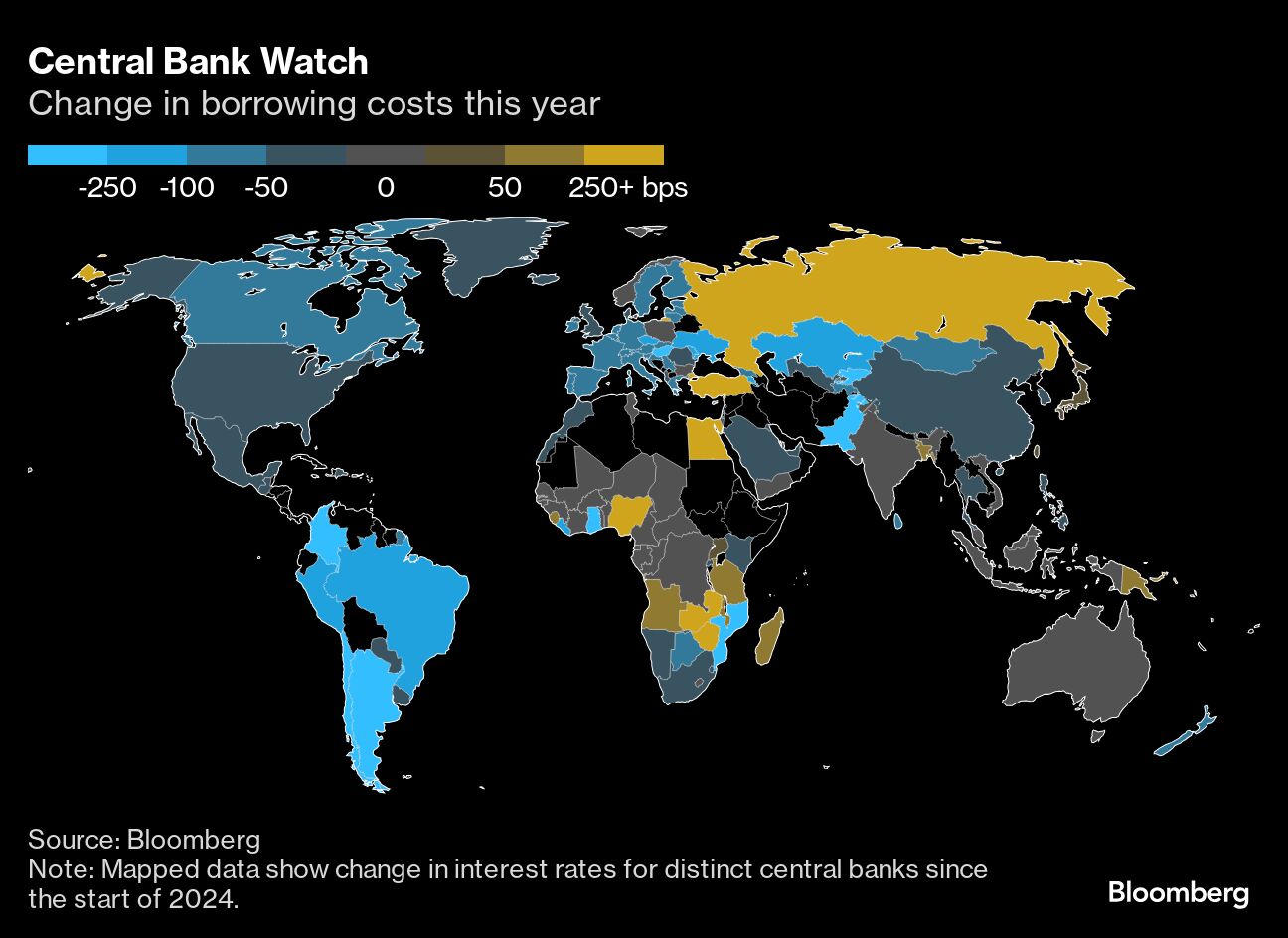

(Bloomberg) -- The European Central Bank lowered interest rates for the third time this year as a hastier retreat in inflation allows it to offer support to the region's stuttering economy.

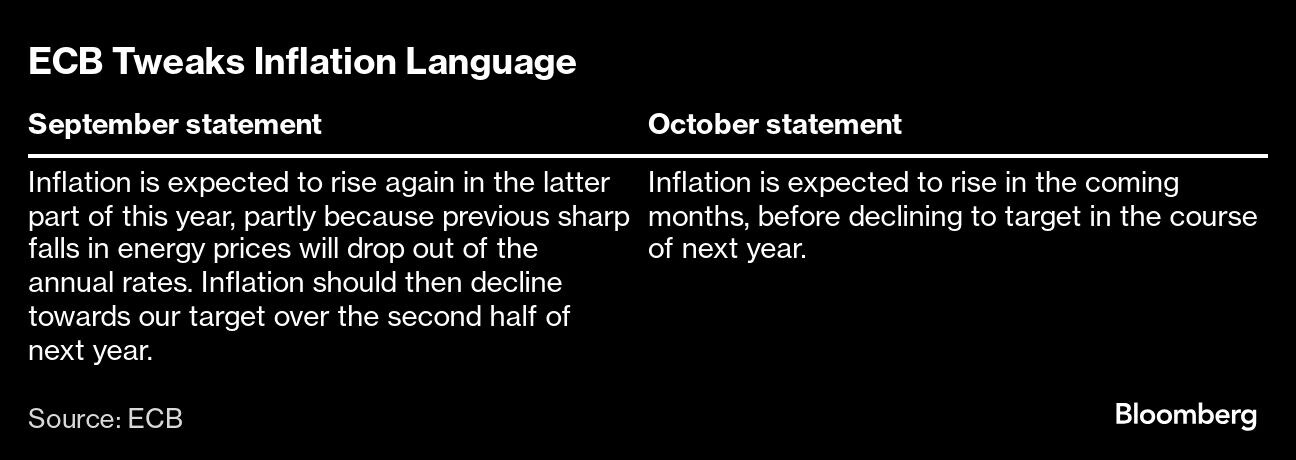

The key deposit rate was cut by a quarter-point to 3.25% — as predicted by all analysts in a Bloomberg survey. The ECB said the process of taming prices should be complete “in the course of next year” — tweaking its previous language for that landmark to only be reached in the second half of 2025.

Officials, however, didn't specify when or how quickly borrowing costs will be reduced from here.

“The incoming information on inflation shows that the disinflationary process is well on track,” the ECB said in its statement. The Governing Council “will keep policy rates sufficiently restrictive for as long as necessary.”

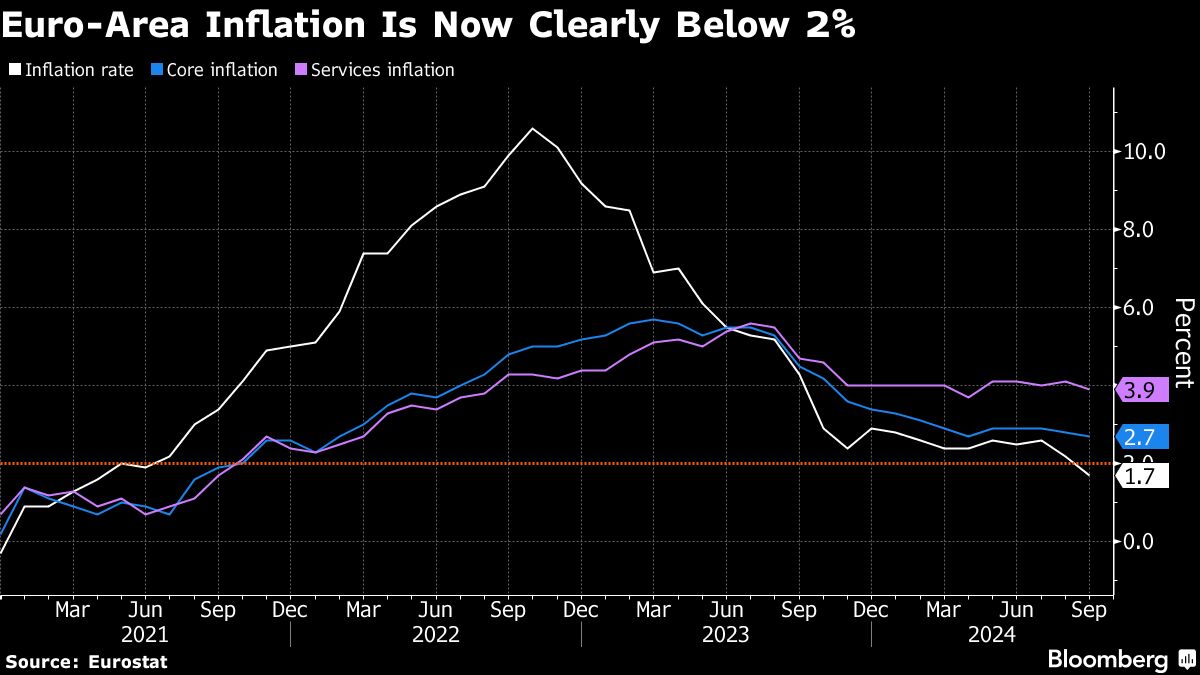

Thursday's move quickens the pace at which officials are removing the shackles on the euro-zone economy, whose early-year promise has petered out. While looking unlikely just five weeks ago, it follows a slump in inflation to below 2% for the first time since 2021, alongside softer private-sector activity and cracks in the so-far resilient jobs market.

Dangers lurk further afield, too: The hostilities in the Middle East and the tariffs that could accompany another Donald Trump presidency risk sapping confidence. Policymakers are also keeping an eye on the Federal Reserve after it began its own loosening campaign.

Euro area bonds were little changed right after the decision, with yields on German 10-year bonds remaining slightly higher on the day at 2.20%. Wagers on another quarter-point cut in December were steady, with such a move fully priced by swaps.

President Christine Lagarde will discuss the ECB's decisions at a press conference at 2:45 p.m. in Brdo, Slovenia, where officials have gathered for the one policy meeting of the year that they hold outside of their Frankfurt headquarters.

Lagarde had given the clearest signal that a rate cut was in the pipeline by telling European lawmakers this month that “the latest developments strengthen our confidence that inflation will return to target in a timely manner.”

Even some hawks have acknowledged intensifying economic risks, with Executive Board member Isabel Schnabel saying officials “cannot ignore the headwinds to growth.”

Her remarks followed a first contraction since March in private-sector output, as the manufacturing sector's woes deepened and services slowed. Analysts in a Bloomberg poll have cut projections for the third and fourth quarters, and their 2025 outlook.

Strong demand in Mediterranean countries including Spain, Portugal and Greece is helping the 20-nation currency bloc to keep a recession at bay. But Germany, the region's biggest economy, remains the laggard and may see output dip for the second year running due to muted demand in key export markets like China.

A trade spat between Brussels and Beijing could yet make matters worse — part of rising geopolitical tensions that are worrying analysts.

Inflation, meanwhile, has been in a steep retreat — sliding to 1.7% in September. Officials highlight that their battle to tame prices isn't yet won, citing a gauge of pressures in the services industry that's stuck near 4%. But bets on monetary easing have been building.

Economists surveyed by Bloomberg agree with money markets that cuts are likely at every ECB meeting through March. After that, the pace of easing is likely to slow, with the deposit rate being brought to 2% by the end of 2025.

That would put it at the lower end of assessments for the so-called neutral rate that neither stimulates not restricts economic activity. Reaching the 2%-2.5% range estimated by analysts in Bloomberg's poll could happen quite quickly.

“It is a straight line to neutral,” Sören Radde, head of European economic research at Point72, told Bloomberg Television before the rate announcement. Recent weeks have seen dangers around the ECB's outlook shift “from there being risks to inflation overshooting — persistently — to there being now also risks that it may undershoot.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.