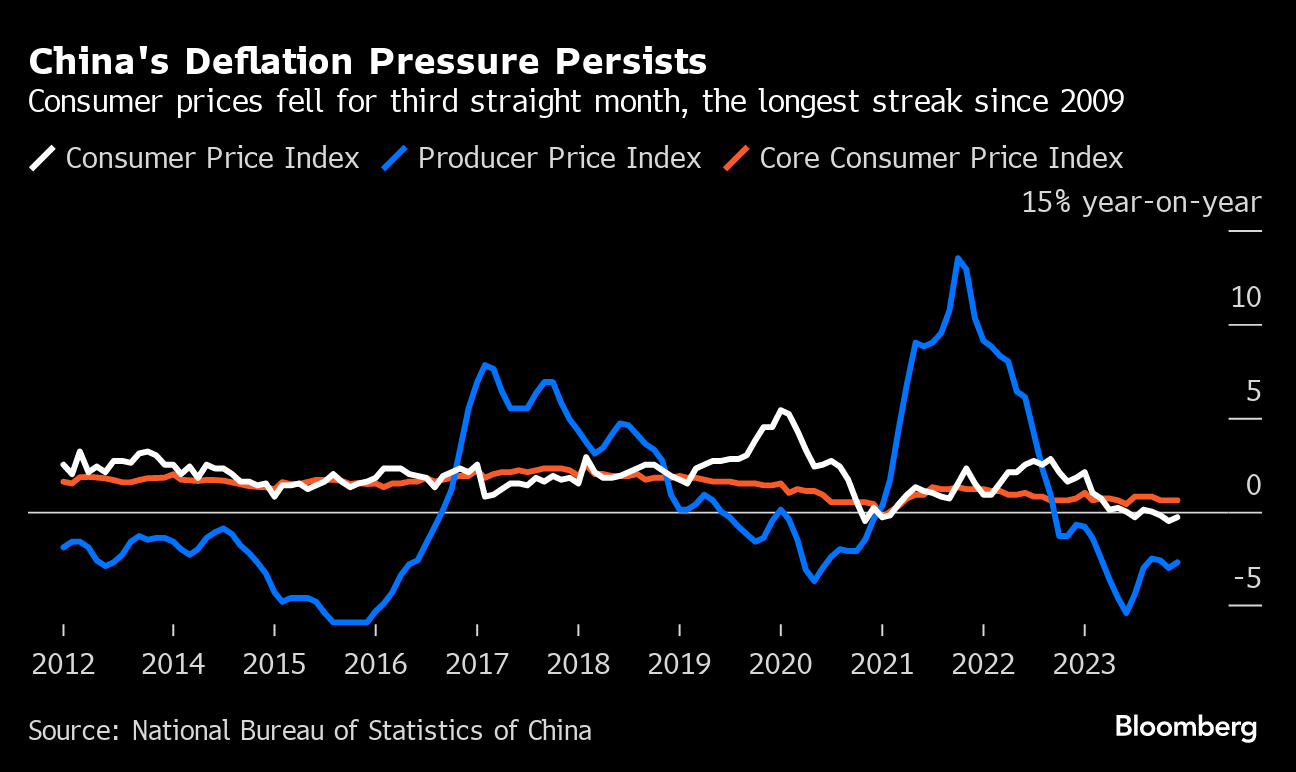

(Bloomberg) -- China's consumer prices marked their longest streak of declines since 2009, threatening a deflationary spiral that may require more government support to reverse. Its export growth engine is also faltering.

The consumer price index slipped 0.3% in December from a year earlier, in line with economists' expectations for a third straight month of declines. Factory-gate costs dropped 2.7% and have been falling for more than a year because of lower commodity prices and weak demand at home and abroad.

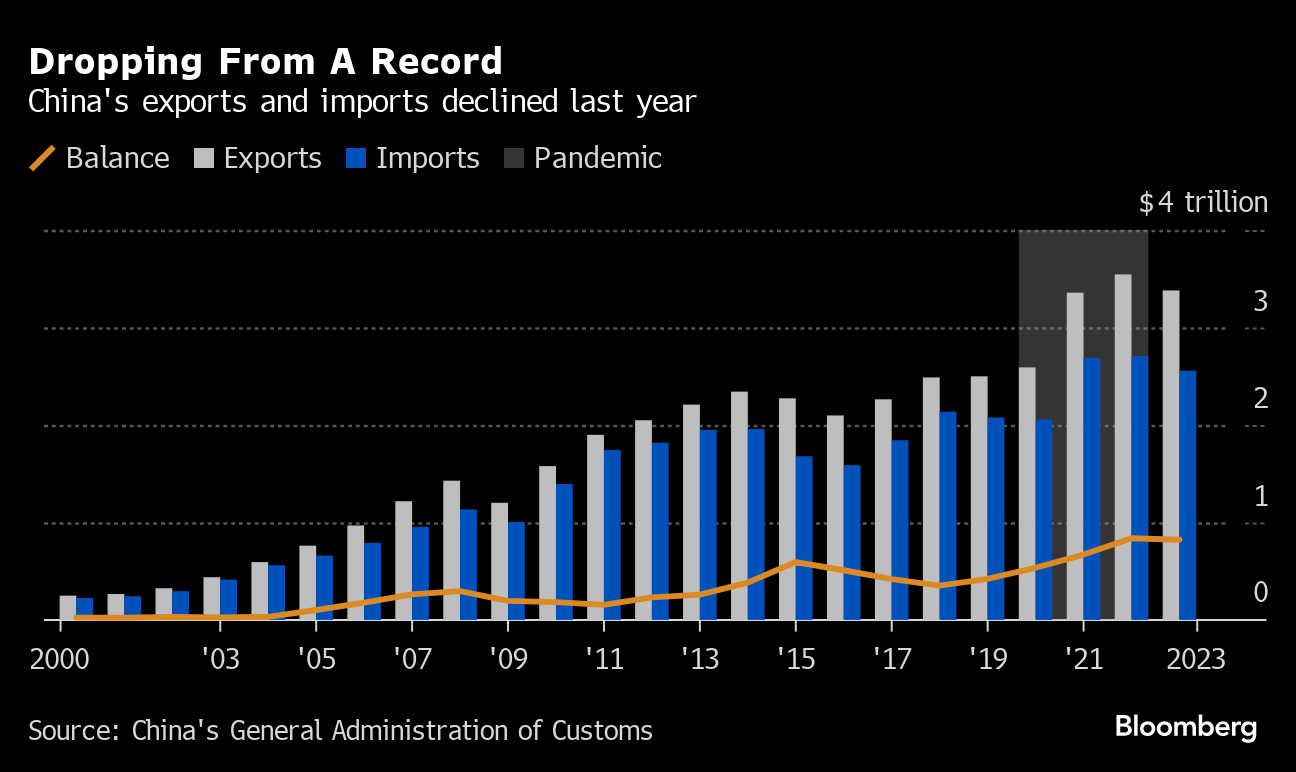

Chinese exports, meanwhile, fell 4.6% over all of last year for the first time since 2016 — yet another knock to what has historically been a major pillar of growth for the world's second-largest economy. The December data shows signs of a pickup, helped by favorable comparisons with a year ago.

“China needs to act boldly to break the deflationary cycle. It will fall into a negative spiral otherwise,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd., adding that firms have been cutting their selling prices and migrant workers have been slashing asking wages as price pressures persist.

He's among economists predicting rate cuts to shore up domestic demand and confidence, which has remained weak over the past year. Most analysts surveyed by Bloomberg project the People's Bank of China will on Monday lower the rate on its one-year policy loans for the first time since August, as well as inject more cash into the financial system to meet funding demands.

The sustained deflation is also dragging down the value of Chinese exports and making them cheaper for foreign consumers. In October, the index of export prices hit the lowest in data back to 2006, and was only slightly higher in November.

Read more: China's Exports Drop for First Time Since 2016 as Demand Cools

Markets showed little reaction to the data Friday, with many investors having already bet on the possibility of a policy rate cut next week.

The onshore benchmark CSI 300 Index was down 0.2% in late morning trade. The offshore yuan was little changed at about 7.17 per dollar, while the yield on China's 10-year government bond held steady at 2.5%.

Price Pressures

The pace of decline in December's CPI figure wasn't as severe as the prior month. Food prices fell 3.7%, slightly better than November's 4.2% drop. Core inflation — which strips out volatile food and energy prices — was 0.6% in December, unchanged from November.

Even so, the extended negative stretch — a result of the ongoing property slump, low consumer confidence and weak exports — presents several concerns for the economy. Falling prices lead to lower corporate revenue, potentially hitting wages and profits. Deflation can also increase debt burdens and encourage consumers to delay purchases.

China's GDP deflator, the widest measure of prices in the economy, dropped in both the second and third quarters, according to Bloomberg estimates based on official data. That was the first time the measure fell for two consecutive quarters since 2015.

“The data don't really ease deflationary concerns in China,” said Michelle Lam, Greater China economist at Societe Generale SA, referring to the CPI and PPI for December. She pointed out that home prices have also been falling, which risks curbing household spending and weighing on price pressures.

“Given that, the chance of a policy rate cut as soon as next week is getting higher, even though that may not do much to lift demand but to ease debt financing pressure,” she said.

Along with the high expectations for a policy rate cut next week, officials have also signaled other easing may be on the table. A senior PBOC official earlier this week hinted that the central back has considered lowering the amount of money banks must keep in reserve. That may help boost lending capacity and bolster credit.

What Bloomberg Economics Says...

“A third straight month of falling consumer prices in December highlights the risk that China could tip into a deflationary spiral. The smaller drop in the headline CPI relative to November is cold comfort — the upward force mainly came from food costs. Core-price gains stagnated at low levels — indicating that underlying demand remained feeble.”

— Eric Zhu, economist

Read the full report here.

Fiscal support is also a consideration. Earlier this month, Minister of Finance Lan Fo'an said government spending will rise this year, telling state media that “we will make sure the overall size of fiscal spending increases to play a better role stimulating domestic demand.”

The next few weeks may be key for policy action, given Chinese leaders will soon gear up for the National People's Congress. That annual legislative session, held in March, is where the government is expected to announce its official growth target for 2024. Economists expect a relatively ambitious goal, perhaps around 5%.

--With assistance from Wenjin Lv, Zhu Lin, James Mayger and Fran Wang.

(Updates with details throughout)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.