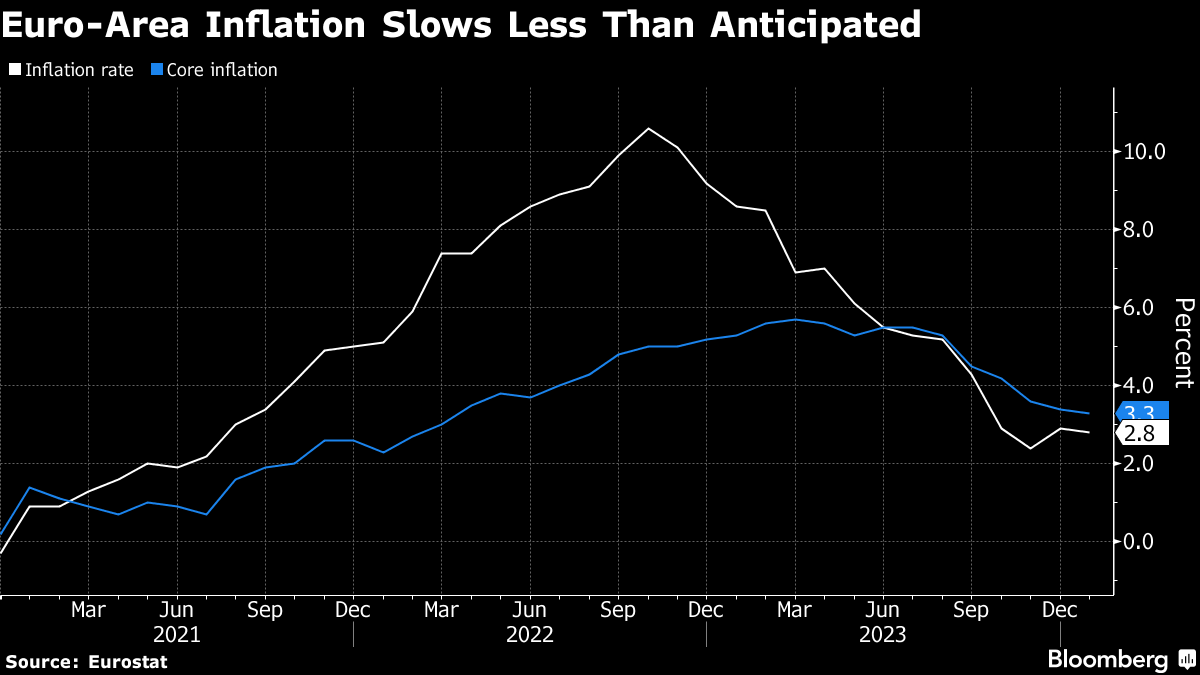

Arguing that the “peak of transmission” has probably passed, she highlighted that since hitting 2.9%, euro-area inflation “has remained broadly stable.”

“We are observing a slowdown in the disinflationary process that is typical for the last mile,” she said. “This is very closely connected to the dynamics of wages, productivity and profits.”

Some policymakers have started thinking about how to pace easing once it starts. Schnabel, questioned on where the neutral rate of the economy might be, said that the difficulty in determining that suggested the need to be careful.

“The problem is we don't know where it is precisely,” she said. “This implies that, once we start to cut rates – and as I said, we're not there yet – we must proceed cautiously in small steps. We may even need to pause on the way down if inflation proves sticky.”

(Updates with comments on neutral rate starting in penultimate paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.