(Bloomberg) -- The yen is coming under renewed pressure as a powerful earthquake that hit Japan on New Year's Day makes it harder for the Bank of Japan to abolish negative interest rates.

Morgan Stanley MUFG Securities Co. changed its call for the BOJ rate decision this month and now sees it leaving current policy in place, partly as the central bank has to assess the adverse impact from the Noto Peninsula disaster on the economy. Any move may not come until April at the earliest, according to Mitsubishi UFJ Morgan Stanley Securities Co.

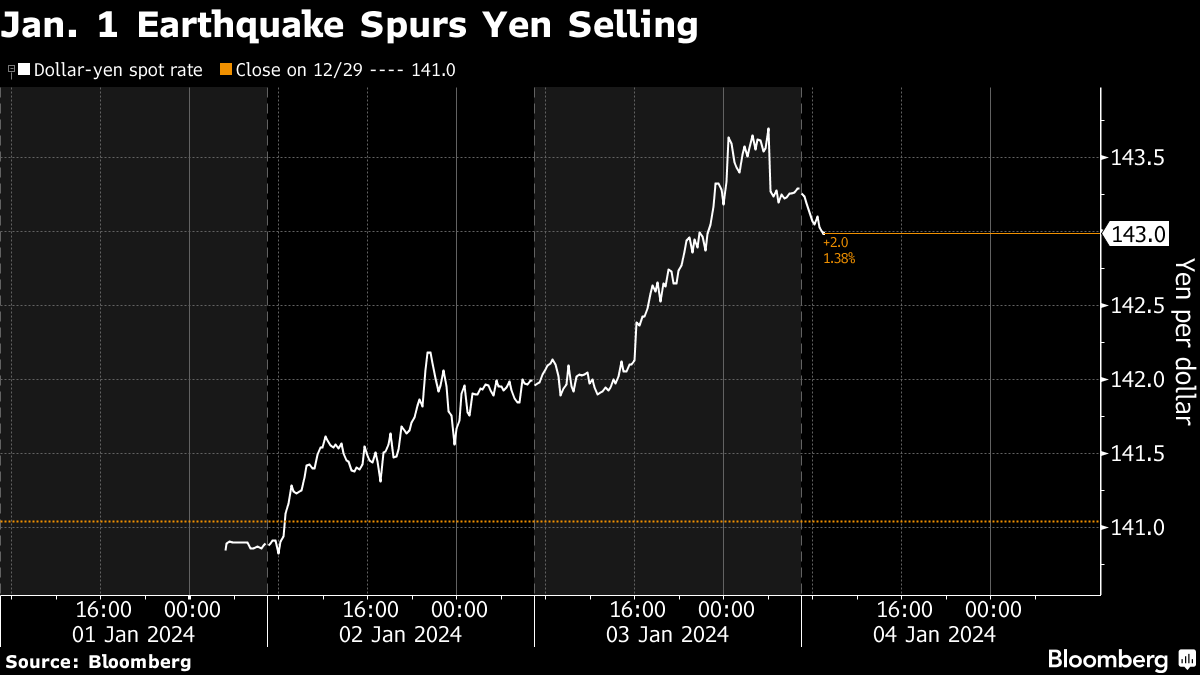

The yen weakened to 143.39 per dollar in Tokyo on Thursday morning, from 141.04 at the end of 2023 in New York trading. The Japanese currency had been widely expected to strengthen in 2024 on speculation the Federal Reserve would start cutting interest rates in the first half of the year, while at the same time normalization of ultra-easy monetary policy in Japan would narrow the yield gap between the two economies.

“Although there must be quite a few foreign investors who have been anticipating the end of negative rates in January, under these circumstances, the BOJ will almost certainly not move this month,” said Daisuke Karakama, chief market economist at Mizuho Bank Ltd. “Should negative rates not be lifted in January, ending it in the first half of 2024 will also become doubtful.”

Mari Iwashita, chief market economist at Daiwa Securities Co., removed her forecast for an end to negative rates in January following Governor Kazuo Ueda's speech on Dec. 25 and his interview with NHK on Dec. 27.

“The January move seems even more impossible,” Iwashita said. The earthquake is likely to depress production activity while the government may have to set up a supplementary budget for recovery measures, she said. Iwashita now expects an exit from negative rates in April.

Ueda said Thursday in a speech that the BOJ will be fully prepared to support the financial system after the earthquake, and he hopes wages and inflation will rise in a balanced manner this year.

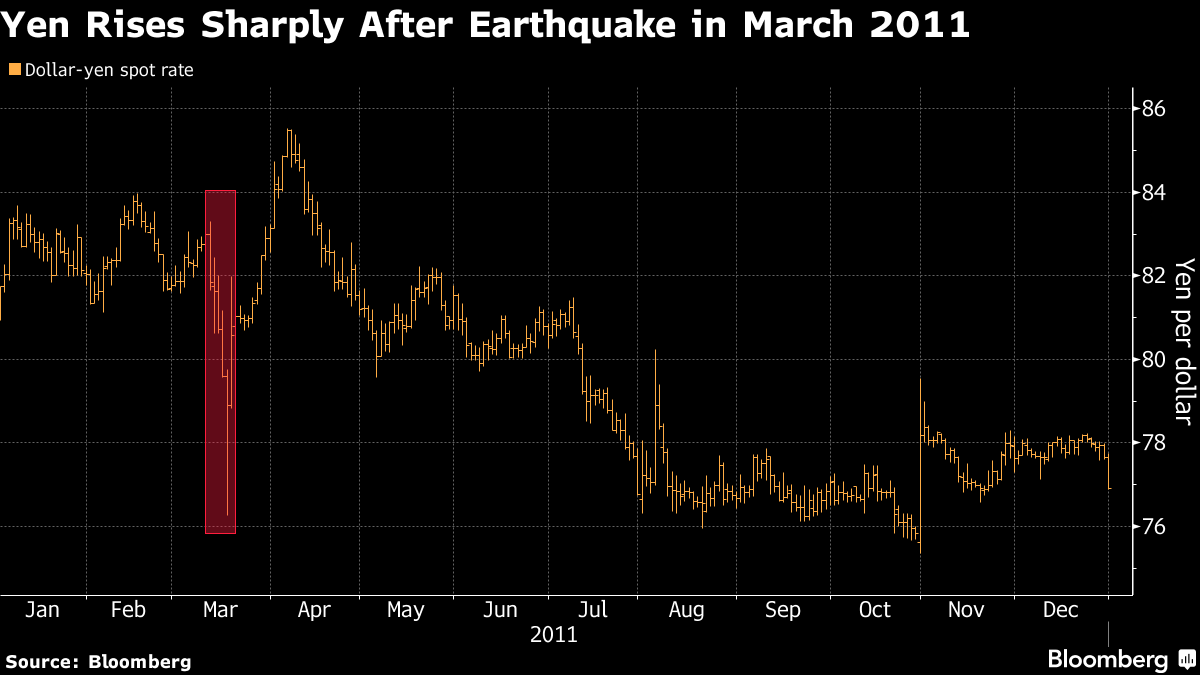

The yen's decline following the major tremor is contrary to what happened in March 2011, when a deadly earthquake and tsunami triggered coordinated intervention to sell the yen by Japan, the US and Europe. That move aimed to halt a sharp rally in the yen on the back of repatriation of assets held overseas by Japanese companies.

The Japanese currency subsequently hit an all-time high of 75.35 in October that year.

The situation is “different now,” said Mizuho's Karakama. Japan had accumulated trade surpluses over many years at that time and corporate demand for the yen supported the currency's appreciation. It now has a deficit. “It's unreasonable to expect the same reaction in the yen to the earthquake,” he said.

--With assistance from Yumi Teso, Masaki Kondo and Hidenori Yamanaka.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.