(Bloomberg) -- China's consumer prices fell last month at the fastest pace since the global financial crisis as the world's second-largest economy struggles to shake off persistent deflation pressures.

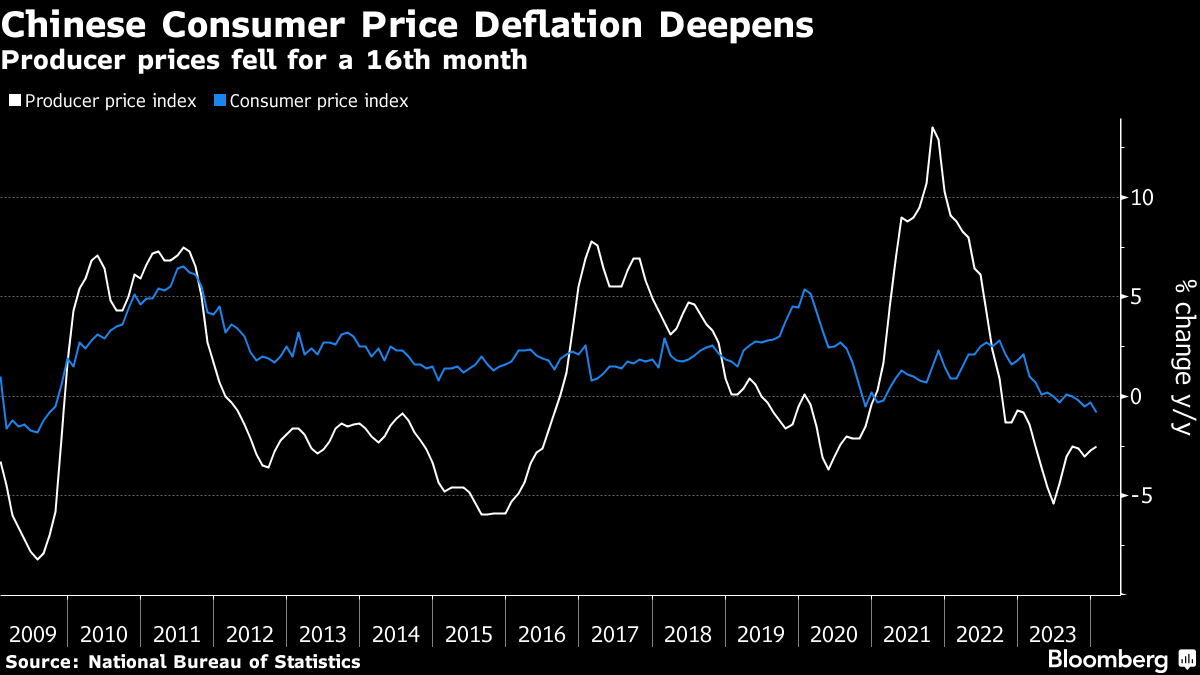

The consumer price index dropped 0.8% in January from a year ago, the National Bureau of Statistics said Thursday, worse than economists' expectations for a 0.5% decline. The producer price index fell 2.5%, compared with projections for a 2.6% decline. Factory-gate costs have been stuck in deflation for 16 consecutive months.

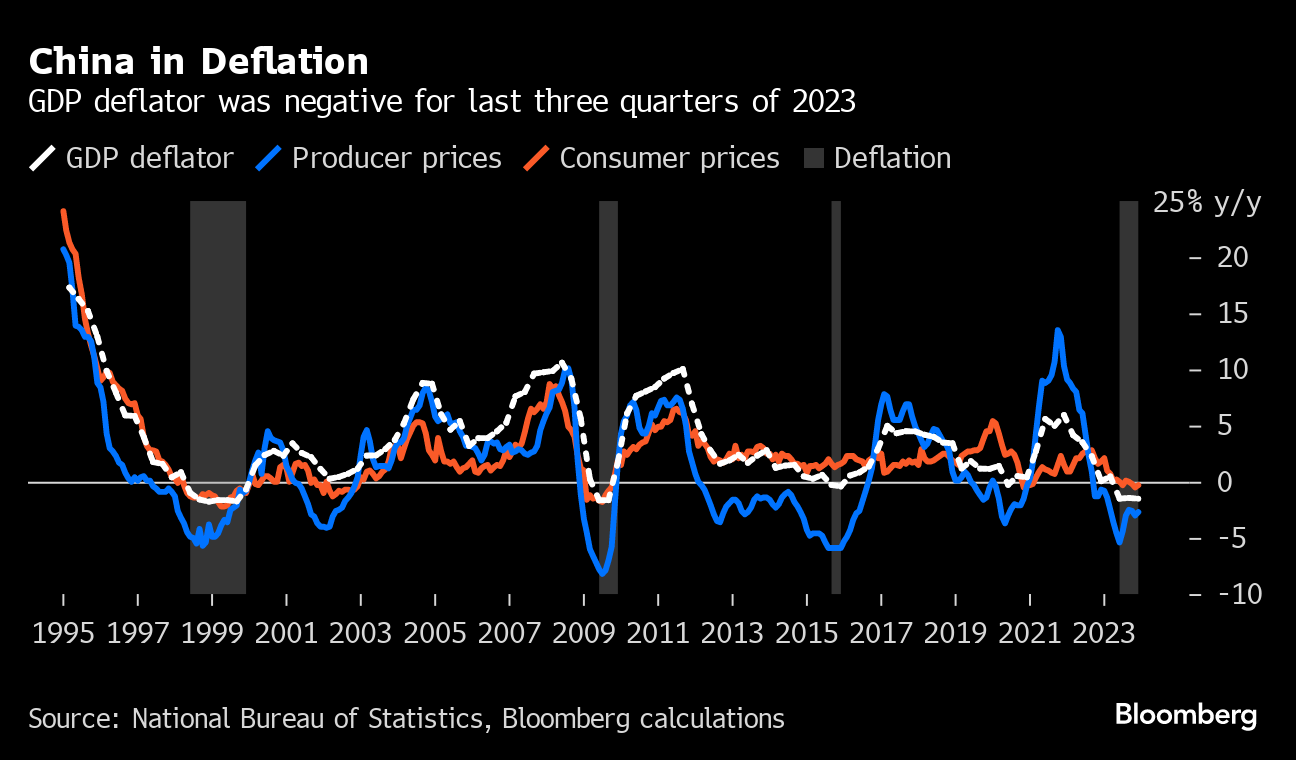

China has been beset by falling prices for much of the last year as the nation struggles to revive domestic demand and consumer confidence. A measures of economy-wide prices marked its longest slide since 1999 in the fourth quarter, underscoring the magnitude of the challenge as policymakers look to boost growth in 2024.

The risks from deflation are serious. If China is unable to meaningfully turn the trend around, it risks leading to a downward spiral with people holding off on purchases on expectations for prices to continue falling. That would dent overall consumption and spill over to businesses.

The property crisis remains the biggest drag on the economy and on confidence. But the most visible sign of economic gloom recently has come from the stock market, which is in the midst of a multi-trillion dollar rout. Equities have rallied in recent days, but investors are awaiting more policy support from Beijing.

Economists see deflation pressure in China continuing for at least another six months, largely because of the real estate turmoil.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.