(Bloomberg) -- A record amount of Chinese money is flowing into overseas equities as despondent investors seek a way out of the sagging local stock market.

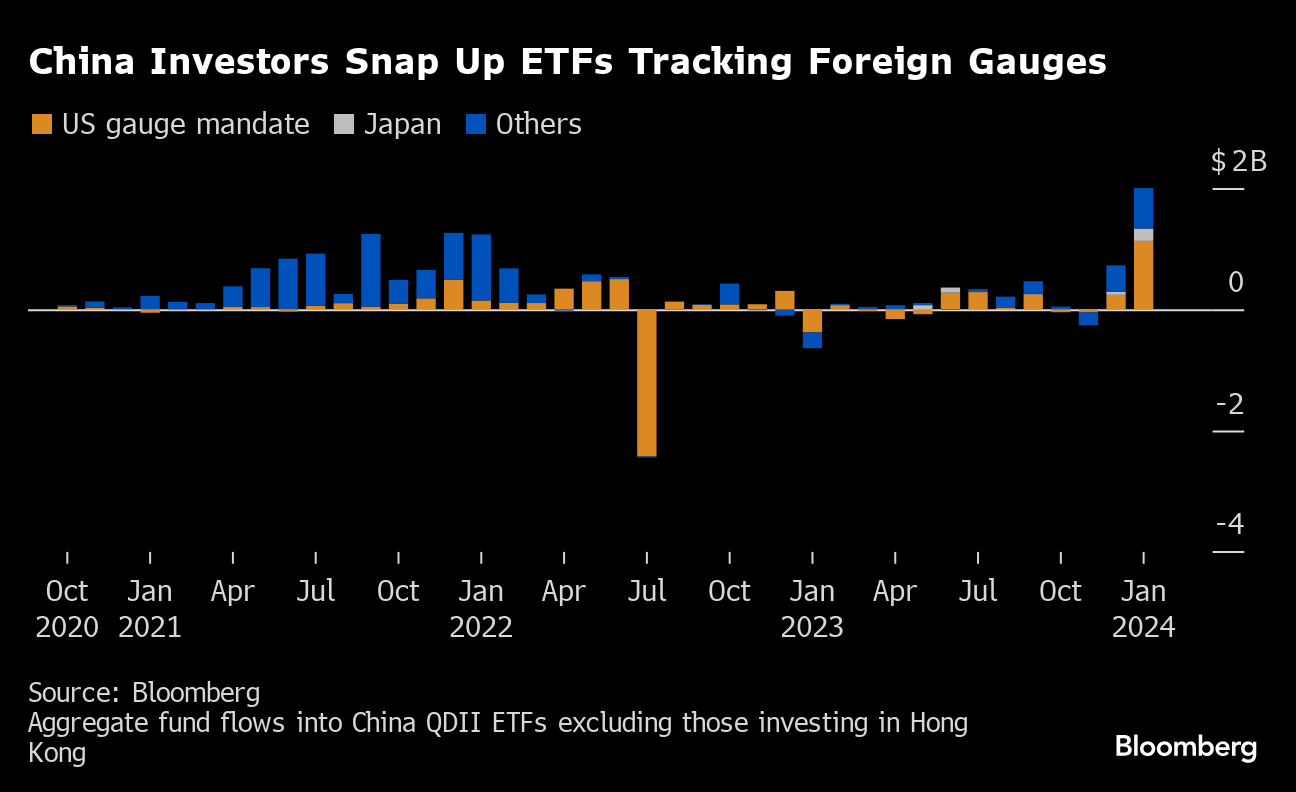

Inflows into 33 onshore exchange-traded funds that track foreign benchmarks excluding Hong Kong reached $2 billion in January. That's the biggest monthly tally in Bloomberg data going back to late 2020. More than half of that poured into US stocks as the S&P 500 hit fresh highs, while another $204 million flocked to Japan.

Such fervor has created huge distortions in the domestic ETF market. Prices have in some cases jumped 40% above the value of the underlying assets, with extreme volatility and frequent trading halts. Despite the risks, investors are undeterred. Due to China's capital controls, these products are heavily sought after as the most viable channel for retail money to tap overseas markets while local stocks extend their losing run.

“Investors are voting with their feet,” said Peng Hong, fund manager at Shenzhen Zhichang Fund Management Co. “Chasing these funds at a high premium is risky, but it's choosing the lesser of two evils. US stocks could see a correction taking you to ankle-deep in losses, but if you bottom fish onshore stocks, you are likely to be neck-deep.”

The flows are part of a broader shift away from China as domestic investors lose faith in the local share market. Global funds' exodus continued for a record sixth month in January, when they withdrew another 14.5 billion yuan ($2 billion).

Bouts of stock gains spurred by stimulus hopes have only lasted a few days as weak economic data soon poured cold water on optimism. The CSI 300 Index has tumbled to a five-year low after losing more than 7% this year. Only one in 17 firms trading in Shanghai and Shenzhen are in the green this year.

That contrasts with powerful runs in overseas markets. Solid corporate earnings and expectations of a soft landing in the US economy saw equities extend gains into the new year, while Japanese benchmarks hover near three-decade highs as its economy emerges from a deflationary spiral.

The ETFs in hot demand are part of China's qualified domestic institutional investor program, which allows certain fund houses to buy foreign securities within a quota. The limited pool has triggered ETF prices to surge beyond the underlying asset's value. As a result, investors stand to face a double whammy if the overseas markets get a sudden correction and if the premium disappears.

READ: Chinese Exodus for Overseas ETFs Thwarted by State Quotas, Halts

Invesco Great Wall Fund Management's ETF tracking the Nasdaq 100 garnered the heaviest inflow last month at $513 million. The fund gained more than 8% during the period while the US tech gauge advanced less than 2%. The Huatai-PineBridge CSOP iEdge Southeast Asia+ TECH Index ETF attracted $426 million.

While premiums have generally eased off from the extreme levels in January after warnings from issuers and purchase restrictions, demand remains strong particularly for new products that are yet to face such limits.

A fund by China Universal Asset Management Co. tracking the MSCI USA 50 Index reached its target of 220 million yuan in a single day, while fund raising was planned to last until late March.

In an attempt to rein in the enthusiasm, 20 ETFs tracking foreign stocks or the mutual funds that invest directly in them introduced a cap on daily subscriptions this year, exchange filings show.

“Herd behavior is a typical reverse indicator. Pursuing highs in other markets at such premiums could mean being wrong-footed if the trend flips,” said Chen Shi, fund manager at Shanghai Jade Stone Investment Management Co. “But you can't blame people seeking emotional venting in these QDIIs when sentiment is so weak.”

--With assistance from Jack Wang and Rebecca Sin.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.