(Bloomberg) -- A resurgence in travel over China's Lunar New Year holiday is offering some signs of a consumer spending pickup in the world's second-largest economy as it struggles with low confidence and deflation.

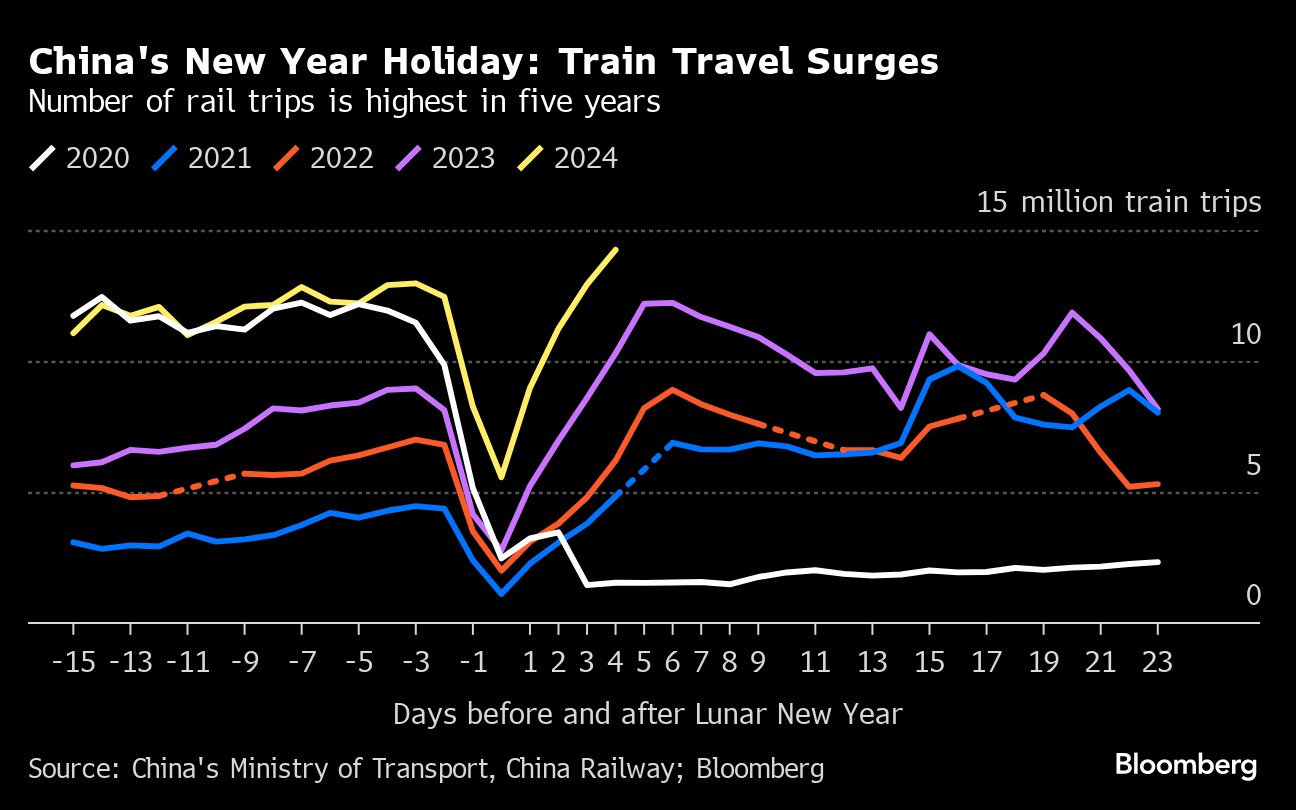

More than 61 million rail trips were made in the first six days of the national new year holiday, according to official reports. That was the highest in data compiled by Bloomberg News in the last five years, and it marked a 61% increase over the same vacation period in 2023.

“The Chinese consumer is beginning to stir,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc., adding that spending indicators had exceeded expectations. He acknowledged, though, that surpassing 2023 was a “low bar” given the country was still contending with a rampant outbreak of Covid-19 at the time.

The travel data is welcome news for an economy struggling with concerns about growth this year as the ongoing property crisis dents confidence and deflationary pressures persist. Consumer prices dropped last month at the fastest pace since the global financial crisis, adding pressure on the government to step up support. A multi-trillion dollar selloff in Chinese stocks has underscored the economic gloom.

Some initial data on road and air trips during the holiday also showed improvement over last year, Chinese state media reported. Hotel sales on Chinese e-commerce platforms surged more than 60% from a year earlier, according to media reports citing the Ministry of Commerce.

Just ahead of the holiday, Shanghai reported some 8.8 million tourists, up more than 50% year-on-year, according to state broadcaster China Central Television.

The average daily consumer spending on Meituan's online platforms during the holiday period jumped some 36% from the same period last year, according to a report from the delivery giant. The report didn't give the actual value of consumption, but said it exceeded pre-Covid levels in 2019. There was also strong growth from restaurant spending in the first five days of the Chinese New Year break, with overall order volume from groups rising by 161% from last year.

Chinese shoppers also took their spending overseas during the long holiday week, with tourists from the country spending 70% more on food and beverages compared to 2019, according to data from fintech giant Ant Group. Among the top destinations for Chinese travelers were Hong Kong, Japan, Thailand, France and Australia.

The travel and spending bright spots have helped boost market sentiment in Hong Kong this week, where markets reopened Wednesday after a holiday break. A gauge tracking Chinese companies listed in the city has risen for two consecutive sessions, clocking a 2% gain through the end of trading Thursday. China Tourism Group Duty Free Co. has jumped about 9%, while travel platform Trip.com Group Ltd. added 4.7%. Meituan and e-commerce firm JD.com Inc have inched 6% higher.

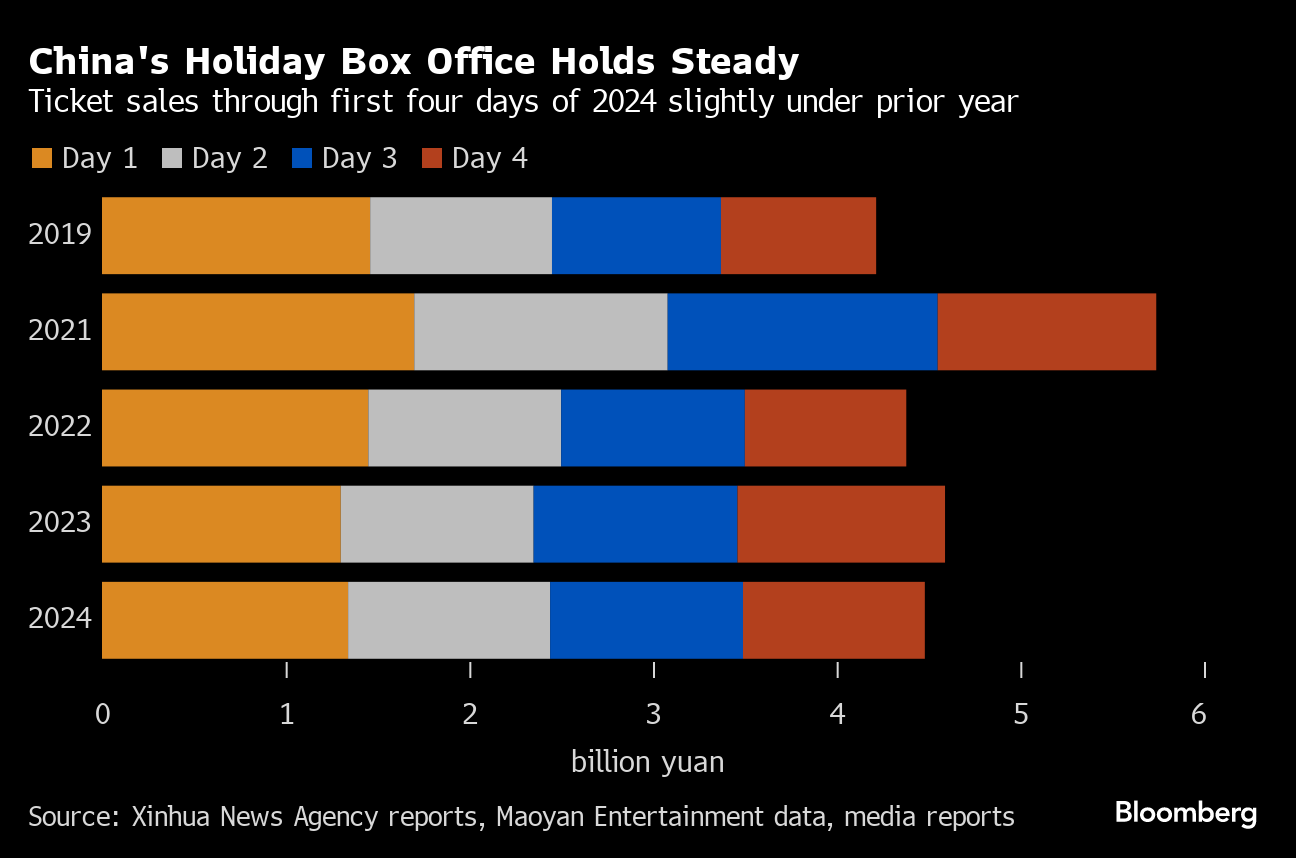

More muted initial box office receipt data, though, suggested that consumers may be reducing their spending per trip. Chinese cinemas took in 4.48 billion yuan in the first four days of the eight-day vacation period — down about 2% from last year, according to Bloomberg calculations based on data from Maoyan Entertainment.

Thriftier holiday spending was a pattern seen during national holidays last year in China. While travel surged above pre-pandemic levels, spending per person fell as consumers sought out cheaper deals.

The Lunar New Year — the most important holiday in China and one of a handful of week-long events that see hundreds of millions of people travel to see family — is a key barometer for consumption early in the year. This year's holiday is one day longer than last year's. China is expected to release comparable tourism spending data at the end of the holiday period, providing the best measure of consumption growth.

Consumer confidence in China has been weak for a range of reasons, including declines in home prices. Sales of some goods such as cars have also lost steam: Passenger car sales fell 26% in January compared to December, according to the China Association of Automobile Manufacturers.

While traveling is the “main theme” of this year's Lunar New Year holiday, “it is uncertain if this can fully offset the consumption shift away from durable goods, and the downgrade trend for some residents,” said Gary Ng, senior economist at Natixis SA. “The extra spending cannot replace traditional big-ticket items, like automobiles.”

--With assistance from Charlotte Yang, James Mayger and Sarah Zheng.

(Adds Meituan, Ant Group data. An earlier version of this story included an incorrect period of comparison for some spending data.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.